- YashoBhoomi : Convention and Expo Centre

- Trends and Transformation of Indian Parliament over 75 Years

- Gross Direct Tax Collection

- Sacred Ensembles of the Hoysala

- PM Vishwakarma Scheme

- Parlay Ballistic Missiles

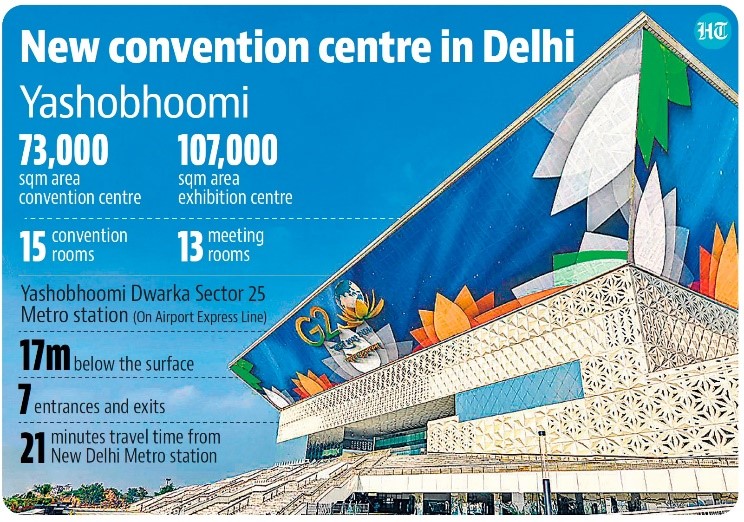

YASHOBHOOMI : CONVENTION AND EXPO CENTRE

Context:

The Prime Minister inaugurated the inaugural phase of the ‘YashoBhoomi’ India International Convention and Expo Centre (IICC) in Dwarka, Delhi, establishing it as a world-class facility.

About YashoBhoomi

- YashoBhoomi, the second convention center of its kind after the Bharat Mandapam, which recently hosted world leaders during the G20 Summit, exemplifies the Prime Minister’s vision to create top-tier infrastructure in India for hosting conventions, meetings, and exhibitions.

- Its operational status in Dwarka promises significant benefits.

Key Attributes of YashoBhoomi Vast Project:

The India International Convention and Expo Centre, known as YashoBhoomi, covers an impressive area of 8.9 lakh square meters, with a built-up space exceeding 1.8 lakh square meters.

- Capacity and Facilities: This conference facility can accommodate an astounding 11,000 guests. It comprises 15 convention rooms, including the main auditorium, the grand ballroom, and 13 meeting rooms.

- Auditorium and Ballroom: The primary auditorium can seat 6,000 individuals, while the grand ballroom can host an additional 2,500. There is also seating for up to 500 people in a large open area.

- Exhibition Hall: A massive exhibition hall, spanning over 1.07 lakh square meters, stands out as a prominent feature of YashoBhoomi.

- Architectural Grandeur: The conference center incorporates elements inspired by Indian civilizations, such as terrazzo floors adorned with brass inlays resembling rangoli patterns, suspended sound-absorbing metal cylinders, and illuminated patterned walls.

Emphasis on Sustainability: YashoBhoomi is dedicated to sustainability, boasting rooftop solar panels, an advanced wastewater treatment system enabling 100% wastewater reuse, rainwater harvesting, and Green Cities Platinum certification from the Indian Green Building Council (IGBC) under CII.

TRENDS AND TRANSFORMATION OF INDIAN PARLIAMENT OVER 75 YEARS

Context:

Over the course of 75 years, India’s parliamentary system has undergone significant transformations in political representation, legislative procedures, and societal shifts.

This retrospective analysis offers insights into the intriguing aspects of India’s parliamentary development, encompassing changing demographics, parliamentary norms, and electoral dynamics.

Prominent Trends in the Indian Parliament

- Representation of Youth

- Despite the country’s burgeoning young population, the Lok Sabha has witnessed a notable decline in Members of Parliament (MPs) aged 35 and below.

