1. Core Sector Growth Slowdown

1. Core Sector Growth Slowdown

|

Core Industries: Definition- Eight key sectors representing a significant portion of industrial production:

- Coal

- Crude oil

- Natural gas

- Refinery products

- Fertilizers

- Steel

- Cement

- Electricity

Importance: Serve as a leading indicator of overall industrial performance.

June 2024 Core Sector Performance: Overall Growth: Slowed to 4%, lowest in 20 months.

Sectoral Trends:

- Coal: Strongest growth (14.8%), highest in 8 months.

- Electricity: Growth slowed to 7.7%, lowest in 4 months.

- Steel: Growth declined to 2.7%, lowest in 27 months.

- Cement: Recovered to 1.9% growth after two months of contraction.

- Natural Gas: Growth slowed to 3.3%, lowest in 13 months.

- Refinery Products: Contracted by 1.5% for the first time in 5 months.

- Crude Oil: Contraction deepened to 2.6%.

- Fertilizers: Recovered after 5 months of contraction, grew by 2.4%.

Reasons for Slowdown

- Decline in public capex: Due to general elections.

- Slowdown in construction activity: Impacting steel and cement demand.

- Monsoon impact: Reduced electricity demand.

Implications

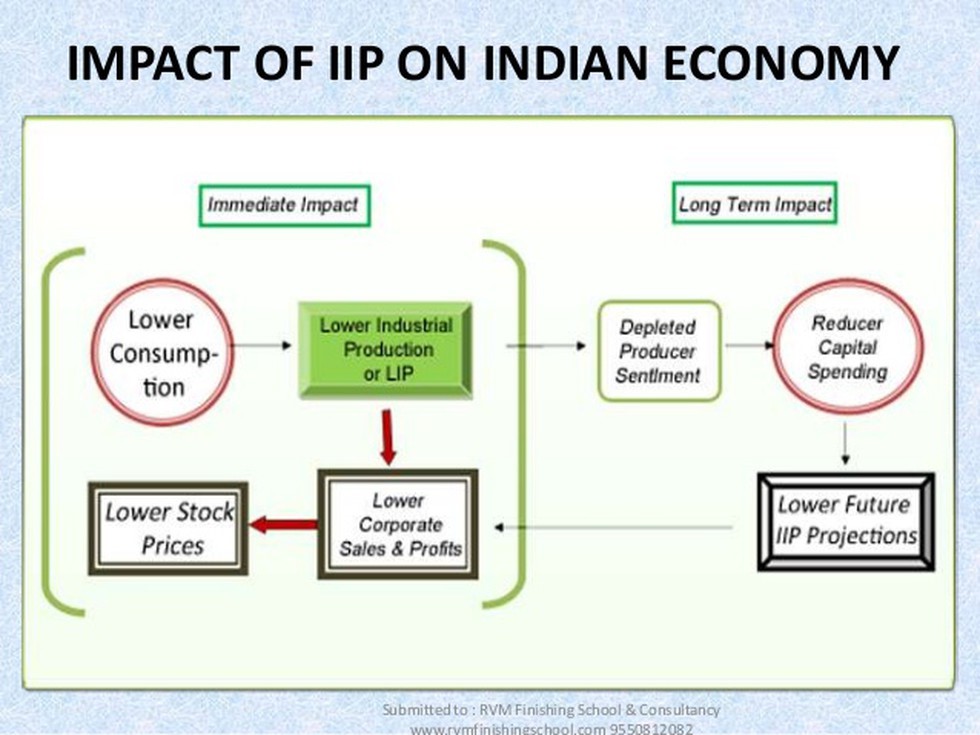

- Industrial Growth: Indicates potential slowdown in overall industrial production (IIP) in June.

- Economic Growth: Could impact overall GDP growth for the quarter.

- Policy Response: Government may need to consider measures to stimulate growth in affected sectors.

IIP Index

- Index of Industrial Production (IIP): A composite index measuring short-term changes in the volume of production of industrial products.

- Importance: Key indicator of industrial performance and overall economic health.

- Relationship to Core Sector: Core industries account for a significant portion of IIP, making it a leading indicator for the overall index.

- The Central Statistical Organisation (CSO) is responsible for the compilation and publication of the Index of Industrial Production (IIP)

2. India-China Relations and LAC

Line of Actual Control (LAC)

- Definition: A de-facto border between India and China, not officially defined or agreed upon by both countries.

- Disputed Areas: Aksai Chin (claimed by India, controlled by China) and Arunachal Pradesh (claimed by China, controlled by India).

- Current Situation: Persistent tensions and standoffs along the LAC, especially in the Galwan Valley and other areas.

