Topics:

1.India’s Reforestation Legacy: A 200-Year Experiment

2. Transit Card for Digital fare payment

3. Heatwave leading Ozone pollution

4. India-US Defence deal

5. Financial Inclusion in India

6. Incremental CRR

India’s Reforestation Legacy: A 200-Year Experiment

Context:

India’s extensive history of tree planting spanning over two centuries provides valuable insights into the outcomes of different approaches to forest restoration.

Plantations in Colonial-Era India:

- During the colonial era, the British, represented by the East India Company and later the British Crown, exerted control over India.

- Their focus shifted towards India’s forests to fulfill their significant demands for timber, required for railway sleepers and shipbuilding.

- The Indian Forest Act of 1865 was enacted to ensure a consistent supply of high-yield timber trees like teak, sal, and deodar.

- This legislation placed numerous forests under state ownership, restricting the rights of local communities to harvest beyond grass and bamboo, even curbing cattle grazing.

- In response, some Indian communities resorted to forest burning.

- Teak monocultures proliferated as teak trees, well-suited to India’s hot and humid climate and valued for their durable timber, aggressively expanded. This transformation displaced native hardwood trees like sal.

- Exotic species such as eucalyptus, European and North American pines, and acacia trees from Australia were introduced for timber, fodder, and fuel.

- The introduction of wattle in 1861 in the Nilgiris district marked the beginning of its invasion in this ecologically significant region.

- These introduced species, especially wattle and pine, began to displace native vegetation, adversely affecting the ecology and livelihoods of local communities.

- The loss of native oak and sal trees, crucial for various purposes, further exacerbated these challenges.

Importance of Studying Past Tree Plantation Efforts:

- Studying historical strategies for natural forest regeneration reveals their positive impact on reducing carbon emissions, enhancing biodiversity, and creating livelihood opportunities.

- Global Tree Cover Initiatives emphasize the need to distinguish between reforestation for timber production and carbon offsetting, the latter often involving the planting of fast-growing trees for timber and carbon credit certification for emission offsets.

- Sustainable practices, like planting trees on farms and barren lands for firewood and timber, alleviated the pressure on natural forests and aided their recovery.

- Unintended Consequences: The introduction of exotic species without thorough research can lead to invasive species and dispossess local communities of their land and resources.

Current Restoration Efforts in India:

- India has committed to restoring approximately 21 million hectares of forest by 2030 as part of the Bonn Challenge, a global initiative aimed at restoring degraded and deforested landscapes.

- To achieve the National Forest Policy target of a 33% forest cover, India has focused on planting single species like eucalyptus or bamboo, which grow quickly and increase tree cover.

Impact on People and Environment:

- There are concerns that afforestation in grassland ecosystems, which naturally have low tree cover, may harm rural and indigenous communities.

- The Forest Rights Act of 2006 empowers village assemblies to manage traditional forest areas.

- The continued planting of exotic trees poses a risk of new invasive species emerging, reminiscent of the wattle invasion two centuries ago.

Case Studies:

Community-Led Restoration: In the Gadchiroli district of Maharashtra, Gram Sabhas have successfully restored degraded forests, sustainably managing them as a source of tendu leaves used for wrapping bidis (Indian tobacco).

Invasive Species Control: Communities in Kachchh, Gujarat, have restored grasslands by removing the invasive Gando Bawal tree, introduced by British foresters in the late 19th century.

Future Considerations:

- A holistic approach to policy-making should encourage both natural forest regeneration and plantations for timber and fuel, while assessing their impact on people and ecosystems.

- Local implications, such as the effect of afforestation on forest rights, local livelihoods, biodiversity, and carbon storage, should be thoroughly evaluated. Successful restoration practices by communities should be scaled up.

- Reviving ecosystems should be a priority for policymakers, focusing on a limited number of tree species that emphasize environmental benefits over the extent of forest canopy.