- While the First Lok Sabha boasted 82 such MPs, the 17th Lok Sabha has a mere 21.

- This drop is in stark contrast to India’s youthful demographics, where roughly 66% of the population is below 35 years of age.

- Women’s Participation and Representation

- The turnout of female voters has consistently risen since 1962, even surpassing male turnout in 2019.

- The number of female candidates has also increased from 45 in 1957 to 726 in 2019.

- However, female representation in the Lok Sabha remains notably low, with only 14.36% of total seats occupied by women in 2019.

- The Women’s Reservation Bill, aimed at achieving a 33% representation, has encountered hurdles in its passage.

- 3. Absence of a Deputy Speaker

The 17th Lok Sabha marks a departure from tradition as it becomes the first independent India Lok Sabha without a Deputy Speaker.

- Declining Parliamentary Sessions

- The Lok Sabha consistently held over 100 sessions annually between 1952 and 1974, but this trend has dwindled.

- The pandemic in 2020 contributed to a substantial decrease in parliamentary sessions, and the average daily sitting time has also decreased over the years.

- Legislation and Ordinances

- Both Houses of Parliament are passing fewer bills compared to previous decades.

- The highest number of bills was passed during the Emergency in 1976, while the lowest was in 2004.

- The increase in ordinances issued by the Union government has coincided with a reduction in parliamentary sessions.

- Voter Enrollment and Political Parties

- The number of voters has multiplied six-fold from 1951 to 2019, leading to a higher number of polling stations. The number of political parties participating in Lok Sabha elections has also significantly increased, with 673 parties in 2019 compared to 53 in 1951.

- Moreover, the number of election contestants has witnessed substantial growth.

- Voting Trends and Majority Outcomes

- Among the 17 Lok Sabha elections conducted thus far, 10 have resulted in clear majorities, while 7 have produced fractured mandates.

- Recent trends show that the winning party tends to secure a higher vote share than the runner-up since 2004.

- Evolution of Question Time

- The time allocated for questions in the Lok Sabha has diminished over the years.

- While the First Lok Sabha dedicated 15% of its time to questions, the 14th Lok Sabha allocated only 11.42%.

- Data for the 15th, 16th, and 17th Lok Sabhas is unavailable for comparison.

Conclusion

As India’s Parliament commemorates 75 years of its existence, these trends offer a captivating glimpse into the evolving dynamics of the nation’s highest legislative body.

Gross Direct Tax Collection

Context:

- In the context of Fiscal Year 2023-24, which was assessed as of September 16, 2023, there has been a notable increase in Gross Direct Tax collections, marking a growth rate of 18.29% compared to the previous fiscal year.

- As of September 16, 2023, the net direct tax collections for FY 2023-24 amounted to Rs. 8,65,117 crore, reflecting a substantial growth of 23.51% when compared to the preceding fiscal year, FY 2022-23.

- Breaking down the net collections, it can be observed that Rs. 4,16,217 crore was attributed to Corporation Tax (CIT), while Rs. 4,47,291 crore originated from Personal Income Tax (PIT), after accounting for refunds.

- The provisional figures for FY 2023-24’s gross direct tax collections stood at Rs. 9,87,061 crore, also demonstrating a significant 18.29% growth in comparison to FY 2022-23.

- This division of collections indicated that Rs. 4,71,692 crore was derived from Corporation Tax (CIT), and Rs. 5,13,724 crore was derived from Personal Income Tax (PIT).

Further categorizing the collections by minor heads, we observed the following figures:

- Advance Tax: Rs. 3,55,481 crore

- Tax Deducted at Source: Rs. 5,19,696 crore

- Self-Assessment Tax: Rs. 82,460 crore

- Regular Assessment Tax: Rs. 21,175 crore

- Tax under other minor heads: Rs. 8,248 crore

- The Advance Tax collections for FY 2023-24 experienced a substantial growth of 20.73%, reaching a total of Rs. 3,55,481 crore.

- This comprised Rs. 2,80,620 crore in Corporation Tax (CIT) and Rs. 74,858 crore in Personal Income Tax (PIT).

