- Green Hydrogen Push

- Collegium System

- ‘Pink Blooms’ in Kole wetlands of Kerala

- MHA extends ‘Disturbed area’ status in parts of Arunachal, Nagaland

- Dadasaheb Phalke Award

- Ease in Angel Tax Provision

Green Hydrogen Push

Context:

Recently, the government reaffirmed its dedication to establishing India as a hub for green hydrogen through a trial run involving two buses powered by this eco-friendly fuel.

Concept

- Green hydrogen, celebrated for its minimal emissions and superior efficiency in comparison to internal combustion engines, is at the forefront of government plans.

- The government’s decision to initiate a trial with two buses running on green hydrogen forms part of a larger initiative aiming to introduce 15 additional such buses by the year’s end.

- However, several challenges must be addressed to ensure the commercial viability of green hydrogen.

Understanding Green Hydrogen

- Green hydrogen, also known as clean hydrogen, represents a hydrogen gas variety produced using processes that rely on renewable energy sources or other low-carbon methods with minimal to zero greenhouse gas emissions.

- Green hydrogen (GH2) results from the separation of water (H2O) into hydrogen and oxygen (O2) through the application of renewable electricity.

- This form of hydrogen production is viewed as eco-friendly and sustainable since it abstains from reliance on fossil fuels and avoids harmful pollutant emissions or greenhouse gases during its production.

- It serves both as an energy source (beneficial for heavy industry, long-distance mobility, aviation, and power storage) and an energy carrier (suitable for use as green ammonia or blending with natural gas).

Familiar with Green Steel?

- Green steel denotes steel manufactured using sustainable and environmentally responsible methods.

- Its production relies on renewable energy sources such as wind and solar power and employs low-emission technologies to minimize carbon emissions.

- The substitution of hydrogen for coal or natural gas as the reducing agent in the steel-making process is a primary method for producing green steel.

- Green steel offers a means of reducing the environmental footprint of the steel industry, which is a significant contributor to global carbon emissions.

- Currently, the production costs for green steel made from green hydrogen are considerably higher but could be reduced with economies of scale and advancements in production technology.

Challenges and Obstacles

- Renewable Energy Capacity Gap: India needs to add approximately 100 GW of renewable energy capacity annually for the next seven years to meet green hydrogen production objectives. Last year, only about 16 GW of renewable energy capacity was added, highlighting a substantial capacity shortfall.

- Water Intensity: The production of 1 kg of green hydrogen consumes roughly eight to nine liters of water, posing a significant challenge in regions already facing water scarcity issues.

- Electrolyser Manufacturing Capacity: The global manufacturing capacity for electrolysers, a vital component in green hydrogen production, currently stands at around 10 GW. To meet 2030 targets, India may need to increase its capacity six to tenfold, necessitating rapid expansion.

- Access to Rare Earth Minerals: Rare earth minerals are crucial for electrolyser production, with China currently dominating this market. India must secure a consistent mineral supply through strategic partnerships or domestic production to support its green hydrogen ambitions.

- Safety Concerns: Green hydrogen is highly flammable, necessitating stringent safety measures throughout production, storage, and transportation processes. These concerns may impact public perception and adoption.

The Path Forward

- Accelerated Deployment of Renewable Energy: India should intensify efforts to deploy renewable energy sources like solar and wind power, supported by policies, investments, and streamlined regulatory processes to attract investments and expedite capacity expansion.

- Research and Development for Water-Efficient Technologies: Investment in research and development is pivotal for creating water-efficient hydrogen production technologies. Collaborations with research institutions and international partners can expedite progress.

- Domestic Electrolyser Production: India should prioritize the development of domestic electrolyser manufacturing capabilities through strategic diplomatic negotiations and alliances to ensure access to rare earth minerals for indigenous production.

- Stringent Safety Standards: Developing and enforcing robust safety standards and protocols for green hydrogen production, storage, and transport is essential to instill confidence in the technology.

- Infrastructure Development: Building the necessary infrastructure, including pipelines and refueling stations, for green hydrogen production, storage, and distribution is crucial for its widespread adoption.

Positive Developments

- Green Hydrogen Mission: The Indian government has initiated the Green Hydrogen Mission, aiming to produce 5 million tonnes of green hydrogen annually by 2030. This endeavor seeks to reduce the country’s dependence on imported fossil fuels and cut 50 million metric tonnes of greenhouse gas emissions.

