1. New 'Click-to-Cancel' Rule by US FTC

Introduction

- FTC (Federal Trade Commission) Rule: A new rule making it easier for consumers to cancel subscriptions and memberships.

- Objective: To simplify the cancellation process and impose penalties on businesses that complicate it.

Key Features of the Rule

- Ease of Cancellation: Companies must make cancellation as easy as signing up.

- No Compulsory Calls: Customers cannot be forced to talk to live/virtual agents if they don’t want to.

- No Extra Charges: Companies cannot charge extra for phone cancellations.

- Prompt Responses: Companies must respond promptly if they take messages during business hours.

- In-Person Cancellation Restrictions: For in-person sign-ups, in-person cancellation cannot be mandated for other subscriptions.

Scope of Applicability

- Applies to Negative Option Programs: Includes prenotification, continuity plans, automatic renewals, free trials, etc.

- Definition of Negative Option: Companies assume a consumer’s acceptance unless they specifically reject it (e.g., free trials converting to paid services if not canceled).

Reasons for Introduction

- FTC’s 1973 Negative Option Rule Update: Modernized to combat deceptive practices in subscriptions and memberships.

- Rising Complaints: Daily complaints about negative option features have increased significantly from 42 in 2021 to 70 in 2024, reflecting the subscription economy’s growth.

- Study Insights: A 2022 study found that 42% of consumers forgot about subscriptions they weren’t using.

Companies Targeted: Companies like Adobe, Amazon, Brigit, and Planet Fitness were previously accused of making cancellations difficult.

Global Context – India: Currently lacks similar regulations, unlike the US’s updated FTC rule.

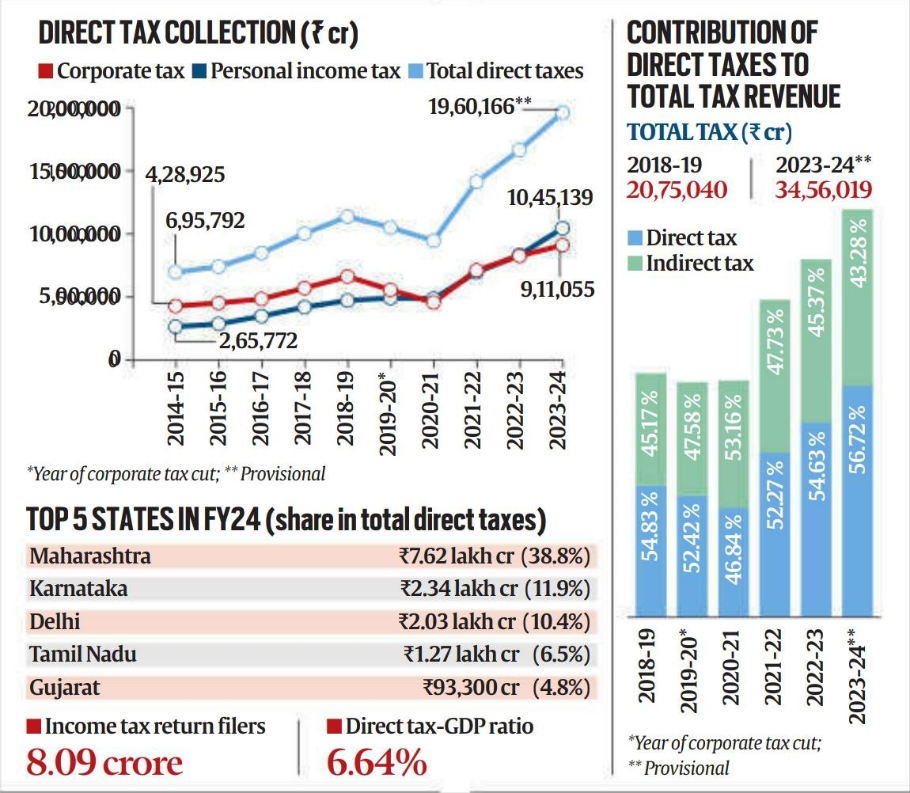

2. Direct Tax Share Up at 57% of Total Tax Revenue, Highest in 14 Year

Introduction

- Direct Tax Share: Contribution of direct taxes to total tax revenue in 2023-24 reached 56.72%, the highest in 14 years.

- Direct Tax-to-GDP Ratio: Rose to 6.64%, a two-decade high, showing the growing importance of direct taxation in India’s fiscal structure.

Key Data

- Direct Tax Collection (₹ crore):

- 2023-24: ₹19,60,166 crore (provisional data)

- Growth: Significant increase compared to previous years.

