1. Taxing Industrial Alcohol

Context:

- The Supreme Court (SC) ruled that states have the power to tax not just alcoholic beverages but also industrial alcohol.

- The ruling resolves the dispute over whether industrial alcohol falls under “intoxicating liquor,” a subject that was contested between the Union and the State Lists.

- Definition of ‘Intoxicating Liquor’:

- The core issue was whether “intoxicating liquor,” which states have the power to regulate, includes industrial alcohol.

- Industrial alcohol is generally used in industries (e.g., for manufacturing goods like paints, cosmetics, etc.) and is not meant for human consumption, unlike liquor.

- Overlapping Entries in Union and State Lists:

- Seventh Schedule of the Indian Constitution:

- Entry 52, Union List: Central control over industries such as alcohol production.

- Entry 8, State List: State power to regulate intoxicating liquor.

- Disputes arose from this overlap concerning the regulation and taxation of alcohol, particularly industrial alcohol.

- Seventh Schedule of the Indian Constitution:

The Case and Background:

- 1989: Synthetics & Chemicals Ltd. v State of UP: SC held that states could only regulate liquor meant for human consumption and not industrial alcohol.

- 2007: Case referred to a larger bench to reconsider the 1989 decision.

- 2010: SC referred the case to a 9-judge bench.

- 2024: Final decision delivered by a 9-judge SC bench.

Supreme Court’s Rationale:

- Industrial Alcohol:

- Despite its use in industries, it can be misused for human consumption and intoxication.

- Therefore, states can tax industrial alcohol under the broader definition of “intoxicating liquor.”

- Justification for State Regulation:

- Potential misuse of industrial alcohol as intoxicating liquor creates public health risks.

- States’ right to tax and regulate industrial alcohol is necessary for controlling possible intoxication from industrial substances.

Dissenting Opinion: Justice B V Nagarathna dissented, arguing that regulating industrial alcohol should fall under the Centre’s domain, based on industrial control and manufacturing regulations.

Impact on Federal Balance:

- The ruling emphasizes federalism, allowing states to have a significant say in controlling alcohol-related products.

This reaffirms states’ rights under the Constitution to manage substances that can impact public health through intoxication.

2. Stubble Burning and the Supreme Court's remarks

Context: The Supreme Court (SC) reprimanded the Centre and state governments (Punjab, Haryana) over the issue of stubble burning and environmental pollution, emphasizing the fundamental right to live in a pollution-free environment under Article 21 of the Constitution.

- Stubble Burning and Pollution:

- Stubble burning, mainly in Punjab and Haryana, has been a major contributor to air pollution in the Delhi-NCR region, worsening during the winter months.

- Despite the Committee for Air Quality Management’s directives, stubble burning continues due to inadequate enforcement.

- Article 21:

- The SC reminded the government that citizens have the fundamental right to a clean, pollution-free environment, which falls under Article 21 of the Constitution (Right to Life).

- This links environmental protection to citizens’ fundamental rights, making it a constitutional issue.

- Environment Protection Act (EPA) – Section 15:

- The amendment to Section 15 of the EPA, 1986 came into effect on April 1, replacing penal provisions for violations with penalties.

- However, the SC noted that the amendment had become ineffective because the machinery to enforce penalties—such as framing rules and appointing adjudicating officers—had not been created.

- SC’s Criticism:

- The SC criticized the Centre’s inaction, stating that the amendment to Section 15 had rendered the law “toothless.”

- Without proper machinery (rules, officers), law enforcement agencies cannot impose penalties on violators of the EPA.

Government Responses:

- Centre’s Assurances:

- The Centre’s counsel promised that the enforcement machinery would be set up within two weeks.

- State Governments (Punjab & Haryana):

- The SC pulled up both states for not effectively implementing the Committee for Air Quality Management’s guidelines.

- While Haryana claimed that stubble burning incidents had decreased, the SC observed that selective action was being taken.

Impact of the Court’s Remarks:

- Environmental Governance:

- The SC’s remarks highlight gaps in environmental governance, especially in enforcement mechanisms under the EPA.

- The inefficiency in addressing stubble burning not only affects pollution control but also compromises the fundamental right to a clean environment.

- Public Health:

- Stubble burning leads to severe air pollution, causing respiratory illnesses and health hazards, particularly in the Delhi-NCR region.

- The court’s intervention underscores the connection between environmental protection and public health.

Next Hearing: The SC scheduled the next hearing for November 4, 2024, seeking updates from the Centre and the states on the progress of enforcement actions.

3. Jama Masjid and its status as a protected monument

Context: The Union government has filed an affidavit in the Delhi High Court explaining why Jama Masjid should not be declared a “protected monument.”

- The issue stems from petitions calling for the mosque to be protected under the Ancient Monuments and Archaeological Sites and Remains Act, 1958.