- Investment in Electrolysis Technology: A significant portion of the Green Hydrogen Mission’s budget is allocated to developing electrolysers, essential devices for the electrolysis process in green hydrogen production. This investment is critical to scaling up hydrogen production capacity.

- Leveraging Indian Oil Corporation’s Expertise: The government wisely leverages the Indian Oil Corporation’s expertise for the country’s inaugural green hydrogen vehicle project. To access global markets and foster collaborations with other nations, India must further develop its capabilities in the green hydrogen sector.

Conclusion

India’s ambition to establish itself as a green hydrogen hub is commendable and aligns with global efforts to combat climate change.

However, it faces numerous challenges on this path. The key to transforming these ambitions into a sustainable reality lies in technological innovation, international partnerships, and a sustained commitment to clean energy.

Collegium System

Context:

In response to the ongoing delays in processing recommendations for the appointment and transfer of High Court judges, the Supreme Court has taken a proactive stance.

It has declared its intent to closely monitor the situation every 10-12 days until resolution is achieved. Currently, around 70 Collegium recommendations remain pending with the government.

National Judicial Appointments Commission (NJAC):

- Overview: The NJAC is responsible for the selection and relocation of judges within India’s higher courts.

- Established By: The NJAC was established through the 99th Constitutional Amendment Act of 2014.

- Purpose: Originally, the NJAC was designed to replace the existing collegium system for judge selection.

- Composition: The NJAC consists of six members: the Chief Justice of India serves as the Chairperson, along with two other senior judges of the Supreme Court, the Union Minister of Law and Justice, and two eminent individuals nominated by a committee, as well as the Leader of the Opposition in the Lok Sabha.

- In October 2015, the Supreme Court’s Constitution Bench, with a majority of 4:1, declared the NJAC unconstitutional and upheld the continuation of the Collegium System:

- Under the Collegium System, decisions regarding the appointment of judges, elevation of lawyers to the Supreme Court, and transfers of judges between High Courts and the Supreme Court are made by a group comprising the Chief Justice of India and the four most senior judges of the Supreme Court.

- The selection and reassignment of judges under this system are determined by the Supreme Court’s decisions rather than by specific legislation or constitutional provisions.

Notably, the term ‘Collegium’ is not explicitly mentioned in the Indian Constitution; instead, it has evolved as a customary practice based on legal precedents.

‘Pink Blooms’ in Kole wetlands of Kerala

Context:

The Impatiens genus, known locally as Kasithumba and Onappovu, is currently captivating tourists with its vibrant pink blossoms in the region of Munnar.

Understanding Balsams

- Unique Characteristic: Balsams have earned the nickname ‘touch-me-not’ due to their distinctive behavior, where mature seeds burst open upon contact, dispersing seeds.

- Sign of a Vibrant Micro-Climate: Scientists propose that the profuse flowering of balsams in Munnar indicates the sustained vitality of the micro-climate in this hill station.

- Indian Balsam Variety: India is home to a total of 220 balsam species, with a substantial presence of 135 species in the southern Western Ghats.

- Balsam Haven: Idukki, especially the high-altitude areas around Anamudi, is renowned for its abundant diversity of wild balsams. Experts often refer to this district as a ‘balsam paradise.’

Conservation Initiatives

- Balsams in Munnar: Munnar boasts 46 distinct balsam species, stretching from Munnar to Chinnar and Bison Valley.

- Preservation in the National Park: Eravikulam National Park alone houses more than 40 wild balsam species, with the Forest Department taking measures to protect them.

- Unmatched Diversity: Prasad G, a working plan officer, emphasizes that the elevation of Munnar has unveiled 46 balsam species, a level of diversity unparalleled anywhere else in the world.

Indicator of Environmental Changes: Balsams hold a vital role as indicator species for monitoring climate change. Alterations in a region’s climate are often reflected in the population of these plants.

MHA extends ‘Disturbed area’ status in parts of Arunachal, Nagaland

Context:

The Union Home Ministry has extended the designation of areas in Arunachal Pradesh and Nagaland as “disturbed” under the Armed Forces (Special Powers) Act, 1958 for an additional six-month period.