- Personal Income Tax vs. Corporate Tax:

- Personal income tax collections surpassed corporate tax collections for the second consecutive year.

- Personal income tax collection: ₹10.45 lakh crore.

- Corporate tax collection: ₹9.11 lakh crore.

Historical Context

- The last time the direct tax share crossed 56.72% was in FY10 (at 60.78%).

- Post-2019: Corporate tax collections declined following the government’s corporate tax rate cut in September 2019.

- Corporate tax rate reduced from 30% to 22% (for existing companies) and to 15% (for new manufacturing companies).

Economic Implications

- Tax Buoyancy:

- The ratio of tax growth to nominal GDP growth was 1.22 in 2023-24.

- This shows that tax collections are growing faster than the overall economy, indicating improved tax compliance and administration.

- Cost of Collection: The cost of collecting taxes fell to 0.44% of revenue in FY24, the lowest since 2000-01.

Key Trends

- Progressivity of Direct Taxes:

- Direct taxes are seen as progressive, with higher-income groups contributing more.

This trend is favorable for economic equity, as it broadens the tax base and reduces reliance on indirect taxes (which can disproportionately affect lower-income groups).

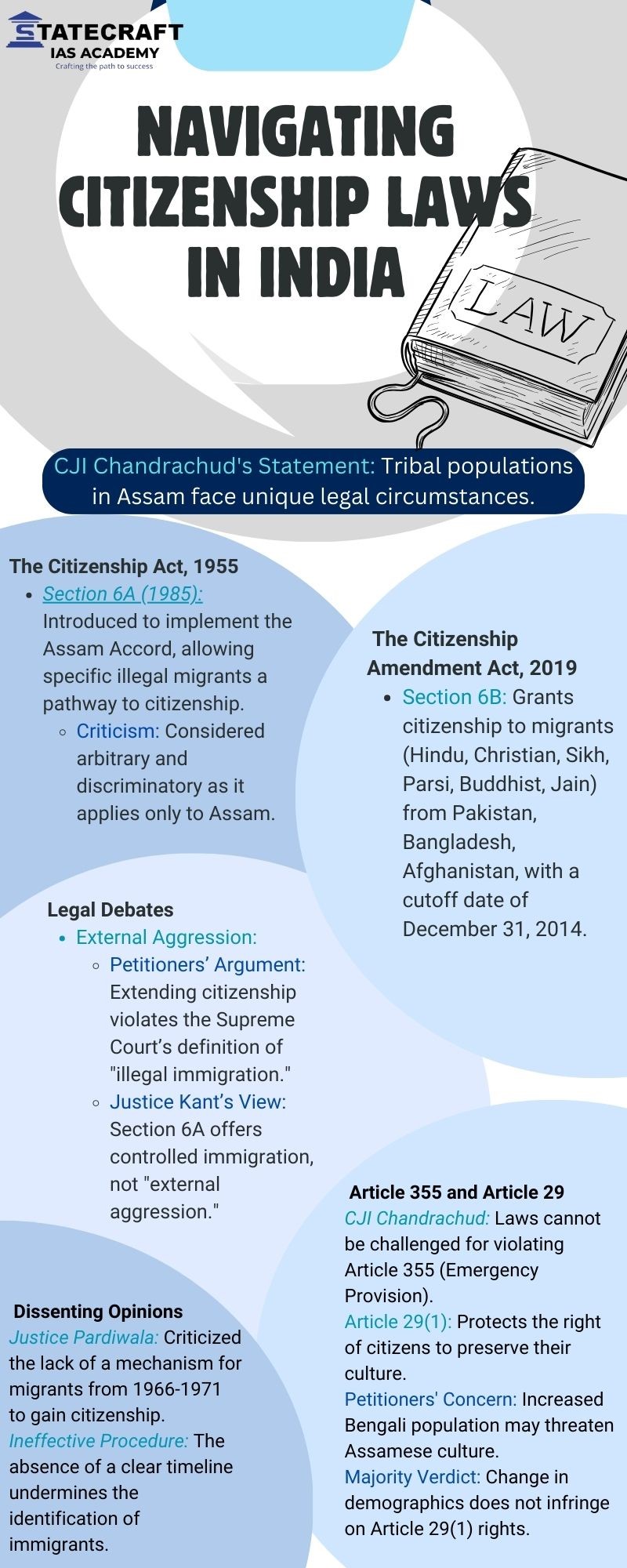

3. Supreme Court's Ruling on Section 6A of the Citizenship Act

Introduction

- Case: A 4-1 judgment by the Supreme Court upholding the constitutional validity of Section 6A of the Citizenship Act, 1955.