- Government’s Position:

- The Archaeological Survey of India (ASI), through the Ministry of Culture, argued that declaring Jama Masjid a protected monument would have substantial implications.

- Provisions under the Ancient Monuments Act would impose restrictions on construction and activities within a 300-meter zone around the monument (100-meter prohibited area, 200-meter regulated area).

- These restrictions would affect any ongoing or future activities at the mosque, and therefore, the government decided not to declare it a protected monument.

- Jama Masjid’s Current Status:

- Jama Masjid is under the protection and guardianship of the Delhi Waqf Board under the Waqf Act, 1995.

- Despite this, the ASI has undertaken conservation and restoration work at Jama Masjid, spending over ₹6.12 crore between 2007 and 2020 for its upkeep.

- Revenue and Waqf Board:

- The Delhi High Court observed that, even if Jama Masjid is not declared a protected monument, revenue generated from the monument cannot go solely to any private individual or entity.

- Part of the revenue could be given to the Delhi Waqf Board and the ASI.

Court Observations:

- Justice Prathiba Singh remarked that the Union government appears hesitant about declaring the monument protected but emphasized that even without the status, revenue management needs transparency.

- The court clarified that declaring the monument as protected is not based on requests from Jama Masjid authorities alone.

Historical and Legal Context:

- Jama Masjid: Built in the 17th century during the Mughal period, Jama Masjid in Delhi is one of the largest mosques in India and holds historical and cultural significance.

- Ancient Monuments Act, 1958: This Act provides legal protection to monuments of national importance and regulates construction or activity around them.

- Declaring a site as a protected monument comes with restrictions aimed at preserving its heritage.

Delhi Waqf Board and Waqf Act, 1995: The Waqf Board is responsible for the administration and management of Waqf properties, which include mosques, shrines, and other religious properties.

4. Geoengineering: Diamonds in the Sky for cooling the Earth

Context: Geoengineering is being explored as a potential solution to combat global warming. The concept of spraying diamonds or other reflective particles into the atmosphere to cool the Earth is one such innovative idea.

Key Ideas:

- Geoengineering Definition:

- Refers to large-scale interventions to manipulate the Earth’s natural climate systems to counteract global warming.

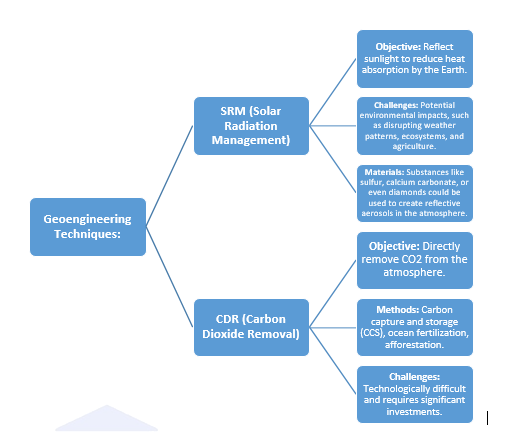

- Two main approaches:

- Solar Radiation Management (SRM): Aims to reflect a portion of the Sun’s radiation back into space, thereby reducing the Earth’s temperature.

- Carbon Dioxide Removal (CDR): Involves technologies that reduce atmospheric CO2 levels through capture and storage.

- Diamonds in the Sky:

- A novel proposal suggests spraying millions of tons of diamond dust into the atmosphere, which could act as reflective particles to cool the planet.

- This is part of SRM technologies, similar to earlier ideas using materials like sulfur, calcium, aluminum, and silica to reflect sunlight.

- Mimicking Volcanic Eruptions:

- This idea draws inspiration from volcanic eruptions, which naturally release particles (sulfur) into the atmosphere, reflecting sunlight and temporarily cooling the planet.

- For instance, the eruption of Mount Pinatubo in 1991 cooled the Earth by 0.5°C for nearly a year.

- Scientific Research:

- Research published in Geophysical Research Letters highlighted that diamonds could be more effective than other substances in scattering solar radiation.

While experimental studies are underway, no large-scale deployment has been done yet.

Challenges and Concerns:

- Technological and Financial Hurdles:

- SRM requires substantial technological advancement and could have unintended consequences such as altering precipitation patterns, disrupting ecosystems, and affecting global agriculture.

- Costs: The research estimates it could cost around $30 billion annually to implement SRM technologies effectively by 2050

- Ethical and Governance Issues:

- Manipulating natural systems raises questions about the ethics of altering Earth’s climate.

- Global governance and regulation would be needed to avoid geopolitical conflicts over the impacts of geoengineering.

- Effectiveness:

- While SRM could reduce global temperatures, it does not address the root cause—greenhouse gas emissions.

CDR technologies, on the other hand, directly reduce atmospheric CO2 but face scale-up challenges.