Moving on to the broader taxation landscape in India:

Direct Taxes:

- Direct taxes are applicable to both corporate entities and individuals.

- Income tax, the most significant form of direct tax for individuals, is mandatory for those whose annual incomes exceed the minimum exemption limit.

- Income tax calculations are based on applicable slab rates, with adjustments and deductions permitted under various sections of the Income Tax Act.

- Other forms of direct taxes include capital gains tax, which is applicable to profits from the sale of capital assets, and corporate tax, levied on businesses and entities filing returns as companies.

Indirect Taxes:

- Indirect taxes are imposed on expenses and are typically collected by businesses providing goods and services.

- Previous indirect taxes in India included service tax, Indian excise duty, value-added tax (VAT), customs duty, securities transaction tax (STT), stamp duty, and entertainment tax.

- Goods and Services Tax (GST) has replaced many of these indirect taxes and is a comprehensive tax system applying to the supply of goods and services.

- Customs duty is levied on goods imported into India and, in some cases, on goods exported from India.

- Securities Transaction Tax (STT) is imposed on financial securities transactions, such as equity stocks and mutual fund units, primarily on securities exchange transactions.

- Stamp duty is a state government levy on asset or security transfers within their jurisdiction.

- Entertainment tax is a state-level tax applied to entertainment-related transactions, including movies, sporting events, and concerts.

SACRED ENSEMBLES OF THE HOYSALA

In the context of the recent addition of the Hoysala sacred ensembles in Karnataka to the UNESCO World Heritage List, several significant details can be highlighted:

- These remarkable ‘Sacred Ensembles of the Hoysala’ were originally inscribed on UNESCO’s Tentative List on April 15, 2014.

- These temples, considered protected monuments, fall under the custodianship of the Archaeological Survey of India (ASI), entrusted with their preservation and upkeep.

- Architecturally, these temples predominantly adhere to the Dravidian tradition, but they also exhibit substantial influences from the ‘Bhumija’ style found in central India, as well as elements of ‘Nagara’ traditions originating from northern and western India.

- Their inclusion in the prestigious UNESCO World Heritage List is a testament to their exceptional craftsmanship and historical significance.

As for the specifics:

- These sacred edifices were constructed during the 12th-13th century and are most notably represented by Belur, Halebid, and Somnathpur.

- The architecture of these temples showcases a fascinating blend of various styles, encompassing Dravidian, Bhumija, Nagara, and Karnata Dravida modes. This amalgamation results in a unique Hoysala Temple form.

- Notably, these temples have been part of UNESCO’s Tentative List since 2014, awaiting their official recognition.

Brief overview of the individual temples:

- Chennakeshava Temple in Belur:

– A 12th-century Hindu temple commissioned by King Vishnuvardhana.

– Situated on the banks of the Yagachi River in Belur.

– Dedicated to Vishnu and adorned with intricately sculpted exteriors narrating scenes from Vishnu’s life and epics.

- Hoysaleshwara Temple in Halebid:

– A 12th-century Hindu temple dedicated to Shiva.

– Famed for its over 240 wall sculptures along its outer walls.

– Constructed during the reign of Hoysala King Vishnuvardhana Hoysaleshwara.

- Keshava Temple in Somanathapura:

– A Vaishnava temple located on the banks of the River Kaveri in Somanathapura, Karnataka.

– Consecrated in 1258 CE by Somanatha Dandanayaka, a general of Hoysala King Narasimha III.

– Features a main temple on a raised star-shaped platform housing three sanctums dedicated to Kesava, Janardhana, and Venugopala, all different forms of Vishnu.

Historical context about the Hoysala dynasty:

- The Hoysalas initially served as vassals or feudatories of the Chalukyas of Kalyana.

- Their capital was known as Dwarasamudra, which is the present-day Halebeedu.

- The dynasty’s origins trace back to its founder, Sala, succeeded by rulers such as Vinayaditya and Balalla I.

- A prominent figure in Hoysala history is Vishnuvardhana, also known as Bittideva. He gained fame for his victory over the Cholas in the Battle of Talakadu, earning him the title “Talkadugonda.”