Conclusion:

India’s historical journey in tree planting offers valuable insights into the complexities and consequences of reforestation efforts. By drawing lessons from the past, India can develop more sustainable and inclusive strategies for restoring its forests, addressing the needs of both the environment and its diverse communities.

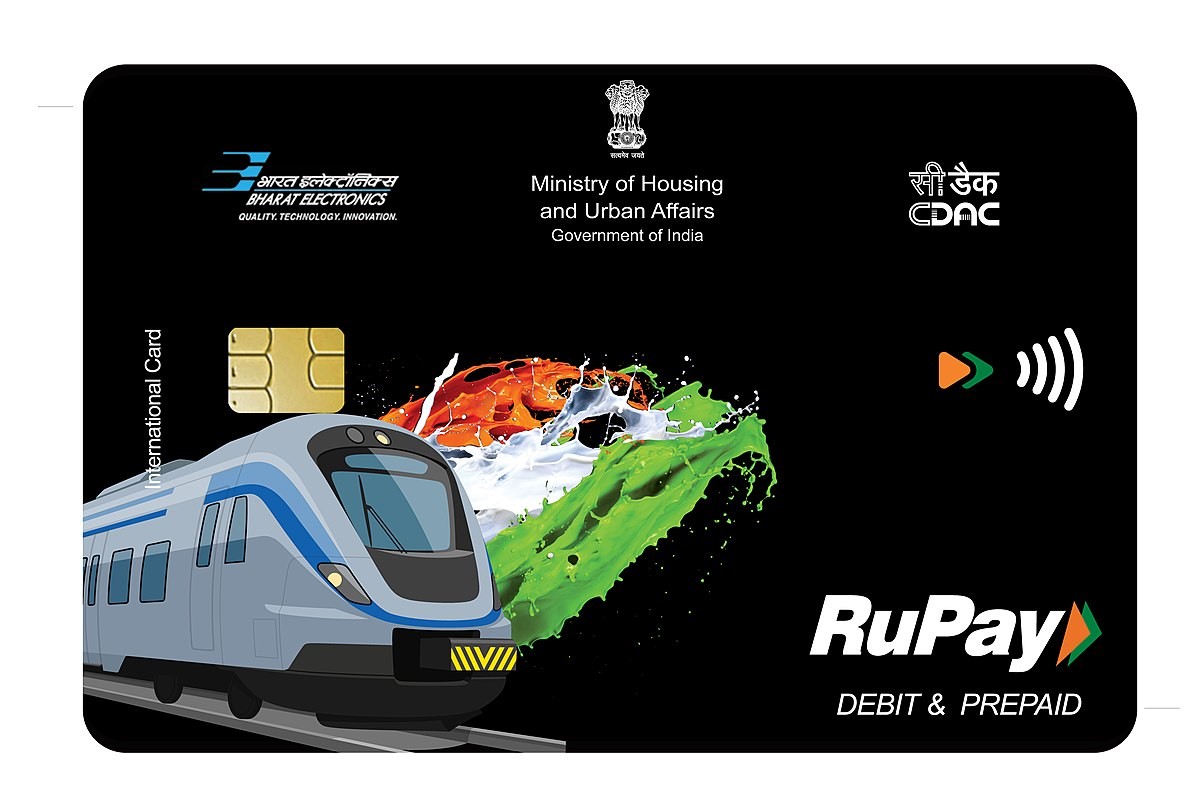

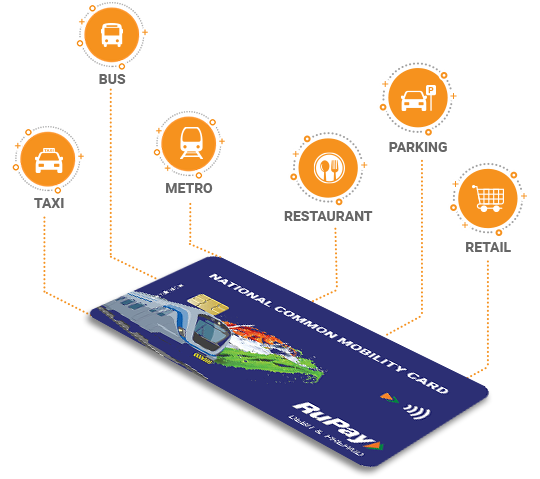

Transit Card for Digital fare payment

Context:

The State Bank of India (SBI) has introduced the ‘Nation First Transit Card,’ aimed at providing a seamless and convenient digital fare payment system for commuters.