Background:

- The Armed Forces Special Powers Act (AFSPA) was initially enacted by the Parliament in 1958.

- Initially, its application was limited to the Naga Hills, which were then part of Assam.

- Over time, its scope was expanded to encompass various regions within Assam, Nagaland, Manipur, and Arunachal Pradesh.

- In 1983, AFSPA was extended to Punjab and Chandigarh but was subsequently withdrawn in 1997.

- In 1990, it was enforced in Jammu and Kashmir and has remained in effect since then.

Current Situation:

- Under the authority granted by Section 3 of the AFSPA 1958, the Central government declared the districts of Tirap, Changlang, and Longding, as well as bordering areas in Arunachal Pradesh, as “disturbed” on March 24, 2023.

- Given the ongoing instability, the Central government, once again invoking the AFSPA, 1958, declared eight districts and 16 police stations in five other Nagaland districts as “disturbed” for a six-month duration, commencing from April 1, 2023.

Definition of ‘Disturbed Area’ Status:

- A “disturbed area” is one formally designated through notification under Section 3 of the AFSPA.

- Such designation can arise from differences or disputes among various religious, racial, linguistic, regional, or caste groups.

- The AFSPA confers special powers upon the Indian Armed Forces to maintain public order in these areas.

- In “disturbed areas,” armed forces personnel possess extensive authority to conduct searches, make arrests, and, if deemed necessary for public order, use force, including opening fire.

Key Points about the AFSPA:

- The AFSPA is enacted when a state or part thereof is declared a “disturbed area.”

- Once an area is designated as “disturbed,” it remains in that category for a minimum of six months, per the Disturbed Areas (Special Courts) Act, 1976.

- The AFSPA traces its origins back to the Armed Forces Special Powers Ordinance of 1942, initially imposed by the British colonial government to suppress the Quit India Movement.

- After independence, it was employed by the Indian government to address internal security concerns stemming from the Partition of India.

- Article 355 of the Indian Constitution grants the Central Government the authority to protect states from internal disturbances.

Special Powers Granted under AFSPA:

- Armed forces personnel are empowered to arrest individuals without a warrant and may use force, including lethal force, when making arrests.

- In “disturbed areas,” army personnel are permitted to open fire after issuing a warning or employ other forms of force against those who violate the law or disrupt public order.

- They have the authority to enter and search any premises or area to make arrests, and they may also destroy such premises or areas if required.

- Armed forces can stop and search vehicles or vessels.

- Any individual arrested under the AFSPA must be promptly handed over to the nearest police station.

- Armed forces personnel enjoy legal immunity for their actions, and no legal proceedings or prosecutions can be pursued against them under this law.

- The government’s power to declare an area as “disturbed” is not subject to judicial review.

Arguments in Favor of AFSPA:

- Supporters argue that AFSPA is necessary because neither soldiers nor their superiors receive training in civilian law or policing procedures.

- This unique law legitimizes the presence and actions of armed forces in exceptional circumstances.

- Repealing AFSPA could encourage insurgency and militancy, posing a threat to national unity and peace.

- It is argued that extraordinary situations require extraordinary measures.

Criticism of AFSPA:

The law has faced criticism for human rights violations in regions where it is enforced.

It is suggested that AFSPA has triggered a vicious cycle in the North East, as its use has fueled demands for greater autonomy, providing justification for its continued enforcement by the Indian government.

Dadasaheb Phalke Award

Context:

- The Union Information and Broadcasting Minister recently announced that veteran actor Waheeda Rehman is to receive the Dadasaheb Phalke Lifetime Achievement Award for 2021, in recognition of her exceptional contributions to Indian cinema.

About the Dadasaheb Phalke Award

- Purpose: The Dadasaheb Phalke Award is the highest honor in Indian cinema, presented to individuals who have made outstanding contributions to its growth and development.

- Inception: Instituted by the Indian government in 1969, this prestigious award has been a symbol of recognition for cinematic excellence.

- Named After: It is named after Dhundiraj Govind Phalke, often referred to as the “Father of Indian Cinema.”

- Components: The award includes a ‘Swarna Kamal’ (Golden Lotus), a cash prize of INR 10 lakh, a certificate, a silk scroll, and a shawl.

- Presentation: The award is presented by the President of India in the presence of prominent figures from the film industry and government officials.

