1. Proposed Changes to the Waqf Law: Waqf (Amendment) Bill, 2024

CONTEXT: The Waqf (Amendment) Bill 2024, has been sent reffered to Joint Parliamentary Committee (JPC) for further scrutiny following strong opposition from various parties.

Current Framework of Waqf Law

- Definition:

- Waqf Property: Personal property dedicated for religious, charitable, or private purposes under Islamic law. Ownership is considered to be with God.

- Formation: Can be established through a deed, instrument, or oral declaration.

- Governing Legislation:

- Waqf Act, 1995: Governs Waqf properties and management in India.

- Historical Context: Previous laws include the Muslim Waqf Validating Act (1913), Mussalman Wakf Act (1923), and Central Waqf Act (1954).

- Management:

- Managed by mutawalli (caretaker).

- Disputes resolved by Waqf Tribunal.

- Waqf Boards: State-level bodies overseeing Waqf properties. Composition includes Muslim members and legislators.

Proposed Amendments (Waqf (Amendment) Bill, 2024)

- Name Change: From “Waqf Act, 1995” to “Unified Waqf Management, Empowerment, Efficiency and Development Act, 1995”.

- New Provisions:

- Section 3A: Requires that the person creating a Waqf must be the lawful owner and competent to transfer or dedicate the property.

- Section 3C(1): Government Property: Government property identified as Waqf cannot be deemed Waqf property.

- Section 3C(2): Determination of Government Land: Disputes over whether a property is government land to be decided by the Collector, not the Waqf Tribunal. The property remains outside Waqf control until resolution.

- Audit and Oversight: Central Government given power to direct audits of Waqf properties by the Comptroller and Auditor-General or designated officers.

- Redefinition of Waqf: Removal of the concept of “Waqf by use”: Previously, continuous use for religious purposes could deem a property as Waqf. The Bill proposes that a property must have a valid Waqfnama to be considered Waqf.

- Changes to Waqf Boards: Composition: Allows inclusion of non-Muslims as CEOs and members of Waqf Boards.

Significance and Controversies

- Government Perspective: The amendments aim to streamline management, enhance efficiency, and resolve ambiguities concerning government properties.

Opposition Concerns: Unconstitutional and anti-minority: Opposition parties argue that the Bill undermines the autonomy of Waqf Boards and adversely impacts minority communities.

2. RBI and Food Inflation

Background on Food Inflation

- Significance: Food inflation has a significant weight in the Consumer Price Index (CPI) basket, approximately 46%.

Contribution to Headline Inflation:

- In May and June, food inflation contributed over 75% of the headline inflation.

- Vegetable prices alone accounted for about 35% of the headline price increases in June.

Governor Shaktikanta Das’s Remarks

- Policy Importance: RBI Governor Shaktikanta Das emphasized that the RBI must address food inflation in its monetary policy to maintain policy credibility and avoid spillover effects.

- Current Situation:

- High Food Inflation: Persistent across major food items.

- Core Inflation: Shows a downward trend, with core services inflation reaching a new low in the CPI series for May-June.

Inflation Dynamics

- July Trends: Food price pressures may have continued into July, but a favorable base effect might have reduced headline inflation in that month.

- Impact of Price Revisions:

- Milk Prices: Revisions in milk prices need to be monitored.

- Mobile Tariffs: Changes in mobile tariffs also require attention.

Policy Considerations

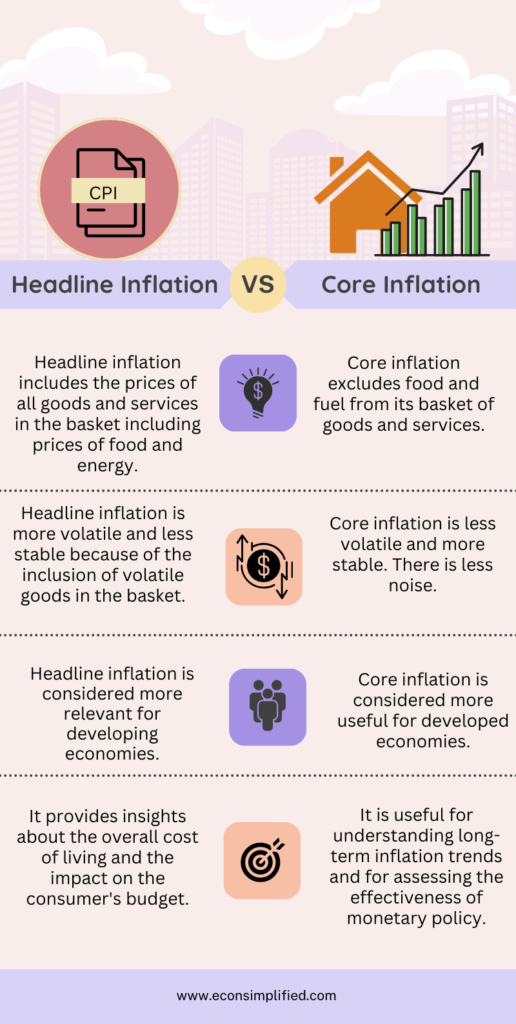

- Divergence: There is a significant divergence between headline inflation and core inflation, raising questions about the role of food inflation in monetary policy.

- MPC’s Role: The Monetary Policy Committee (MPC) must be vigilant to prevent secondary effects from persistent food inflation and protect the gains achieved through monetary policy.

Future Directions

- Economic Survey Suggestion: The Economic Survey proposed potentially delinking food inflation from the inflation-targeting framework.

NSO Survey: The National Statistical Office (NSO) is conducting a survey on food price inflation. Decisions regarding any changes to the inflation-targeting framework will be based on this survey’s findings and will be made by the government and RBI at an appropriate time.

3. RBI Holds Rates Steady: Key Points from the August Meeting

Monetary Policy Decision

- Interest Rates: The Reserve Bank of India (RBI) has decided to keep interest rates unchanged.

- Policy Stance: The RBI maintains its stance on the “withdrawal of accommodation,” aiming to gradually remove supportive measures introduced during economic slowdowns.

Current Inflation Dynamics

- Headline Retail Inflation:

- June 2024: Increased to 5.08%, up from 4.8% in May, primarily due to rising food prices.

- Food Price Index: Rose to 9.36% in June, up from 8.69% in May.

- Food Categories: Inflation is notably high across cereals, pulses, and vegetables.

- Core Inflation:

- Subdued: Remains relatively low, recorded at 3.1% in May and June.

- Historic Low: The divergence between core and headline inflation has deepened.

Economic Projections and Policy Focus

- Inflation Projection: RBI expects inflation for the full year to be around 4.5%.

- Growth Forecast: Economic growth is projected at 7.2% for the year, providing policy space to focus on controlling inflation.

- Governor Shaktikanta Das: Emphasized the need for disinflationary policies to align inflation with the 4% target on a durable basis.

Impact of Food Inflation

- Household Inflation Expectations: High food inflation has led to increased inflation expectations among households.

- Potential Spillovers: Persistent high food inflation could eventually impact core inflation if expectations become unanchored.

Global Context

- Interest Rate Cuts: Major central banks, including the European Central Bank and the Bank of England, have either cut rates or signaled upcoming cuts. The US Federal Reserve is also considering rate cuts, with deeper reductions being factored in due to weaker-than-expected labor market data.

Future Outlook: Factors to Watch:

- Harvesting and Mandi Arrivals: May lead to easing food prices.

Global Food Prices: FAO food price index showed a decline in July, which could influence the RBI’s policy decisions.