Nation First Transit Card:

This card’s primary goal is to simplify the commuting experience by offering digital ticketing options for various modes of transportation and parking, all accessible through a single card.

Key Features of the Nation First Transit Card:

- Streamlines customer commuting and digital fare payments for metro, buses, water ferries, and parking via a single card.

- Enhances versatility by allowing payments for retail and e-commerce transactions.

3. Powered by the technology of RuPay and the National Common Mobility Card (NCMC).

Key Information about the National Common Mobility Card (NCMC):

- Introduced on March 4, 2019.

- Permits SBI customers to use their Debit Cards as travel cards for metro rail and buses in supported locations.

- Originated from the Nandan Nilekani committee, established by the Reserve Bank of India (RBI).

- An initiative led by the Ministry of Housing and Urban Affairs in India, aiming to promote cashless transactions and create a unified payment platform for commuters.

- Provides a unified contactless transport solution through the RuPay platform, developed by the National Payments Corporation of India (NPCI).

6. Acts as an automatic fare collection system, transforming smartphones into interoperable transport cards for metro, bus, and suburban railway services.

Heatwave leading Ozone pollution

Context:

- The World Meteorological Organization (WMO) has issued the “2023 WMO Air Quality and Climate Bulletin.”

- This release coincides with the International Day of Clean Air for blue skies, observed annually on September 7 to underscore the crucial role of clean air in promoting human health and well-being.

Key Points from the Report:

- Strong Link between Heat Waves and Wildfires:

– Heatwaves are exacerbating wildfires, with instances of increased severity observed.

– In 2022, heatwaves in the United States and Europe led to wildfires, which, when combined with desert dust, resulted in hazardous air quality conditions.

- Rise in Greenhouse Gas (GHG) Emissions:

– Heatwaves are contributing to additional carbon emissions, leading to higher concentrations of greenhouse gases in the atmosphere.

- Impact of Desert Dust:

– In the latter part of August 2022, an unusually high influx of desert dust occurred over the Mediterranean and Europe.

- Effects on Human Health and Well-being:

– Heatwaves are deteriorating air quality, with cascading effects on human health, ecosystems, agriculture, and daily life.

– Increased ozone levels have had a global impact on agriculture, causing crop losses ranging from 4.4% to 12.4% for staple crops.

– Wheat and soybean losses reached as high as 15% to 30% in key agricultural regions of India and China.

- Growth of Marine Heatwaves:

– Climate change is intensifying and expanding marine heatwaves, which develop when ocean temperatures in a specific area significantly exceed the average for an extended period.

Definition of a Heatwave:

A heatwave, as defined by the World Meteorological Organization, is a period of five or more consecutive days with daily maximum temperatures exceeding the average maximum temperature by 5°C (9°F) or more. It involves extended periods of abnormally high surface temperatures, leading to physiological stress and, at times, fatalities among inhabitants.

Criteria for Declaring a Heat Wave in India:

– In the plains, a heatwave is declared if the maximum temperature reaches at least 40°C or more.

– In hilly regions, a heatwave is considered when the maximum temperature reaches at least 30°C or more.

– In coastal regions, heatwaves are declared if the maximum temperature departure is 4.5°C or more from normal, provided the actual maximum temperature reaches 37°C or more.

Threats Posed by Extreme Heat:

- Heatstroke, heat exhaustion, and various respiratory and cardiovascular diseases result from prolonged heat exposure.

- The Heat Index, introduced by the India Meteorological Department, gauges the apparent temperature, considering humidity’s impact along with temperature, to assess discomfort levels.