- In honor of his victory, he constructed the Kirtinarayana Temple in Talakadu and the Chennakesava Temple in Beluru.

Regarding their religious and literary contributions:

- The Hoysalas were patrons of Shaivism, Vaishnavism, and Jainism.

- Vishnuvardhana initially followed Jainism but later converted to Srivaishnavism under the influence of Sri Ramanujacharya, who had settled in Melukote, Karnataka.

The period of Hoysala rule witnessed significant developments in Kannada and Sanskrit literature, with notable literary works by authors such as Harihara, Raghavanka (known for “Harishchandracharite“), Nemichandra (renowned for “Leelavati Prabhanda”), and Janna.

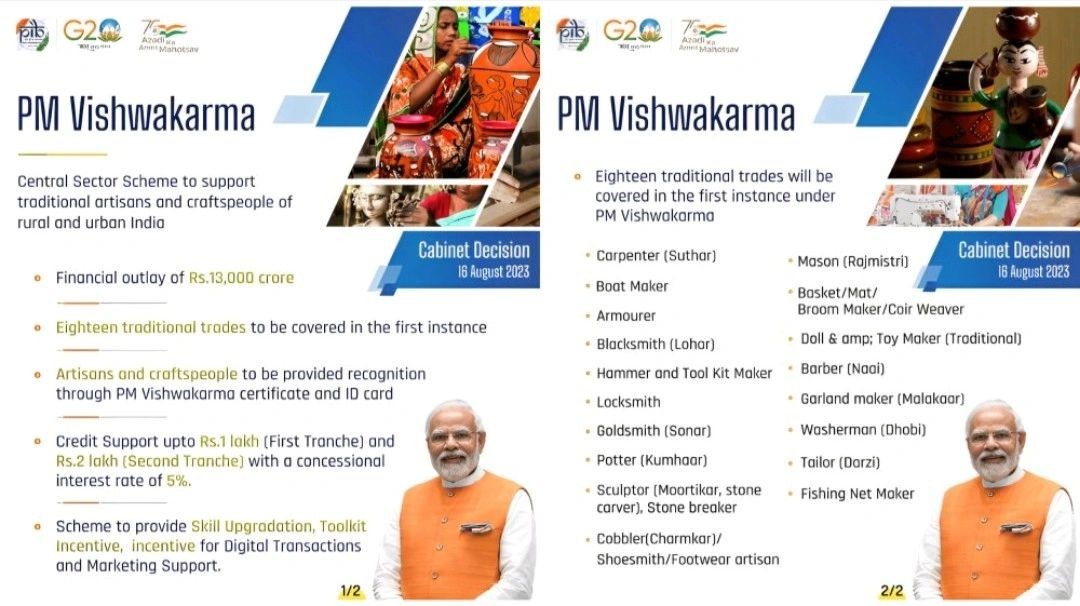

PM Vishwakarma Scheme

Key Features of the Scheme

- Recognition: Workers will receive recognition through the PM Vishwakarma certificate and ID card.

- Skill Upgradation: The scheme offers both basic and advanced training to enhance skills.

- Toolkit Incentive: Artisans receive a toolkit incentive of ₹15,000.

- Credit Support: Collateral-free credit support is provided, with the first tranche offering up to ₹1 lakh and the second tranche up to ₹2 lakh, both at a concessional interest rate of 5%.

- Digital Transactions: Incentives for digital transactions and marketing support are available.

- Knowledge Enhancement: A toolkit booklet, available in 12 Indian languages with accompanying videos, helps workers stay updated on new technologies in their field.

- Skill Training Stipend: Artisans can benefit from a stipend of Rs 500 for skill training and Rs 1,500 for purchasing modern tools.

- Coverage: The scheme aims to cover five lakh families in the first year and 30 lakh families over five years.

9. Global Integration: It also seeks to integrate Vishwakarma into domestic and global value chains.

Rationale for the Scheme

- Traditional craftsmen and skilled artisans, often trained by family elders, face numerous challenges.