- First Recipient: The inaugural recipient of the Dadasaheb Phalke Award was Devika Rani Roerich in 1969.

Who was Dadasaheb Phalke?

- Early Life: Dhundiraj Govind Phalke, born in 1870 in Trimbak, Maharashtra, had a diverse career trajectory. Initially, he pursued studies in engineering and sculpture, but his interest in motion pictures was sparked after viewing the 1906 silent film ‘The Life of Christ.’

- Varied Pursuits: Before venturing into the world of cinema, Phalke worked as a photographer, owned a printing press, and even collaborated with the renowned painter Raja Ravi Varma.

- Filmmaking Pioneer: In 1913, Phalke scripted, produced, and directed India’s first-ever feature film, the silent masterpiece ‘Raja Harishchandra.’

- This groundbreaking film achieved commercial success and marked the commencement of Phalke’s prolific career, during which he created 95 more films and 26 short films over the next 19 years.

Father of Indian Cinema: Dhundiraj Govind Phalke is widely acknowledged as the “Father of Indian Cinema” due to his pioneering contributions that laid the foundation for the growth and evolution of India’s film industry.

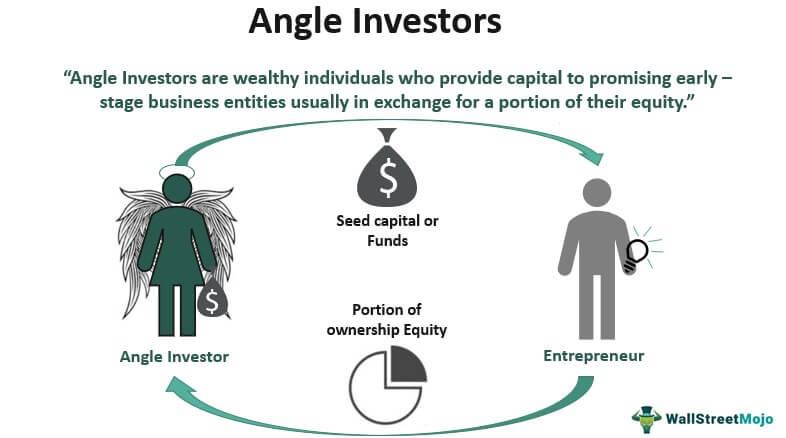

Ease in Angel Tax Provision

Context:

The government has recently made amendments to the angel tax regulations initially introduced in this year’s budget.

These changes primarily focus on investments made by non-resident investors in startups at valuations exceeding their fair market value.

Key Revisions Implemented

- A notification from the Central Board of Direct Taxes has revised Rule 11UA within the Income Tax Act.

- These revisions incorporate adjustments to the previously proposed guidelines.

- Notably, five different methods for valuing shares have been introduced, with a 10% tolerance allowance for deviations from accepted valuations.

- These alterations are designed to offer some relief to foreign investors considering investments in Indian startup ventures.

Angel Investment

- An angel investor is an individual who offers financial support to early-stage startups or entrepreneurs, typically in exchange for an ownership stake in the company.

- Angel investors are often individuals with substantial personal wealth who invest their own funds, rather than representing a corporation or institution.

Characteristics of Angel Investing:

- Early-stage funding

- Equity investment

- High-risk, high-reward

- Active involvement

- Personal investment

- Flexible terms

- Shorter investment horizon

What is Angel Tax?

- Angel Tax, formally known as Section 56(2)(viib) of the Income Tax Act, 1961, is a unique tax on capital receipts that is specific to India.

- This provision was introduced in 2012 to curb money laundering and the practice of channeling unaccounted funds into unlisted companies through investments at a significant premium.

- The scope of this tax covers investments in any private business entity, although it was only extended to startups in 2016.

Reasons for Introducing Angel Tax

- The complex nature of venture capital fundraising involving offshore entities, multiple limited partners, and blind pools has been a source of controversy.

- There have been instances of money laundering and the circumvention of regulations through these practices.

Details of the Taxation

- Angel Tax is imposed on startups at a rate of 9% on the amount of net investment exceeding the fair market value.

Angel investors can claim a 100% tax exemption on the excess investment amount, provided they have a net worth of ₹2 crores or an income of more than ₹25 lakh in the past three fiscal years.