- Economic impacts include reduced worker productivity due to heatwaves, affecting India’s overall economy.

- Agriculture suffers from reduced productivity and livestock vulnerability, with heatwaves causing up to a 25% reduction in wheat yields according to a report by the Indian Council of Agricultural Research (ICAR).

- Urban heat islands, where urban areas are significantly hotter than surrounding regions, are exacerbated by infrastructure absorbing and radiating heat.

The Way Forward:

- Implementation of heat preparedness plans, identifying vulnerable populations, and establishing cooling centers during extreme heat events.

- Efforts to combat the urban heat island effect, such as installing cool roofs, green roofs, cool pavements, and planting shade-providing trees.

- Pursuing energy efficiency to reduce electricity grid demands, particularly during heatwaves.

- Utilization of the Climate Mapping for Resilience and Adaptation portal, providing real-time climate risk information.

- Emphasizing the effective implementation of the Sendai Framework for Disaster Risk Reduction (SFDRR) 2015-30, with collaboration among various stakeholders.

- Installation of improved Early Warning Systems (EWS) to communicate heatwave threats, recommend preventive measures, and predict disaster impact scenarios.

Consideration of declaring heatwaves as natural disasters to enable state and district administrations to prepare regional-level heatwave action plans.

INDIA-US DEFENCE DEAL

Context:

The joint statement issued by India and the USA highlights several agreements across various domains, including jet engine production, armed drones, and resolving WTO disputes.

Below are the key points from the statement:

- Manufacturing GE F-414 Jet Engines:

– Approval has been granted for the production of GE F-414 jet engines in India, a result of the collaboration between General Electric Aerospace and Hindustan Aeronautics Ltd.

- Settlement of Outstanding WTO Dispute:

– The final pending WTO dispute between India and the USA has been resolved.

- Procurement of MQ-9B Remotely Piloted Aircraft:

– India has requested to acquire 31 General Atomics MQ-9B remotely piloted aircraft to enhance its military surveillance capabilities.

- Establishing India as a Hub for U.S. Navy Assets:

– There is a commitment to make India a hub for the maintenance and repair of U.S. Navy assets and aircraft.

- Encouraging U.S. Industry Investments:

– The statement encourages further investments by U.S. industries in India’s aircraft maintenance and repair capabilities.

Summary of Defense Relations:

- Highlights of Defense Relationship:

– The defense relationship constitutes a major pillar of the India-U.S. strategic partnership.

– It involves increased defense trade, joint military exercises, personnel exchanges, and collaboration in maritime security.

- Bilateral Exercises:

– India conducts more bilateral exercises with the United States than with any other nation.

Noteworthy exercises include:

– Tiger Triumph involving the Indian Army, Navy, and U.S. Navy.

– Vajra Prahar with the United States Army Special Forces and Para SF.

– Yudh Abhyas, the largest ongoing joint military training between India and the United States.

– Cope India, involving Air Force units.

– Malabar Exercise, a quadrilateral naval exercise with India, the USA, Japan, and Australia.

- Defense Trade and Initiatives:

– The total value of defense-related acquisitions from the United States exceeds $15 billion.

– The India-U.S. Defence Technology and Trade Initiative (DTTI) promotes co-development and co-production.

– India was designated as a “Major Defence Partner” by the U.S. in 2016, facilitating technology sharing.

– India’s elevation to Tier I of the Strategic Trade Authorization (STA) license exception in 2018 enables advanced technology interactions.

- Foundational Agreements:

Four key agreements strengthen cooperation:

– GSOMIA (2002): Ensures the protection of shared classified information and promotes interoperability.

– LEMOA (2016): Facilitates the sharing of military logistics.

– COMCASA (2018): Allows secure communications using U.S. proprietary equipment.

– BECA (2020): Provides India with real-time access to American geospatial intelligence.

- Cooperation Mechanisms:

– Defense cooperation involves several mechanisms:

– Defense Policy Group.

– Military Cooperation Group.

– Defense Technology and Trade Initiative with Joint Working Groups.

