Topics:

- Offer for Sale

- Collapse of Gulf Stream

- Stapled Visa

- International Tiger Day

- India’s Per Capita Income

- Free Movement Regime

Offer-for-Sale (OFS)

News: The government’s stake sale in Rail Vikas Nigam Ltd (RVNL) through an offer-for-sale (OFS) received an enthusiastic response from institutional investors.

Basics

- Introduced by India’s securities market regulator SEBI in 2012, Offer for Sale (OFS) is a share sale method.

- Aimed at assisting promoters of listed companies in reducing their holdings and meeting the minimum public shareholding requirements within specified deadlines.

- This mechanism has become widely adopted by both state-run and private listed companies as a means of complying with SEBI’s regulations.

- Additionally, the government has also embraced OFS as a way to divest its shareholding in public sector enterprises.

Advantages of OFS

- OFS is faster and cheaper as it does not require drafting of prospectus, filing of documents, book building or road shows.

- OFS is more transparent as it is done through the exchange platform and the bids are visible to all participants.

- OFS is more flexible as it allows the seller to decide the floor price, offer size, discount, timing and duration of the offer.

- OFS is more convenient as it does not require any physical application form, demand draft or cheque. The investors can bid online using their existing trading and demat accounts.

Disadvantages of OFS

- OFS may not attract enough demand from investors as it does not involve any marketing or publicity campaign.

- OFS may not fetch the best price for the seller as it depends on the market conditions and investor sentiment on the day of the offer.

- OFS may not be suitable for companies that want to raise fresh capital or increase their public shareholding as it only involves secondary sale of existing shares.

Key Aspects of Offer for Sale:

- Stake Dilution: An Offer for Sale (OFS) involves the reduction of the promoters’ stake in a company by selling existing shares to various entities, including retail investors, companies, Foreign Institutional Investors (FIIs), and Qualified Institutional Buyers (QIBs), through an exchange platform.

- Restriction on Fresh Issuance: Unlike a follow-on public offering (FPO), which allows companies to raise funds by issuing fresh shares or promoters to sell existing stakes (or both), OFS is solely used for selling existing shares.

- Eligibility Criteria: Conducting an OFS is limited to promoters or shareholders who hold more than 10% of the share capital in the company.

- Limited to Top 200 Companies: The OFS mechanism is available only for the top 200 companies based on their market capitalization.

- Reserved Quota for Institutions: At least 25% of the shares offered in an OFS are reserved for mutual funds (MFs) and insurance companies. Additionally, no single bidder, except MFs and insurance companies, can be allocated more than 25% of the offering size.

- Retail Investor Participation: A minimum of 10% of the offer size is set aside for retail investors to encourage their active participation in the share sale.

- Discount Provision: Sellers have the flexibility to offer a discount to retail investors either on the bid price or on the final allotment price.

8.Timely Notification: The company is required to inform the stock exchanges about its intention to conduct an OFS at least two banking days prior to the event.

Difference between Offer for Sale (OFS) and Initial Public Offering (IPO)

| Factor | OFS | IPO |

| Meaning | Offer for Sale is when the promoters or large shareholders of a listed company sell their shares to the public through the stock exchange platform. | Initial Public Offering is when a private company issues new shares to the public for the first time to raise capital and become publicly listed. |

| Purpose | To dilute the stake or exit the investment by the existing shareholders. | To raise fresh capital for the company’s growth and expansion. |

| Regulations | Only the top 200 companies by market capitalization can do OFS. The company has to inform the exchange two working days before the OFS. The offer is open for one or more trading days. | Any company that meets the SEBI’s criteria can do IPO. The company has to file a draft prospectus, book build the issue, and conduct road shows. The offer is open for three to ten working days. |

| Cost | OFS is cheaper and faster as it does not require drafting of prospectus, filing of documents, book building or road shows. | IPO is expensive and time-consuming as it involves various intermediaries, fees, and processes. |

| Allotment | OFS allotment is done on a price priority or proportionate basis depending on the type of offer. The settlement is done on a T+1 basis. | IPO allotment is done on a lottery basis for retail investors and on a proportionate basis for institutional investors. The settlement is done on a T+6 basis. |

| Effect on Balance Sheet | OFS does not affect the balance sheet of the company as no new shares are issued or capital is raised. It only transfers the ownership from one shareholder to another. | IPO affects the balance sheet of the company as new shares are issued and capital is raised. It increases the share capital and reserves of the company. |

What is the Gulf Stream?

- The Gulf Stream is a part of the Atlantic Meridional Overturning Circulation (AMOC), a system of warm ocean currents that bring heat from the tropics to the higher latitudes of the Northern Hemisphere.

- The AMOC also transports cold water from the north to the south, creating a global conveyor belt of water, heat, carbon and nutrients.

