Introduction

- The period before World War I saw the dominance of free capital flows and fixed exchange rates tied to the gold standard.

- The gold standard’s success relied on cooperation among major global economic powers.

- The interwar chaos led to the post-1940s Bretton Woods system, creating the IMF, World Bank, GATT, and WTO.

The Collapse of the Bretton Woods System and the Rise of Floating Exchange Rates

- The stable Bretton Woods system with semi-fixed exchange rates and controlled capital flows gave way in the 1970s due to doubts about the US dollar’s gold convertibility and sufficient gold reserves.

This led to the modern system of floating exchange rates and open capital accounts.

Emerging Market Challenges and Increased Financial Crises

- The 1980s and 1990s witnessed frequent balance of payments crises and macroeconomic instability in emerging markets.

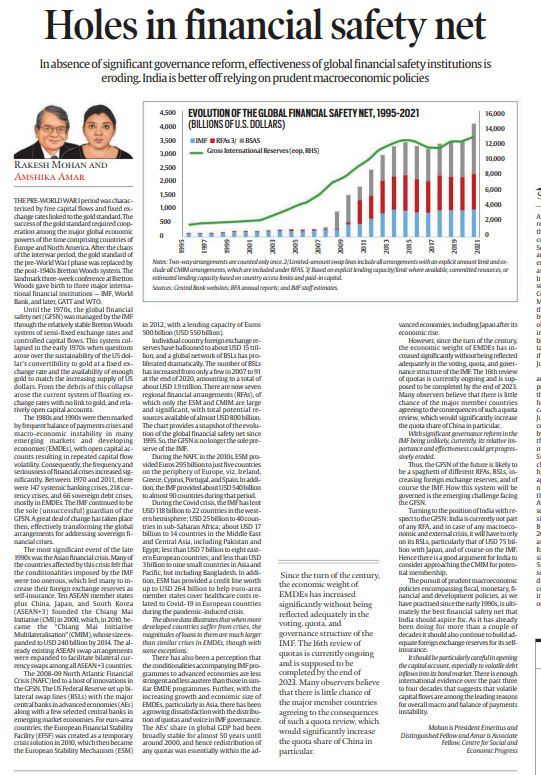

Open capital accounts led to capital flow volatility and a surge in financial crises. The IMF struggled to manage the global financial safety net (GFSN), and crises increased significantly.

Rise of Regional Initiatives and Innovations

- The Asian financial crisis prompted the establishment of the Chiang Mai Initiative (CMI) in 2000, evolving into CMIM with a substantial lending capacity.

- The 2008-09 North Atlantic Financial Crisis (NAFC) resulted in innovations like bilateral swap lines (BSLs) and regional financial arrangements (RFAs) like ESM.

Foreign exchange reserves and BSLs increased dramatically.

Changing Landscape of the GFSN

- The GFSN shifted from being solely under the IMF’s control. ESM and CMIM emerged as significant players.

- Quota distribution dissatisfaction and growing economic weight of EMDEs raised governance concerns within the IMF.

India’s Position and Future Considerations

- India is outside RFAs and relies on BSLs and the IMF in crises. Joining CMIM could enhance India’s position.

- Prudent macroeconomic policies, self-insurance via foreign exchange reserves, and cautious capital account opening are essential for stability.

Conclusion

The GFSN has evolved from the gold standard to Bretton Woods to floating exchange rates, marked by crises and innovations. RFAs, BSLs, IMF, and other components comprise the future GFSN.

Challenges of governance reform and India’s potential involvement underline the complexity of managing the GFSN in an ever-changing global economic landscape.

Source: Indian Express

Introduction

- On August 9, 2023, the Rajya Sabha unanimously passed the Digital Personal Data Protection Bill (DPDP), marking the culmination of a decade-long journey.

- The bill aims to balance personal data protection with lawful data processing for innovation and economic growth.

- However, the bill’s provisions have evoked mixed reactions due to its approach and potential implications.

Balancing Personal Data Protection and Processing

- The primary objective of the DPDP is to strike a balance between safeguarding personal data and enabling lawful data processing to foster innovation and economic advancement.

- Despite this, the government has carved out significant exemptions for itself from the law’s purview, both in its wording and intent.

State’s Exemption for National Security

- The bill contains a clause that allows the state to exempt itself from the DPDP’s regulations in the interest of national security, public order, or prevention of incitement to cognizable offenses.

- This clause could potentially be used to justify government actions under the pretext of national security, leading to concerns about abuse of power.

Significant Data Fiduciaries (SDFs) and Obligations

- The DPDP mandates the identification of Significant Data Fiduciaries (SDFs) and places various obligations upon them, including regular audits and data protection impact assessments.

- The government will consider factors like data volume, sensitivity, risks to individual rights, impact on national sovereignty, electoral democracy, and public order while designating SDFs.

Data Protection Board (DPB)

- The legislation establishes a Data Protection Board (DPB) with quasi-judicial powers to oversee matters related to data protection.

- However, the DPB’s members are wholly appointed by the central government, raising concerns about its independence and impartiality.

Ex Ante Regulation for Digital Behemoths

- The DPDP demonstrates an intention to impose ex ante rules to regulate powerful platforms with significant market power (SMP) that could potentially abuse their dominance.

