1. ASEAN and PM Modi's 10-point plan to enhance cooperation

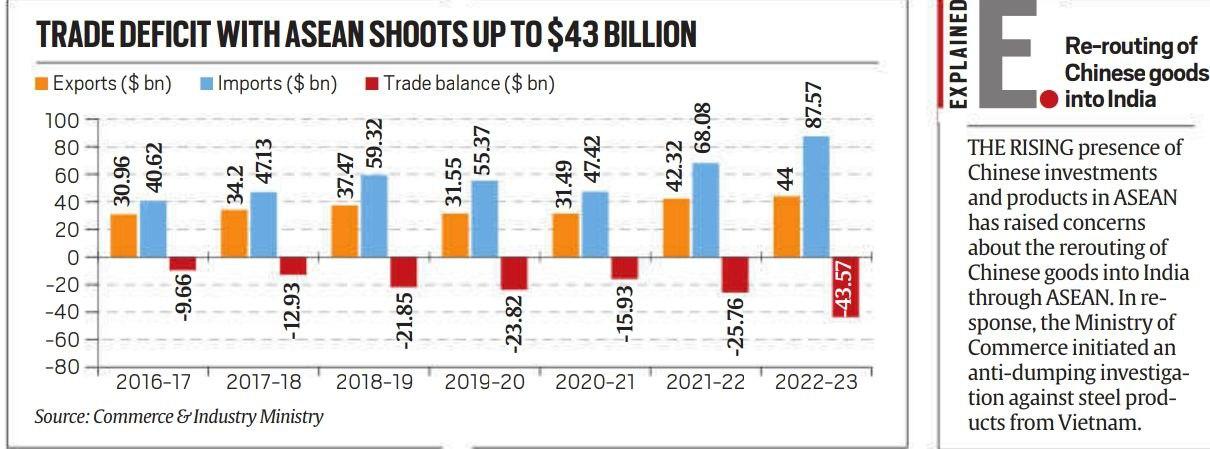

- Trade Agreement Review: PM Modi has called for a review of the India-ASEAN trade deal by 2025 due to concerns about the rising trade deficit, ASEAN’s growing trade advantage, and increasing Chinese investments in the region.

- Trade Deficit: India’s trade deficit with ASEAN has increased significantly, from $8 billion in FY13 to $44 billion in FY23, largely due to increasing imports from ASEAN countries.

- Chinese Influence: The influx of Chinese investments and products into ASEAN is a key factor driving India’s concerns. India fears Chinese goods are being rerouted into India via ASEAN, claiming benefits under the trade deal.

- India-ASEAN FTA (AITIGA): Signed in 2009, the ASEAN-India Trade in Goods Agreement (AITIGA) has favored ASEAN more than India, as ASEAN countries enjoy higher tariff benefits in India than Indian companies do in ASEAN markets.

- Slow Review Process: The process to review the India-ASEAN FTA has been slow, taking three years just to agree on the scope. This slow progress has further exacerbated concerns of disproportionate benefits to ASEAN.

- India’s Opt-Out from RCEP:

India opted out of the China-led Regional Comprehensive Economic Partnership (RCEP) in 2019 due to concerns about the potential for rising imports from China and its impact on domestic industry.

- Impact of ASEAN-China Trade:

The ASEAN-China Free Trade Agreement gives China better access to ASEAN markets than India enjoys under AITIGA, disadvantaging India.

- Anti-Subsidy Measures:

Indian industries have called for anti-subsidy measures to curb industrial imports from ASEAN, citing rerouting of Chinese goods. An anti-dumping investigation against steel products from Vietnam was initiated.

- Strategic Imports: ASEAN countries are important suppliers of raw materials such as palm oil and natural gas (Indonesia, Malaysia) and rubber (Thailand), making them strategically significant for India’s industrial needs.

- India’s Rising Imports from China:

Despite efforts to curb dependence, India’s imports from China surpassed $100 billion in FY24, a 10% rise compared to previous years, exacerbating trade imbalances.

2. PM Internship Scheme

- Launch and Objective: The PM Internship Scheme aims to provide internships to 1 crore youth in India’s top 500 companies over five years, focusing on enhancing employability and skill training.

- Target Age Group:

The scheme is open to youth applicants aged between 21-24 years, with a focus on providing internship opportunities across 24 sectors.