- Provision: Section 6A deals with migrants who entered Assam before March 24, 1971, providing them with citizenship rights, but those entering after this date are considered illegal immigrants.

Majority Ruling (4-1)

- Constitutional Validity: The Court upheld the constitutionality of Section 6A, citing that the law does not violate Articles 6 and 7 of the Constitution.

- Cut-off Date: March 24, 1971, was confirmed as the cut-off date for providing citizenship to migrants from East Pakistan (now Bangladesh), aligning it with the Assam Accord.

- Balance of Interests: The majority found that Section 6A balances the needs of migrants and Assam’s interests, considering the economic and cultural impact of migration.

Dissenting Opinion

- Justice J B Pardiwala’s Dissent:

- Found serious issues in the implementation of Section 6A, arguing it has a prospective effect and cannot be applied retroactively.

- Called the provision “invalid with prospective effect” and expressed concerns over arbitrariness and misuse of the law over the past 38 years

Key Points from the Judgment

- Legal Framework:

- The Court emphasized the legislative objective to address humanitarian and economic aspects of migration from East Pakistan.

- It acknowledged the cultural and linguistic concerns of Assam’s citizens but ruled that these cannot restrict the rights provided under Section 6A.

- Operation of Section 6A:

- Recognized the difficulties of illegal immigration into Assam and the burden on the state but upheld the March 24, 1971 cut-off date as reasonable.

- Indigenous Rights:

- The Court also flagged the concerns of indigenous people and the potential adverse impact of large-scale migration on Assam’s demography and culture.

- Indigenous Groups: Petitioners argued that indigenous people’s rights, especially cultural and linguistic rights, are compromised by Section 6A.

- Parliamentary Power:

- The Court emphasized Parliament’s primacy in enacting laws on citizenship, stating that legislative power allows for adjustments on citizenship matters.

Impact of the Judgment

- Strict Enforcement Against Illegal Immigration: The Court called for strict enforcement of laws to curb illegal immigration.

Judicial Monitoring: Chief Justice D Y Chandrachud flagged the need for judicial oversight in implementing immigration and citizenship laws.

4. New ‘ Lady Justice’

Introduction

- Case: A 4-1 judgment by the Supreme Court upholding the constitutional validity of Section 6A of the Citizenship Act, 1955.

- Provision: Section 6A deals with migrants who entered Assam before March 24, 1971, providing them with citizenship rights, but those entering after this date are considered illegal immigrants.

Majority Ruling (4-1)

- Constitutional Validity: The Court upheld the constitutionality of Section 6A, citing that the law does not violate Articles 6 and 7 of the Constitution.

- Cut-off Date: March 24, 1971, was confirmed as the cut-off date for providing citizenship to migrants from East Pakistan (now Bangladesh), aligning it with the Assam Accord.

- Balance of Interests: The majority found that Section 6A balances the needs of migrants and Assam’s interests, considering the economic and cultural impact of migration.

Dissenting Opinion

- Justice J B Pardiwala’s Dissent:

- Found serious issues in the implementation of Section 6A, arguing it has a prospective effect and cannot be applied retroactively.

- Called the provision “invalid with prospective effect” and expressed concerns over arbitrariness and misuse of the law over the past 38 years

Key Points from the Judgment

- Legal Framework:

- The Court emphasized the legislative objective to address humanitarian and economic aspects of migration from East Pakistan.

- It acknowledged the cultural and linguistic concerns of Assam’s citizens but ruled that these cannot restrict the rights provided under Section 6A.

- Operation of Section 6A:

- Recognized the difficulties of illegal immigration into Assam and the burden on the state but upheld the March 24, 1971 cut-off date as reasonable.

- Indigenous Rights:

- The Court also flagged the concerns of indigenous people and the potential adverse impact of large-scale migration on Assam’s demography and culture.

- Indigenous Groups: Petitioners argued that indigenous people’s rights, especially cultural and linguistic rights, are compromised by Section 6A.

- Parliamentary Power:

- The Court emphasized Parliament’s primacy in enacting laws on citizenship, stating that legislative power allows for adjustments on citizenship matters.

Impact of the Judgment

- Strict Enforcement Against Illegal Immigration: The Court called for strict enforcement of laws to curb illegal immigration.

Judicial Monitoring: Chief Justice D Y Chandrachud flagged the need for judicial oversight in implementing immigration and citizenship laws.