Why is it important?

- The Gulf Stream influences the climate of western Europe by moderating the temperatures and bringing moisture to the region.

- It also affects the weather patterns, marine ecosystems, fisheries and coastal erosion of the Atlantic basin.

- The AMOC is considered a key component of the Earth’s climate system and a potential tipping point for abrupt and irreversible changes.

What are the risks of its collapse?

A collapse of the Gulf Stream means that the AMOC would switch from its stronger, faster mode to a weaker, slower one. This would have drastic consequences for the climate, such as:

- Lowering the temperatures in Europe by up to 10 or 15 degrees Celsius.

- Disrupting the rainfall patterns that billions of people depend on for agriculture in Asia and Africa.

- Raising the sea levels in the eastern US and increasing coastal flooding.

- Altering the ocean circulation and affecting the marine life and biodiversity.

- Amplifying the global warming by releasing more carbon dioxide from the ocean into the atmosphere.

When could it happen?

- A recent study published in Nature Communications has warned that the Gulf Stream could collapse as early as 2025, based on sea surface temperature data from 1870 to 2018.

- The study estimates that the AMOC could collapse between 2025 and 2095, depending on how much greenhouse gas emissions continue to rise.

- If emissions start to reduce, the world would have more time to keep temperatures below the point at which the AMOC would collapse.

Consequences of Gulf Stream Collapse

- Disrupted Rainfall Patterns: Numerous regions, such as India, South America, and West Africa, heavily reliant on these rainfall patterns for their agricultural productivity, would encounter food insecurity issues.

- Intensified Storms and Colder Temperatures: Europe would witness an increase in storm frequency and experience colder temperatures as a result of the Gulf Stream’s collapse.

- Rising Sea Levels: Coastal communities along the eastern coast of North America would be at risk due to rising sea levels, posing significant threats to their existence and livelihood.

4. Endangered Ecosystems: The collapse of the Gulf Stream could jeopardize vital ecosystems, including the Amazon rainforest and Antarctic ice sheets, putting them at severe risk of endangerment.

Stappled Visa

Context:

- India has decided to withdraw its eight-athlete wushu contingent from the Summer World University Games in Chengdu.

- The reason behind this decision is China’s issuance of stapled visas to three athletes from the team who belong to Arunachal Pradesh.

The World University Games:

- The Summer World University Games, also known as the FISU World University Games, are held every two years, gathering athletes from around the world to participate in various sports.

- In the current games, Chengdu is hosting 227 Indian athletes competing in 11 different sports.

- A ‘stapled visa’ is different from a regular visa that a country gives to foreign citizens.

- Instead of stamping directly in the passport, it is a separate piece of paper attached (stapled) to the visa.

- This practice allows China to avoid placing official stamps on the passport

- Stapled visas are a type of visa used by China for Indian nationals from Arunachal Pradesh and Jammu and Kashmir.

- Unlike regular visas that are stamped directly onto the passport by the issuing authority, stapled visas involve attaching an unstamped piece of paper to the passport using staples or a pin.

- This practice has been contested by the Indian government, which maintains that these stapled visas are not acceptable as valid travel documents.

Indian Response:

- The Ministry of External Affairs of India has firmly expressed its disapproval of the stapled visas issued by China.

- The Indian government has consistently refused to recognize these visas as legitimate, stating that they have lodged strong protests with the Chinese authorities, reiterating their position on the matter.

Conclusion:

Due to the issuance of stapled visas to Indian athletes from Arunachal Pradesh, India has taken the decision to withdraw its wushu contingent from the Summer World University Games in Chengdu.

This incident highlights the ongoing tensions between the two countries over the validity and acceptance of these visas.

International Tiger Day

Context:

Panthera, a prominent global wild cat conservation organization, in collaboration with the Chinese Academy of Sciences, has shed light on Bangladesh’s significant involvement in the illegal poaching and trafficking of endangered tigers. This revelation marks Bangladesh as an unrecognized but major hub in this illicit trade.

Key Findings of the Research

- Bangladesh’s Supply Chain: The research uncovered that Bangladesh is the source of tiger parts supplied to as many as 15 countries, including Bangladeshi expatriates residing abroad.

- Leading Demand: Among the countries fueling the demand for tiger parts, India, China, and Malaysia are at the forefront, followed by developed G20 nations like the United Kingdom, Germany, Australia, and Japan

- Identified Source Sites: Scientists pinpointed four main locations where tigers are poached: the Sundarbans, spanning India and Bangladesh; India’s Kaziranga-Garampani Parks; Myanmar’s Northern Forest Complex; and India’s Namdapha-Royal Manas Parks.

- Southeast Asia’s Role: While Southeast Asia has been known as ground zero for tiger poaching, the study emphasizes that tiger poaching remains the most critical threat to the survival of the species.