- Significance: A strategically important border, with implications for both countries’ territorial integrity and national security.

India-China Relations: A Historical Overview

- Early Years: Panchsheel principles (1954): Five principles of peaceful coexistence signed by Nehru and Zhou Enlai.

Border disputes emerged in the late 1950s.

- 1962 War: A brief but decisive war with China inflicting heavy losses on India.

- Post-War Period: A period of detente and gradual improvement in relations.

- Economic Engagement: Growing economic ties in the 1990s and 2000s.

- Recent Tensions: Escalating border disputes since 2020, leading to military standoffs and casualties.

India-China Relations: Current Challenges

- Border Disputes: The unresolved LAC issue remains a major point of contention.

- Strategic Competition: Increasing geopolitical rivalry between the two countries in the Indo-Pacific region.

- Trade Imbalance: A significant trade deficit in favor of China.

- Infrastructure Development: China’s infrastructure building activities near the LAC are seen as a challenge by India.

Way Forward

- Diplomacy: Continued diplomatic engagement to manage tensions and find a peaceful resolution.

- Military Preparedness: Strengthening India’s military capabilities to deter aggression.

- Economic Diversification: Reducing dependence on China for trade and investment.

- Strategic Partnerships: Building stronger relationships with other countries to counterbalance China’s influence.

- Mechanisms for Dialogue: Both countries have established mechanisms like the Working Mechanism for Consultation and Coordination (WMCC) to address border issues.

- Confidence Building Measures (CBMs): Implementation of CBMs can help reduce tensions and build trust.

3. State Government Debt

Key Points |

|

State Government Debt

| Increasing Market Borrowings: · Shift from reliance on central loans to market-based financing. · Surge in market borrowings in recent years. · Stock of SGS has grown significantly. Debt Redemption: · Large amounts of SGS are maturing in the coming years, especially in states like Uttar Pradesh, Tamil Nadu, Maharashtra, Karnataka, and Gujarat. · This will necessitate substantial fresh borrowing. Debt Tenor: · States are increasingly opting for longer-term debt to manage rollover risk and benefit from lower interest rates. · However, some states still prefer shorter-term debt.

|

Rollover Risk

| Definition: The risk of being unable to refinance maturing debt. Factors Affecting Rollover Risk: · Amount of debt maturing. · Average maturity of the debt portfolio. · Market conditions. Mitigation Strategies: · Issuing longer-term debt. · Diversifying funding sources. · Building debt service reserves. |

Central Government Loans

| GST Compensation Loans: · Raised by the central government and lent to states. · To be repaid through GST compensation cess. · Significant amount of these loans will mature in the next few years. Interest-Free Capex Loans: · Introduced during the pandemic. · Amount allocated has increased significantly. · Impacts state resource availability and market borrowing. |

Implications

| 1. Fiscal Sustainability: Rising debt levels and rollover risks pose challenges to state fiscal sustainability. 2. Credit Rating: High debt levels can negatively impact state credit ratings, increasing borrowing costs. 3. Development Expenditure: Excessive debt servicing may limit funds available for essential public services. 4. Economic Growth: High debt levels can hinder economic growth.

|

Policy Recommendations

| · Debt Management: States should adopt prudent debt management strategies, including debt ceilings, debt-to-GDP ratios, and expenditure control. · Revenue Mobilization: Increasing own tax revenues can reduce reliance on borrowing. · Public Financial Management: Strengthening financial management systems to improve expenditure efficiency. · Central Government Support: Continued support through interest-free loans and other mechanisms can help states manage their debt burden. |

4. Kerala landslide And Chaliyar River

Context: Disaster Management (GS Paper 3)

Climate change: Increasing frequency and intensity of extreme weather events, including heavy rainfall and landslides.

Landslides in Kerala:

- Recurring issue, exacerbated by climate change.

- High vulnerability due to geographical factors (Western Ghats, hilly terrain).

- Loss of life and property, impact on local communities.

Human-induced factors:

- Deforestation and denudation of flora.

- Unsustainable land use practices (quarrying, construction, monocropping).

- Lack of early warning systems and disaster preparedness.

Recommendations:

- Restore denuded flora.

- Rehabilitate vulnerable populations.

- Decline engineering projects in ecologically sensitive areas.

- Establish expert committees for project feasibility.

- Balance development with environmental concerns.

- Increased water flow and sediment load due to heavy rains and deforestation.

Chaliyar River (Geography) |

The Chaliyar River, also known as the Beypore River, is the fourth longest river in Kerala, stretching over 169 kilometers. Here are some key geographical details:

Source and Course Originates at an altitude of around 2 km. · Origin: The river originates from the Elambaleri Hills in the Western Ghats, located in the Wayanad district of Kerala.