- These include a lack of professional training, limited access to modern tools, geographical remoteness from relevant markets, and insufficient capital for investment.

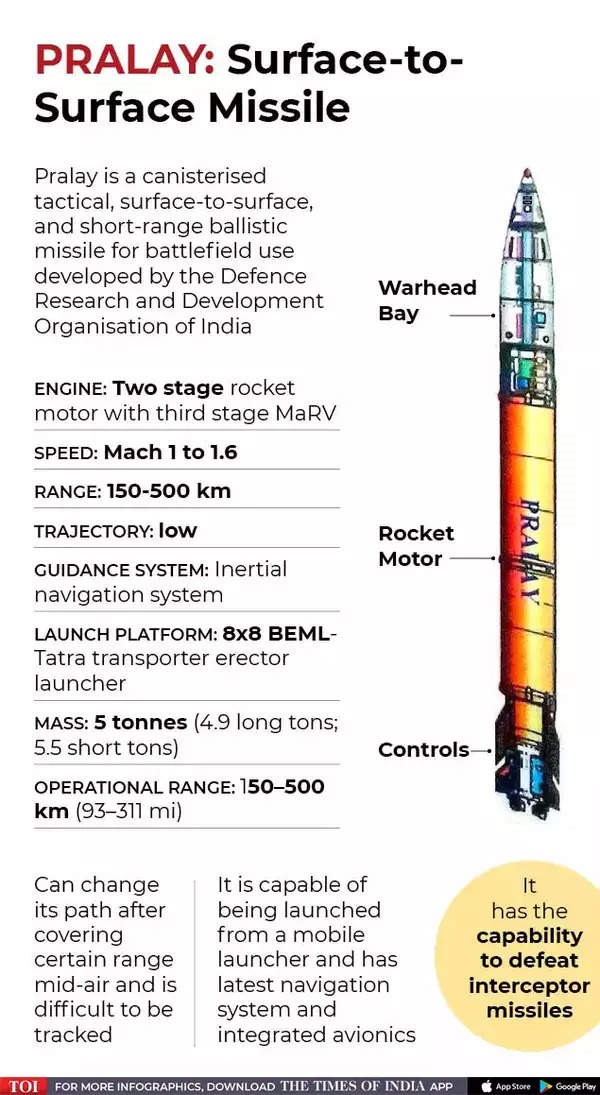

PARLAY BALLISTIC MISSILES

Context:

- The Defense Ministry has approved the acquisition of a regiment of ‘Pralay’ ballistic missiles, intended for deployment along the Line of Actual Control (LAC) and the Line of Control (LoC).

- This marks the first instance of a ballistic missile being introduced for conventional operations in the Indian armed forces.

Key Features of Pralay Missile

- Range: Pralay boasts a strike range spanning from 150 to 500 kilometers.

- Payload Capacity: It can carry conventional warheads weighing between 350 kg to 700 kg, which may include high explosive preformed fragmentation warheads, penetration-cum-blast (PCB) warheads, and runaway denial penetration submunitions (RDPS).

- Classification: This missile falls under the category of quasi-ballistic surface-to-surface missiles.

- Maneuverability: It possesses mid-flight trajectory alteration capability.

- Propulsion: Pralay is powered by a solid propellant rocket motor equipped with advanced guidance systems.

- Global Comparisons: When compared on a global scale, it stands on par with China’s Dong Feng 12 and Russia’s Iskander missile.

- Development History: The development of Pralay commenced around 2015, with significant progress made during the tenure of General Bipin Rawat as Chief of Army Staff.

Strategic Significance

Longest Range: Pralay will become the longest-range surface-to-surface missile within the Indian Army’s arsenal.

Strategic Role: In conjunction with the BrahMos supersonic cruise missile, ‘Pralay’ will play a central role in India’s planned Rocket Force, enhancing the nation’s strategic capabilities.

Necessity: The deployment of ballistic missiles for tactical purposes by China and Pakistan has prompted India’s decision to acquire ‘Pralay’ missiles.