Recognizing International Tiger Day

- International Tiger Day, celebrated annually on July 29th, holds immense significance in the ongoing efforts to protect and preserve these majestic creatures.

- The day’s origins can be traced back to 2010 when it was observed that a staggering 97% of all wild tigers had vanished in the previous century, leaving only around 3,000 remaining.

The Goals of International Tiger Day

- The primary objective of International Tiger Day is to prevent further decline in tiger populations and safeguard their habitats.

- By raising awareness and promoting conservation efforts, the day strives to ensure a brighter future for these endangered species.

India’s Per Capita Income

News:

- Standard Chartered economists recently predicted a significant increase in India’s per capita income, estimating it to rise 1.6 times to $4,000 (approximately ₹2 lakh) by the year 2030.

- This growth is expected to elevate India into the category of an upper-middle income country.

- The report also sheds light on the per capita GDP of specific states contributing significantly to India’s economy.

Prominent States with High Per Capita GDP

- The states of Telangana, Delhi, Karnataka, Haryana, Gujarat, and Andhra Pradesh, jointly accounting for 20% of India’s GDP, are projected to experience a per capita GDP surpassing $6,000 by 2030.

- This highlights the economic prosperity of these regions and their contribution to the nation’s overall growth.

Doubling of Per Capita Income in Uttar Pradesh and Bihar

- The report suggests that the states of Uttar Pradesh and Bihar are expected to witness significant progress, with their per capita income doubling to $2,000 by 2030.

- This growth indicates a positive economic trajectory for these states, which have historically faced development challenges.

Drivers of Sustained Economic Growth

- The report identifies various factors driving sustained economic growth in India.

- These factors include economic reforms, macroeconomic stability, political stability, and the healthy financial standing of corporations.

- Additionally, the report credits the boost in government capital expenditure as a catalyst for increased private investments.

Understanding Per Capita Income (PCI)

- Per capita income (PCI) serves as a crucial economic indicator, measuring the average income earned per person within a specified area, such as a city, region, or country, during a particular year.

- This metric is calculated by dividing the total income of the area by its total population.

Comparing Economies with Varying Population Sizes

- PCI provides a basis for comparing and evaluating the economic situations of different countries with varying population sizes.

- By taking into account each individual within the area, including men, women, children, and infants, PCI offers a comprehensive assessment of the economic well-being of the entire population.

Calculation of Per Capita Income

- To calculate a country’s or state’s PCI, the total national income for the specific geographical region is divided by its population.

- This approach ensures that the economic performance is measured on an individual basis, reflecting the prosperity or challenges faced by each citizen.

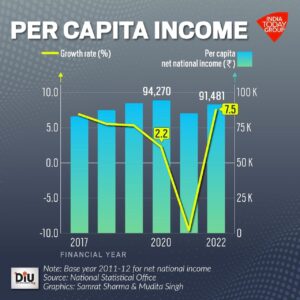

Illustration of Per Capita Income Progress in India

- The All India annual per capita Net National Income (NNI) for the years 2014-15 and 2022-23, at current prices, demonstrate a remarkable achievement, increasing from Rs. 86,647 to Rs. 1,72,000.

- This indicates significant economic growth and progress in improving individual income levels over time.

Free Movement Regime

Introduction

The Free Movement Regime (FMR) is a unique travel arrangement between India and Myanmar that allows the tribes residing along the border to travel 16-km across the boundary without visa restrictions

- The FMR was implemented in 2018 as part of the Act East policy at a time when diplomatic relations between India and Myanmar were on the upswing.

- The FMR aimed to facilitate people-to-people contact, local trade, and business, essential for livelihoods and sustenance.

Benefits of FMR

- The FMR helps tribes across the border to maintain their age-old ties.

- The FMR fosters cross-border cooperation and development in areas such as health, education, tourism, and culture.

- The FMR enhances security and stability in the region by addressing issues such as insurgency, smuggling, and trafficking.

Challenges of FMR

- The FMR has been exploited by militants for smuggling arms, drugs and fake Indian currency.

- The FMR has led to concerns about illegal immigration, especially after the military coup in Myanmar that triggered persecution against the Kuki-Chin peoples, leading to a significant influx of Myanmarese tribals into Manipur and Mizoram, seeking shelter.

- The FMR has created tensions between the Meiteis and Kukis in Manipur over land rights, ethnic identity, and political representation.

Way Forward

- The FMR needs better regulation to address the challenges arising from illegal activities and cross-border movements.

- A middle path could be sought, addressing changing socio-politico-economic conditions in Myanmar and the dynamic demographic profile of the region India needs to find an approach that balances addressing illicit activities and border crimes while considering the concerns and needs of the local population.