Index:

- Switzerland Nixing MFN Status and Its Impact on EFTA Deal

- Services Exports Surpass Goods Exports (2024)

- Carrying Gold from Gulf – Kerala’s “Typical Problem”

- Uniform Civil Code (UCC): Ambedkar & Munshi's Views in the Constituent Assembly

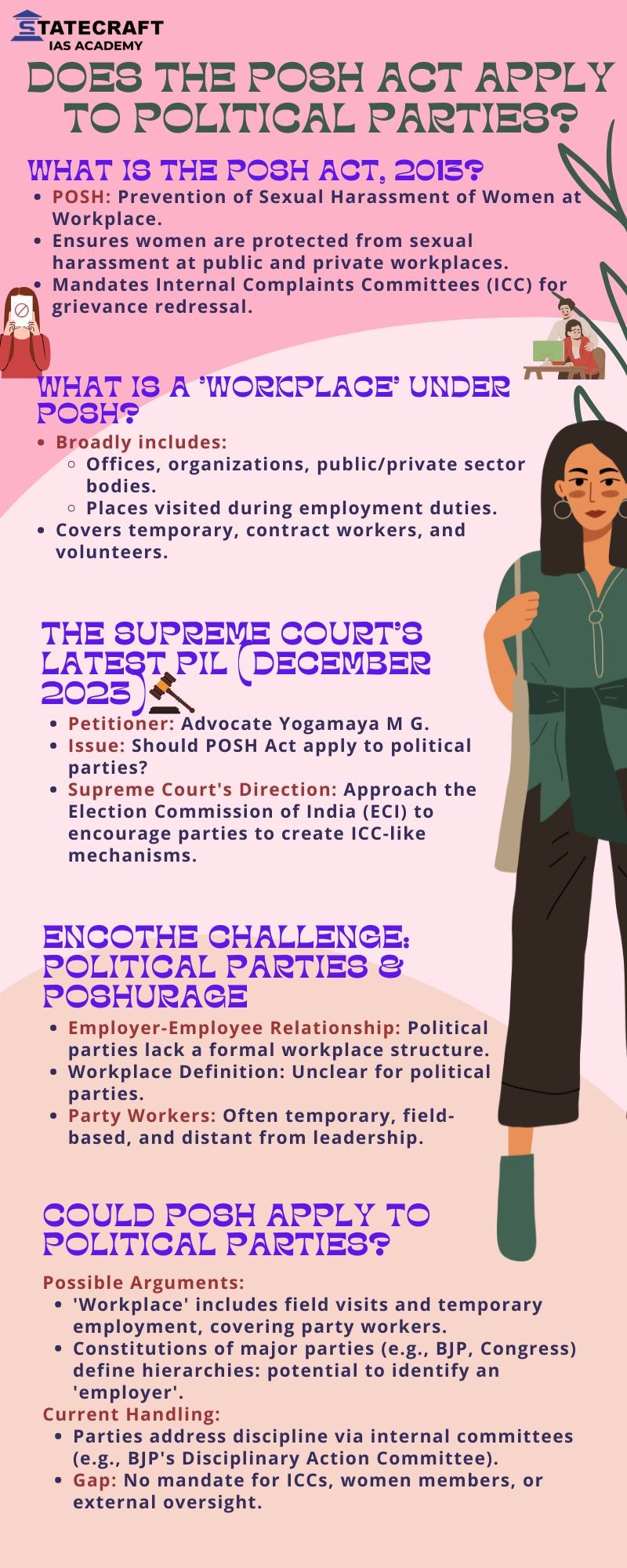

- Does the POSH Act Apply to Political Parties? - Infographic

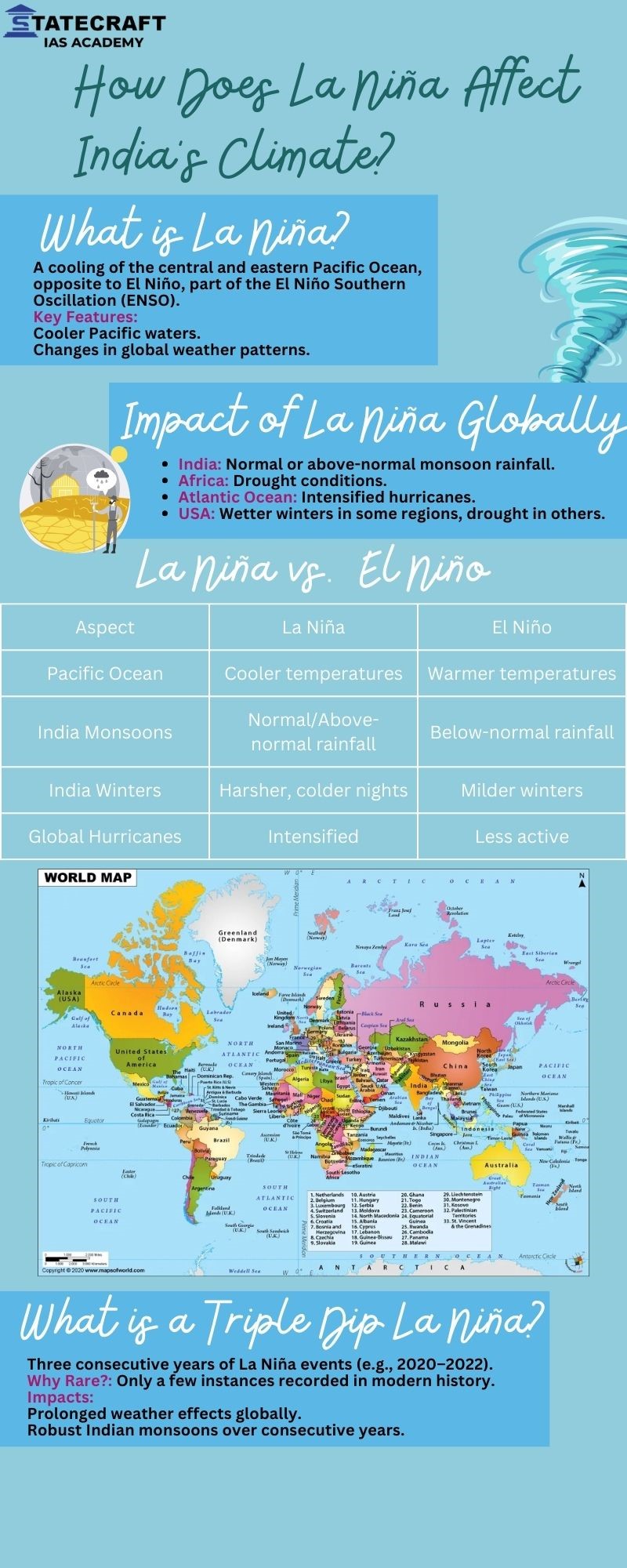

- How Does La Niña Affect India's Climate- Infographic

1. Switzerland Nixing MFN Status and Its Impact on EFTA Deal

Key Points:

- MFN Status Suspension by Switzerland

- Switzerland has decided to suspend Most Favoured Nation (MFN) status for India under the Double Taxation Avoidance Agreement (DTAA) from January 1.

- Despite this, it will not impact the free trade agreement between the European Free Trade Association (EFTA) nations and India.

- India-EFTA Trade and Economic Partnership Agreement (TEPA):

- TEPA was signed between India and the four EFTA nations:

- Switzerland, Iceland, Norway, and Liechtenstein.

- It includes a binding $100 billion investment commitment over 15 years.

- This is expected to generate one million direct jobs in India.

- TEPA was signed between India and the four EFTA nations:

- Government Clarification:

- Sunil Barthwal (Commerce Secretary) clarified that:

- The MFN suspension will not affect investment commitments under TEPA.

- Sunil Barthwal (Commerce Secretary) clarified that:

- The Ministry of External Affairs indicated that the DTAA will be renegotiated in light of TEPA.