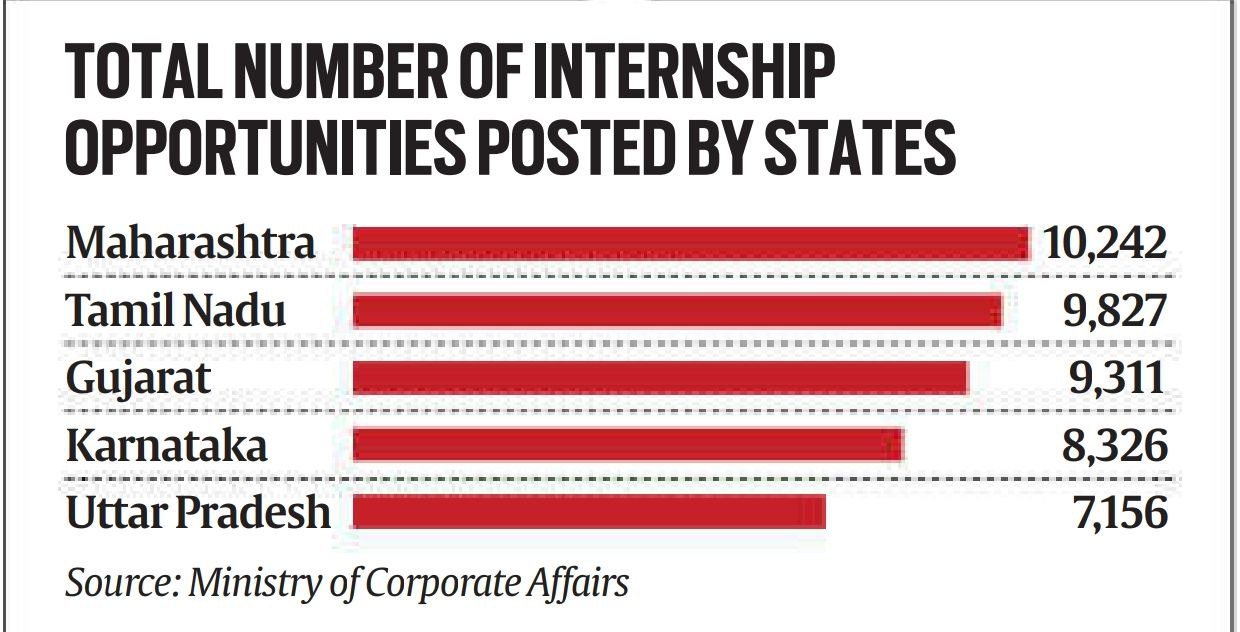

- Internship Listings:

Over 80,000 internships have been listed across 737 districts, with key sectors being oil, gas & energy, travel & hospitality, banking & financial services, and automotive industries.

- Participating Companies:

Companies like Mahindra & Mahindra, Alembic Pharma, Max Life Insurance, Larsen & Toubro, Bajaj Finance, and Jubilant Foodworks have listed internship opportunities.

- Internship Duration and Stipend:

Internships last for 12 months. Selected candidates will receive a stipend of ₹4,500 per month from the government through Direct Benefit Transfer (DBT), plus ₹500 from the company’s CSR funds.

- Eligibility:

Candidates who have passed high school, higher secondary, hold an ITI certificate, diploma, or a bachelor’s degree (B.A., B.Sc., B.Com, etc.) are eligible. Graduates from prestigious institutions (IITs, IIMs, NLUs, etc.) or with higher qualifications like CA, MBA, MBBS are ineligible.

- Income and Employment Exclusions:

Candidates whose family income exceeds ₹8 lakh per annum or have a family member as a regular government employee are ineligible.

- Reservation Policy:

The scheme follows the same reservation structure as government jobs for SCs, STs, OBCs, and persons with disabilities.

9. Budget and Outlay: Announced in the 2024-25 Budget, the scheme is part of the Prime Minister’s Package for Employment and Skilling, with an overall outlay of ₹2 lakh crore.

5. Issues in the Treatment of Rare Diseases and Government Interventions

- Definition of Rare Diseases:

According to WHO, rare diseases affect 1 or fewer people per 1,000. In India, around 55 conditions like Gaucher’s disease, Lysosomal Storage Disorders (LSDs), and certain muscular dystrophies are classified as rare diseases.

- Challenges in Treatment:

Less than 5% of rare diseases have therapies, and fewer than 1 in 10 patients receive disease-specific care. Treatments are often prohibitively expensive due to high development costs and limited market size.

- Categorization of Rare Diseases:

- Group 1: Diseases treatable with a one-time curative procedure.

- Group 2: Diseases requiring long-term but less costly treatment with regular check-ups.

- Group 3: Diseases needing expensive, lifelong treatment.

- National Policy for Rare Diseases (NPRD), 2021:

The policy provides financial assistance up to ₹50 lakh for treatment at identified Centres of Excellence (CoEs), including AIIMS (Delhi), PGIMER (Chandigarh), and SSKM Hospital (Kolkata).

- Funding and Financial Assistance:

The government has progressively increased funding for rare disease treatments:

- ₹24 crore allocated till August 2024.

- ₹3.15 crore, ₹34.99 crore, and ₹74 crore were disbursed in previous financial years. An additional ₹35 crore has been allocated for purchasing equipment to improve care.

- Crowdfunding and Voluntary Donations:

A Digital Portal for crowdfunding was launched to support rare disease patients. Donors can choose the patients they wish to help, and CoEs have their own rare disease funds for treatment support.

- High Cost of Orphan Drugs:

Orphan drugs are expensive due to limited production and patent restrictions. Developing these drugs domestically could lower costs, but government incentives like tax breaks for pharmaceutical companies are necessary.

- Tax and Customs Relief:

Though patients can import rare disease medicines without customs duty, companies importing them still face 11% customs duty and 12% GST. The Delhi High Court has ordered quicker exemption processing for these drugs.

- Government Actions under the Patents Act (1970):

The government can invoke compulsory licensing, allowing a third party to manufacture orphan drugs by paying a royalty. It can also acquire patents if the original holder does not ensure availability.

- Research and Development Gaps:

The Delhi High Court emphasized the lack of sufficient R&D in rare disease treatments in India. It urged the government to negotiate with pharmaceutical companies and invest in domestic drug development to reduce treatment costs.