Index:

- Rare Bat Species in Yamuna Biodiversity Park

- India's Oil Imports Rebound in November

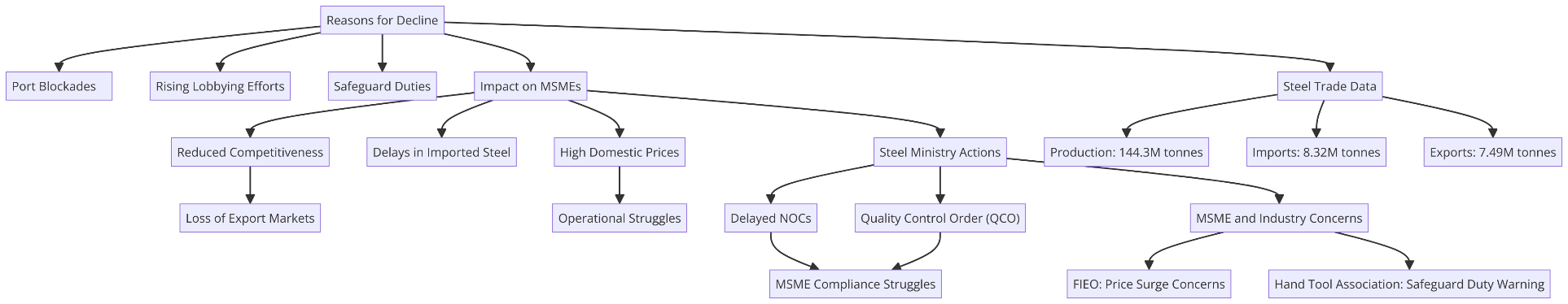

- Iron & Steel Imports Fall Amid MSME Concerns

- Alternative Investment Funds (AIFs): An Overview

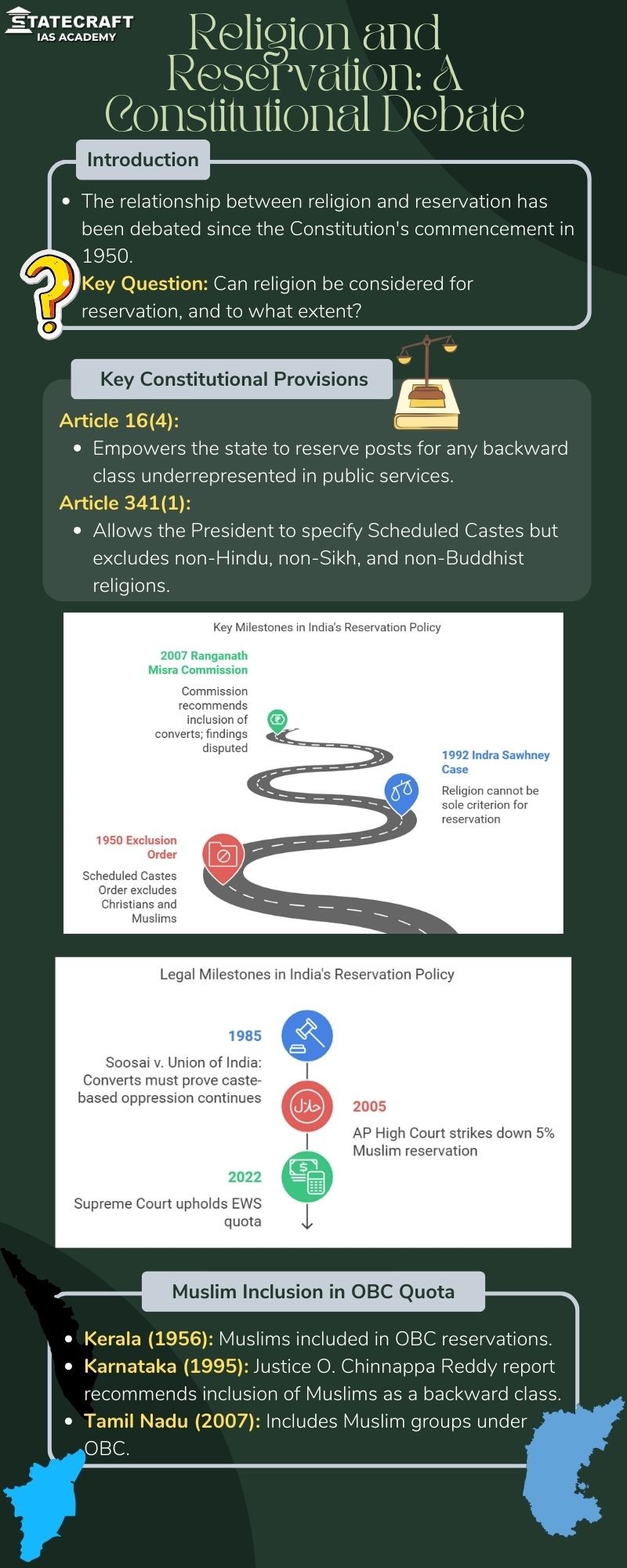

- Religion and Reservation A Constitutional Debate - Infographics

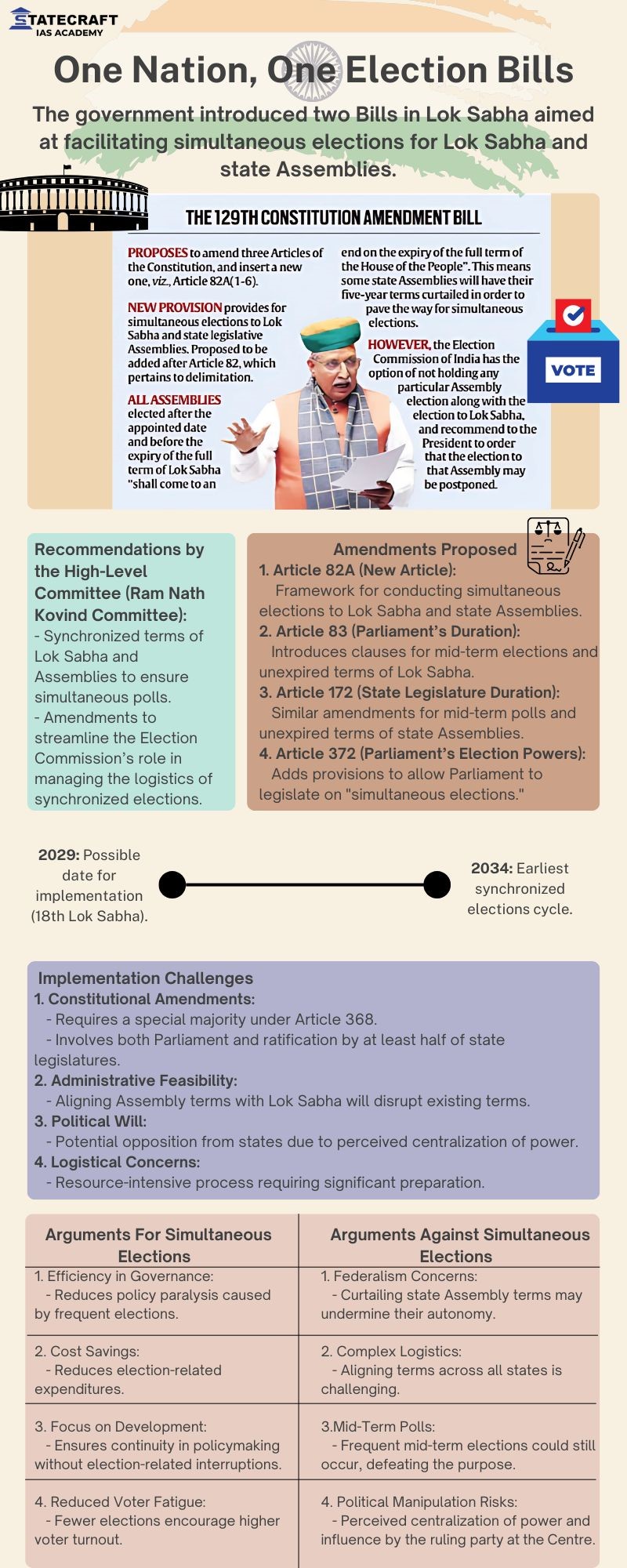

- One Nation, One Election Bills- Infographics

- Other Headlines in News

1. Rare Bat Species in Yamuna Biodiversity Park

Key Highlights

- Species Name: Wroughton’s Free-tailed Bat

- Location of Sighting: Yamuna Biodiversity Park, Delhi (Managed by the Delhi Development Authority – DDA).

- Geographical Distribution:

- Primarily found in the Western Ghats (Southern India).

- Previously recorded in:

- Jaintia Hills of Meghalaya

- Cambodia

- Characteristics of the Bat:

- Size: Large.

- Wings: Capable of powerful flying.

- Fur: Bi-colored velvet-like texture.

- Ecology:

- Very little is known about its feeding habits.

- Can fly long distances.

- Conservation Status:

- Initially Critically Endangered as a single-known species population.

- Later placed under the IUCN Red List as Data Deficient.

- Ecological Restoration Impact:

- Two decades of ecological efforts led to “specialized niches” for species.

- Notable restored sites:

- Yamuna Biodiversity Park

- Aravalli Biodiversity Park (hosts Blyth’s horseshoe bat).

- Significance for Biodiversity:

- Yamuna Biodiversity Park is home to 14 bat species:

- 4 considered locally extinct:

- Yamuna Biodiversity Park is home to 14 bat species:

- Indian false vampire

- Black-bearded tomb bat

- Egyptian free-tailed bat

- Indian pipistrelle

2. India's Oil Imports Rebound in November

Key Highlights

- India’s Oil Import Recovery:

- October 2023: Crude oil imports hit a 12-month low due to:

- Maintenance shutdowns in refineries.