- Steel Import Concerns:

- Industry groups raised concerns about steel imports.

Directorate General of Trade Remedies is probing the issue and will consult stakeholders, including small businesses, before recommending measures.

2. Services Exports Surpass Goods Exports (2024)

Key Highlights:

- Record Performance of Services Exports:

- Services trade exports surpassed merchandise exports for the first time.

- Services exports rose to $35.67 billion, while goods exports declined to $32.11 billion in November 2024.

- Factors Contributing to Growth in Services:

- Consistent demand for software, travel, and business services.

- Growth in engineering goods and non-petroleum products also aided overall export numbers.

- Goods Exports Decline:

- Decline of 83% in goods exports (compared to previous year).

- Contributing factors include weak demand in global markets and sluggishness in key sectors like gems & jewelry and apparel.

Economic Indicators

- Merchandise Trade Deficit:

- Record high of $37.8 billion in November 2024.

- Driven by:

- Surge in gold imports: $14.9 billion in one month.

- Higher oil imports due to global price fluctuations.

- India’s Export Trends:

- Compound Annual Growth Rate (CAGR):

- Goods exports (FY19-FY24): 8%

- Services exports: Robust 5% growth.

- Compound Annual Growth Rate (CAGR):

- World Economic Context:

- Global economy projected to grow at 3–3.5%, sustaining demand for India’s imports.

- Weak Western demand impacts goods exports.