- This approach aims to prevent market distortions before they occur.

- However, questions arise about the government’s role in designating SMP entities.

Challenges and Concerns

- Vague Qualitative Parameters: The inclusion of qualitative parameters like risks to electoral democracy and public order could lead to imprecise designations due to the absence of objective criteria.

- Expertise and Skills: Market analysis required for designating SDFs demands specialized skills and subject matter expertise that may be lacking within the government.

- Limited DPB Term and Government Influence: The DPB’s two-year term, extendable, and its appointment by the government raise concerns about its independence and impartiality.

- Exemptions and Regulatory Asymmetry: The government’s power to exempt private entities from additional obligations of SDFs could result in regulatory arbitrariness and asymmetry.

- Appellate Tribunal: Designating the Telecom Dispute Settlement and Appellate Tribunal (TDSAT) as the appellate tribunal for DPB raises doubts about its adequacy for handling complex data-related disputes.

Conclusion

While the Digital Personal Data Protection Bill (DPDP), 2023, aims to balance personal data protection with data processing for innovation, its provisions and approach have sparked concerns about government influence, regulatory clarity, and the effectiveness of oversight mechanisms.

Addressing these concerns will be crucial for creating a comprehensive and effective framework for data protection and governance.

Source: The Indian Express

THE ANUSANDHAN NATIONAL RESEARCH FOUNDATION (ANRF-2023) BILL AND CHALLENGES FOR RESEARCH ECOSYSTEM IN INDIA

Introduction:

- The recent passage of the Anusandhan National Research Foundation (ANRF-2023) Bill by the Parliament reflects India’s commitment to enhancing its research, innovation, and entrepreneurship landscape.

- The bill aims to provide strategic direction for research and innovation, improve national research infrastructure, and promote scientific pursuit.

- However, the actual impact of the bill depends on its implementation and its ability to address longstanding issues related to funding and bureaucratic processes.

Funding Challenges:

- Inadequate Funding: The research ecosystem faces a dual challenge of insufficient funding and rigid regulations. While an expenditure of 2% of GDP on Research and Development (R&D) is ideal for maintaining competitiveness, India has stagnated at around 0.7% over the past two decades.

- ANRF Funding: The government intends to invest Rs 50,000 crore in the next five years through ANRF. However, if this funding isn’t in addition to the science and technology ministry’s budget allocation, effective funding for research could decline.

- Private Sector Contributions: The ANRF-2023 Bill aims to involve the private sector to bridge the funding gap. Currently, only 35% of Gross Expenditure on R&D (GERD) comes from industry in India, compared to over 50% in countries like the US and UK.

Private Sector Involvement Challenges:

- CSR Limitations: Corporate Social Responsibility (CSR) rules allow contributions to scientific research but with limitations on project duration. To encourage private funding, rules need amendments to enable longer-term support.

- Acceptance of Philanthropy: While philanthropy-funded research centers are emerging, the concept of private sector funding for basic and applied research needs wider acceptance.

- State Government and Public Sector Contributions: Currently at 10%, contributions from state governments and the public sector to GERD need substantial increase.

Bureaucratic and Administrative Challenges:

- Bureaucratic Labyrinth: Scientists have long complained about bureaucratic complexities impacting research. The Science, Technology, and Innovation Policy 2020 (STIP-2020) acknowledges this issue and emphasizes less bureaucracy and improved accountability.

- Timely Allocation and Flexibility: The STIP-2020 highlights the need for amendments to funding rules. Delays in fund allocation and lack of flexibility in utilizing grants hinder research progress.

- Procurement Restrictions: Measures introduced to support domestic industry have sometimes resulted in delays, such as restrictions on procurement of research equipment.

Global Perspective and Competitive Challenges:

- Fast-Paced Research Environment: The global research landscape is evolving rapidly, with industries like semiconductors and AI witnessing exponential growth. Timely and efficient processes are crucial to stay competitive.

- Overhauling Rules and Regulations: Rapid technological advancements necessitate streamlining administrative structures and regulations to keep pace with the dynamic research environment.

Needed Reforms and Conclusion:

- Prime Minister’s Call for Reforms: Prime Minister Narendra Modi’s call for prioritizing scientific exploration over bureaucratic procedures highlights the need for definitive reforms.

- 2. Recalibrating Practices and Attitudes: ANRF’s administrative structures should facilitate a shift in practices and attitudes, aligning with India’s research potential.

- Historical Perspective: The legacy of Vikram Sarabhai’s call for policy changes and administrative reform in 1966 underscores the urgency for adapting to current challenges.

Conclusion

While the ANRF-2023 Bill shows promise in advancing India’s research landscape, its success lies in effectively addressing funding gaps, encouraging private sector involvement, and streamlining bureaucratic processes to foster innovation and competitiveness.

Discuss the key objectives of the Anusandhan National Research Foundation (ANRF-2023) Bill recently passed by the Parliament. Analyze the potential impact of the bill on India’s research, innovation, and entrepreneurship ecosystem, considering both its intentions and the challenges it needs to overcome.

Source: Indian Express