- Volatility caused by the geopolitical crisis in West Asia.

- November 2023: Oil imports recovered as refineries operated at optimum capacity.

- October 2023: Crude oil imports hit a 12-month low due to:

- Crude Oil Import Data (November):

- Total imports: 69 million barrels per day (bpd).

- Growth: 6% month-on-month.

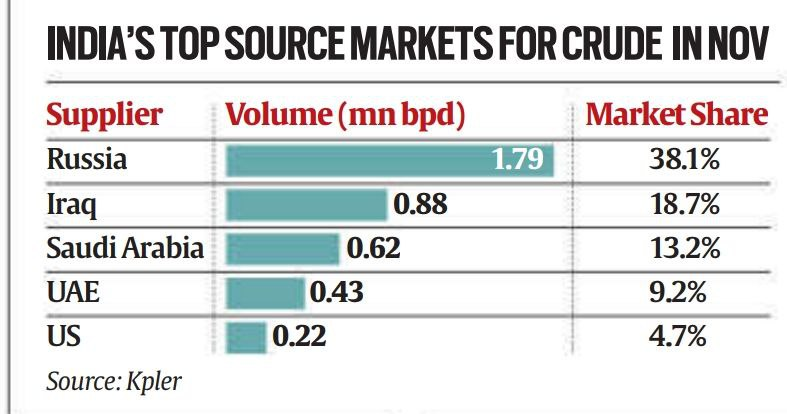

- Top Suppliers of Crude Oil to India:

- Key Observations:

Supplier | Market Share | Volume (mn bpd) | Growth |

Russia | 38.1% | 1.79 | 2% month-on-month |

Iraq | 18.7% | 0.88 | Sequential growth: 1.2% |

Saudi Arabia | 13.2% | 0.62 | Smallest growth: -0.4% |

UAE | 9.2% | 0.43 | Significant growth: 15.1% |

United States | 4.7% | 0.22 | Growth: 31% |

- Geopolitical Context:

- Russia’s dominance is driven by price advantages post-Ukraine war.

- Iraq is regaining share, but struggles to compete with Russia’s discounted oil.

- Saudi Arabia faces market share losses.

Historical Context: Before the Russia-Ukraine war, Iraq and Saudi Arabia were India’s top suppliers.

4. Alternative Investment Funds (AIFs): An Overview

CONTEXT: At a national summit on Alternative Investment Funds (AIFs), SEBI member Ananth Narayan revealed that around 20% of AIF investments, approximately ₹1 lakh crore of the ₹5 lakh crore in total drawdowns, have been used to bypass financial regulations.

He highlighted concerns over funds being structured to circumvent existing financial sector rules, affecting the regulatory intent behind these investments. AIFs are commonly used by high-net-worth individuals to invest in startups, infrastructure, and other high-risk, high-return ventures.

What Are AIFs?

Definition:

Alternative Investment Funds (AIFs) are privately pooled investment vehicles that collect funds from investors (both Indian and foreign) to invest in non-traditional asset classes. These investments typically go beyond stocks, bonds, and cash and include avenues like startups, infrastructure projects, private equity, and other high-risk, high-return investments.

Key Features of AIFs:

- Privately Pooled: Funds are collected from high-net-worth individuals (HNIs) and institutional investors.

- Non-Traditional Investments: Focus on alternative assets such as private equity, venture capital, real estate, hedge funds, and commodities.

- High Risk, High Return: AIFs carry higher risks but offer the potential for significant returns.

- SEBI Regulation: AIFs in India are regulated under the SEBI (Alternative Investment Funds) Regulations, 2012.

- Categories: SEBI classifies AIFs into three broad categories:

- Category I AIF: Focuses on investments that are socially or economically beneficial, such as venture capital funds, infrastructure funds, social venture funds, and SME funds.

- Category II AIF: Includes funds that do not take leverage (borrowed money) other than for meeting day-to-day operational needs. Examples: Private equity funds, debt funds.

- Category III AIF: These funds employ diverse or complex trading strategies, including leverage, to deliver higher returns. Examples: Hedge funds.

Purpose of AIFs:

- Diversification of investment portfolios.

- Promotion of startups and infrastructure development.

- Providing alternative avenues of investment for high net-worth individuals (HNIs) and institutional investors.

Key Concerns:

- Regulatory Challenges: AIFs sometimes circumvent existing financial regulations, as highlighted by SEBI.

- Misuse: About 20% of AIF investments (~₹1 lakh crore out of ₹5 lakh crore) have been deemed questionable in terms of regulatory intent.

- Complexity: The high-risk and complex nature of AIF investments make them unsuitable for retail investors.