– Executive Steering Groups.

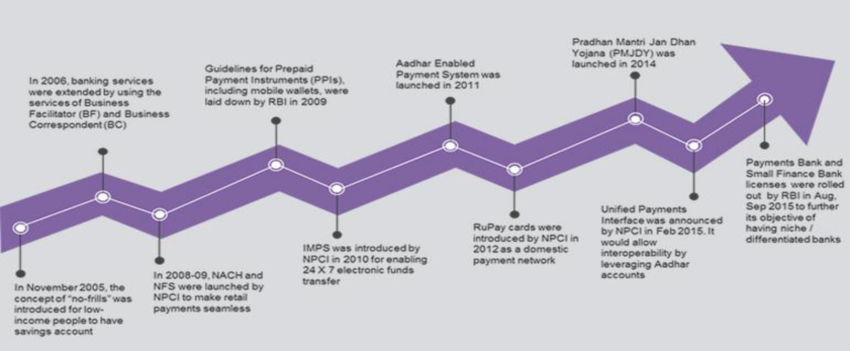

FINANCIAL INCLUSION IN INDIA

Context:

A G20 World Bank report highlights India’s remarkable progress in financial inclusion through digital payment infrastructure (DPI), which has allowed India to reduce its financial inclusion targets from 47 to 6 years.

Key points from the report include:

- Significance of Digital Payment Infrastructure (DPI):

– The World Bank’s G20 document underscores India’s impressive accomplishments in financial inclusion facilitated by DPI.

- UPI Transaction Value:

– In the last fiscal year, the total value of UPI (Unified Payments Interface) transactions approached nearly 50% of India’s nominal GDP.

- Reduced Customer Onboarding Costs:

– The cost of customer onboarding for banks in India has significantly decreased from $23 to $0.1, thanks to the adoption of DPI.

- Savings through Direct Benefit Transfer (DBT):

– By March 2022, India had saved $33 billion, equivalent to approximately 1.14% of GDP, through the implementation of Direct Benefit Transfer (DBT).

- India Stack’s Contribution to Financial Inclusion:

– The India Stack, incorporating digital ID, interoperable payments, digital credentials ledger, and account aggregation, has played a pivotal role in achieving an 80% financial inclusion rate within six years.

- Pradhan Mantri Jan Dhan Yojana (PMJDY) Success:

– The PMJDY accounts tripled from 147.2 million in March 2015 to 462 million by June 2022, with 56% of these accounts owned by women.

- Transformative Impact of Fast Payment System (FPS):

– The adoption of Fast Payment Systems like UPI has been transformative in India, with over 9.41 billion transactions valued at approximately Rs 14.89 trillion in May 2023.

– In the financial year 2022-23, the total value of UPI transactions accounted for nearly 50% of India’s nominal GDP.

Schemes Promoting Financial Inclusion:

- Pradhan Mantri Jan Dhan Yojana (PMJDY):

– Launched on August 28, 2014, by Prime Minister Narendra Modi.

– Aims to expand access to bank accounts, credit, insurance, and pensions.

– Over 318 million bank accounts were opened in the initial four years, with a focus on promoting financial inclusion, particularly among women.

- MUDRA Yojana:

– Launched on April 8, 2015, to stimulate economic growth.

– Provides affordable loans to micro and small enterprises.

– Seeks to integrate the target audience into the formal financial sector through loans offered by various financial institutions.

- PM Jeevan Jyoti Bima Yojana:

– Offers one-year life insurance coverage with annual renewal.

– Launched on May 9, 2015, by Prime Minister Narendra Modi.

– Availed by more than 5 crore people by 2018, providing financial security to families in the event of the breadwinner’s demise.

- PM Suraksha Bima Yojana:

– Launched on May 9, 2015, to provide accidental death insurance.

– Offers financial assistance in case of accidents.

– Managed by both private and public sector insurance companies.

- Atal Pension Yojana (APY):

– Introduced on May 9, 2015, for unorganized sector workers.