Concerns and Challenges

- Goods Exports:

- Decline in labor-intensive exports like garments and jewelry raises unemployment concerns.

- Global uncertainties, geopolitical disruptions, and price volatility worsen prospects.

- Trade Deficit:

- High imports due to gold, energy demands create imbalance.

- Adverse impact on current account deficit (CAD).

- Structural Issues:

- Bias in services sector growth towards upper-income and white-collar jobs, neglecting low-skilled employment.

Future Outlook

- Services Sector:

- Expected to reach $618.2 billion by FY30.

- A significant driver of foreign exchange earnings.

- Challenges for Merchandise Trade:

- Global uncertainties likely to hinder goods export growth.

- Need to diversify export products and markets.

- Policy Recommendations:

- Focus on boosting labor-intensive sectors (e.g., apparel).

Reduce dependency on imports through domestic alternatives.

3. Carrying Gold from Gulf – Kerala’s “Typical Problem”

Context: The Supreme Court remarked on the practice of bringing gold from Gulf countries to Kerala, calling it a “typical problem” unique to the state.

Case Background:

- Union Government Appeal:

- Filed against Kerala High Court’s April 2024 decision, which overturned a detention order under:

- COFEPOSA Act (1974): Conservation of Foreign Exchange and Prevention of Smuggling Activities Act.

- The detention involved a man (Siraj) caught with dirhams worth several lakhs while traveling to Kerala.

- Filed against Kerala High Court’s April 2024 decision, which overturned a detention order under:

- Key Observations of the Supreme Court:

- Common Practice in Kerala:

- Observed that carrying gold back from the UAE is a frequent occurrence.

- Cultural Aspect:

- People earn in Dirhams, buy gold, and return to Kerala.

- Gold is seen as both an investment and savings mechanism in Kerala society.

- Foreign Exchange Concerns:

- Such practices raise issues regarding smuggling and harm to foreign exchange conservation.

- Common Practice in Kerala:

- Legal Framework:

- COFEPOSA Act (1974):

- Allows the Central or State governments to detain individuals involved in:

- Smuggling goods.

- Transporting, concealing, or aiding smuggling activities.

- Customs Act: Separate legal proceedings can still be pursued under this Act against smuggling offenses.

- Allows the Central or State governments to detain individuals involved in:

- COFEPOSA Act (1974):

Supreme Court Verdict:

- The Bench refused to intervene in the Kerala High Court decision.

- Observed that bringing gold from the Gulf may be unique to Kerala but emphasized the legal implications under COFEPOSA.

- Noted gold’s dual role as:

- An investment asset for the public.

- A foreign exchange challenge for the government.

4. Uniform Civil Code (UCC): Ambedkar & Munshi's Views in the Constituent Assembly

Introduction:

- UCC refers to a common set of laws governing personal matters (succession, marriage, inheritance, etc.) for all citizens, replacing religion-based personal laws.

- UCC was discussed as Draft Article 35 in the Constituent Assembly, later renumbered as Article 44 in the Directive Principles of State Policy (DPSP).

Ambedkar’s Views:

- Support for State Power to Legislate on Personal Laws:

- Ambedkar emphasized that no social reform is possible without State jurisdiction over personal laws.

- Religion should not prevent the legislature from reforming social systems plagued by inequities.

- Comparison with Criminal Law:

- India already had a uniform and complete criminal code (IPC & CrPC), which applied uniformly across the country.

- Thus, a UCC was both possible and desirable.

- Muslim Personal Law Not Uniform:

- Highlighted that Muslim personal law was neither immutable nor uniform.

- Example: Up to 1935, the North-West Frontier Province followed Hindu Law in matters of succession.

- Clarification of State Role:

- The State only sought the power to legislate and would not enforce laws objectionable to any community.

KM Munshi’s Views:

- UCC Essential for National Unity & Modernization:

- Munshi saw the UCC as integral to national unity and progress.

- He rejected claims that the UCC would be “tyrannical” to minorities.

- Equality for Women:

- Criticized discrimination in Hindu personal law regarding inheritance and succession.

- A UCC was necessary to ensure equality for women, as enshrined in the Fundamental Rights.

- Global Perspective:

- Argued that no advanced Muslim country recognized personal laws as so sacrosanct as to prevent a Civil Code.

- Restricting Religion to Its Sphere:

- Urged Muslims and others to restrict religion to its spiritual aspects, leaving the rest of life to be regulated by a common code for a strong and united India.

Criticism in the Constituent Assembly:

- Mohamad Ismail Sahib (Indian Union Muslim League): Opposed UCC, arguing that uniformity would regiment personal laws, disrupt harmony, and bring discontent.

Compromise: To address opposition, UCC was incorporated under DPSP and not made enforceable.