– Aims to ensure old-age security.

– Replaced the Swavalamban Yojana.

– Government contributes 50% of the total funds deposited by the worker.

- Stand Up India Scheme:

– Provides bank loans ranging from 10 lakh to 1 Crore to SC/ST and female entrepreneurs.

– Promotes entrepreneurship across various sectors.

– Requires SC/ST or female entrepreneurs to hold a majority stake in non-individual enterprises.

- Pradhan Mantri Vaya Vandana Yojana (PMVVY):

– A pension scheme for citizens aged 60 and above.

– Offers a guaranteed pension for ten years.

– Launched in 2017 and extended until March 2023.

– Allows investors to select their desired pension amount.

- Varishtha Pension Bima Yojana (VPBY):

– A senior citizen pension scheme with annuity payouts.

– Initially announced in 2003-04 and reintroduced in subsequent years.

– Provides social security for senior citizens.

- Sukanya Samriddhi Yojana:

– Launched on January 22, 2015, as part of the Beti Bachao Beti Padhao campaign.

– Aims to secure the future of girl children by enabling savings for their education and marriage.

– Remains valid for 21 years or until the girl reaches marriageable age after turning 18.

- National Strategy for Financial Inclusion:

– Introduced by the Reserve Bank of India (RBI) for 2019-2024.

– Focuses on strengthening digital financial services in Tier II to Tier VI centers.

– Encompasses six strategic objectives: universal access, financial services, livelihood support, financial literacy, customer protection, and effective coordination.

INCREMENTAL CRR

Context:

On September 8, 2023, the Reserve Bank of India (RBI) announced the gradual discontinuation of the Incremental Cash Reserve Ratio (I-CRR) as a measure to absorb surplus liquidity in the banking system, particularly resulting from the return of Rs 2,000 notes.

RBI’s Decision:

- Following a review, the RBI opted to phase out the I-CRR in stages, with the goal of releasing the impounded funds gradually.

- This approach is aimed at preventing sudden shocks to the liquidity of the financial system and ensuring orderly money market functioning.

Understanding Cash Reserve Ratio (CRR):

- Before delving into the Incremental Cash Reserve Ratio (I-CRR), it’s essential to grasp the concept of the Cash Reserve Ratio (CRR).

- Banks are required to maintain a portion of their deposits and specific liabilities as liquid cash with the RBI.

- CRR plays a vital role in the RBI’s liquidity management and acts as a safeguard during periods of banking stress.

- Currently, banks must maintain 4.5% of their Net Demand and Time Liabilities (NDTL) as CRR with the RBI.

Introduction to ICRR:

- I-CRR was introduced on August 10, 2023, as a temporary measure by the RBI to address the excess liquidity situation.

- Banks were mandated to maintain an I-CRR of 10% on the increase in their Net Demand and Time Liabilities (NDTL) between May 19, 2023, and July 28, 2023.

- It became effective from the fortnight starting August 12, 2023. The RBI has the authority to implement ICRR, an additional measure alongside the standard CRR.

- ICRR is used during periods characterized by excessive liquidity in the financial system, requiring banks to park even more liquid cash with the RBI than mandated under CRR.

- This serves as a tool for managing and controlling liquidity in the banking system.

Reason for I-CRR:

- Excess liquidity was attributed to various factors, including the return of Rs 2,000 banknotes, the RBI’s surplus transfer to the government, heightened government spending, and capital inflows.

- Daily liquidity absorption by the RBI reached Rs 1.8 lakh crore in July. Managing surplus liquidity was deemed necessary to maintain price and financial stability.

Impact on Liquidity Conditions:

- I-CRR was expected to absorb an excess of Rs 1 lakh crore from the banking system.

- It temporarily shifted the liquidity status of the banking system from surplus to deficit on August 21. Contributing factors included GST outflows and the central bank’s selling of dollars.

However, liquidity conditions returned to surplus from August 24. On September 8, the RBI absorbed Rs 76,047 crore of surplus liquidity from the system.