Flows through steep terrain, carrying high volume of water and sediment. · Flow: It flows through the districts of Wayanad, Malappuram, and Kozhikode2. The river passes through several towns and villages, including Nilambur, Areekode, Mavoor, and Feroke.

· Mouth: The Chaliyar empties into the Arabian Sea at Beypore, near Kozhikode.

Tributaries · Left Tributaries: Iruvazhinjipuzha, Cherupuzha, Engappuzha1. · Right Tributaries: Cherupuzha

|

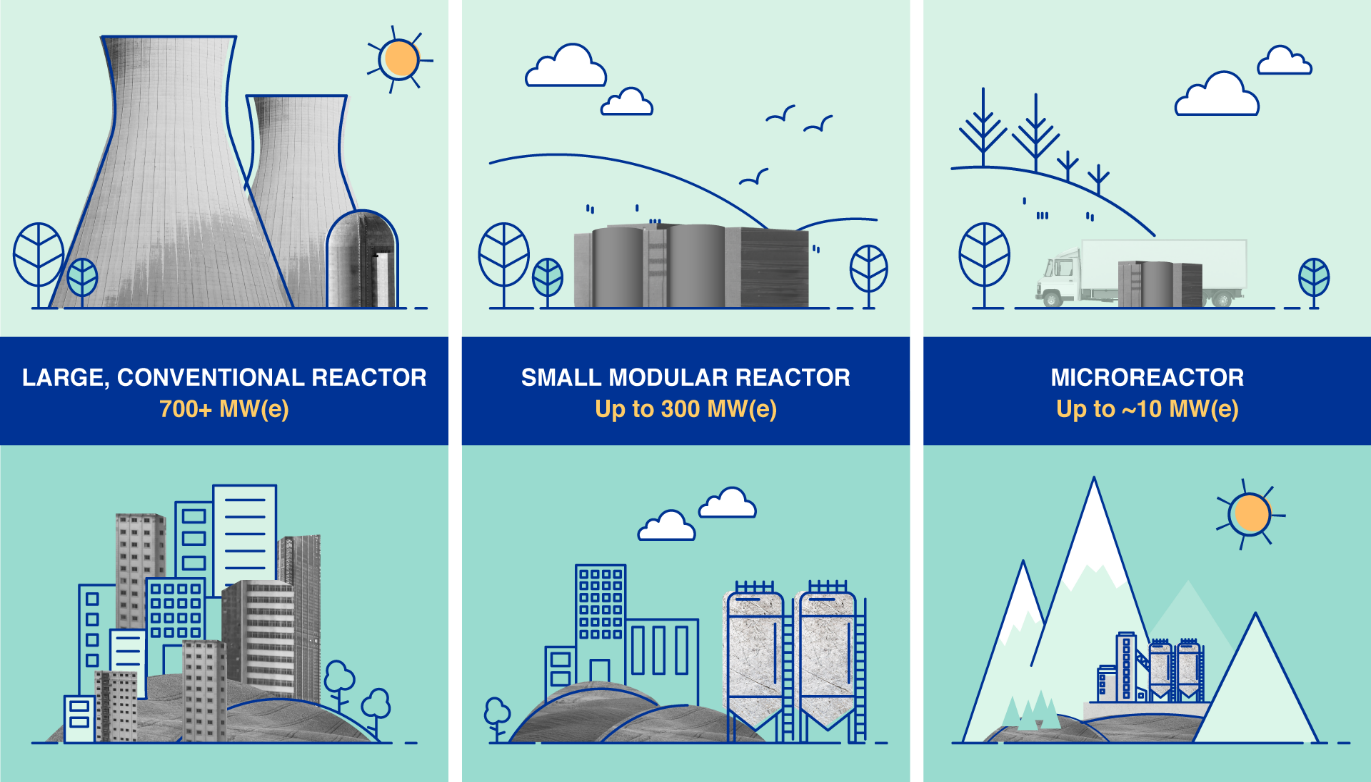

5. Small Modular Reactors (SMRs)

Context: The government is planning to team up with private sector to study test small modular reactor

Definition: Smaller, modular versions of conventional nuclear reactors, typically ranging from 10 to 300 MWe.

Advantages:

- Safer due to inherent design features.

- More commercially feasible due to lower capital costs and smaller operational footprint.

- Can be deployed in remote locations.

- Potential for faster construction and deployment.

Challenges:

- Proliferation risk due to frequent refuelling and plutonium production.

- Higher capital costs for safe guardable designs.

- Uncertain market conditions and grid stability.

- Need for mass production of components to reduce costs.

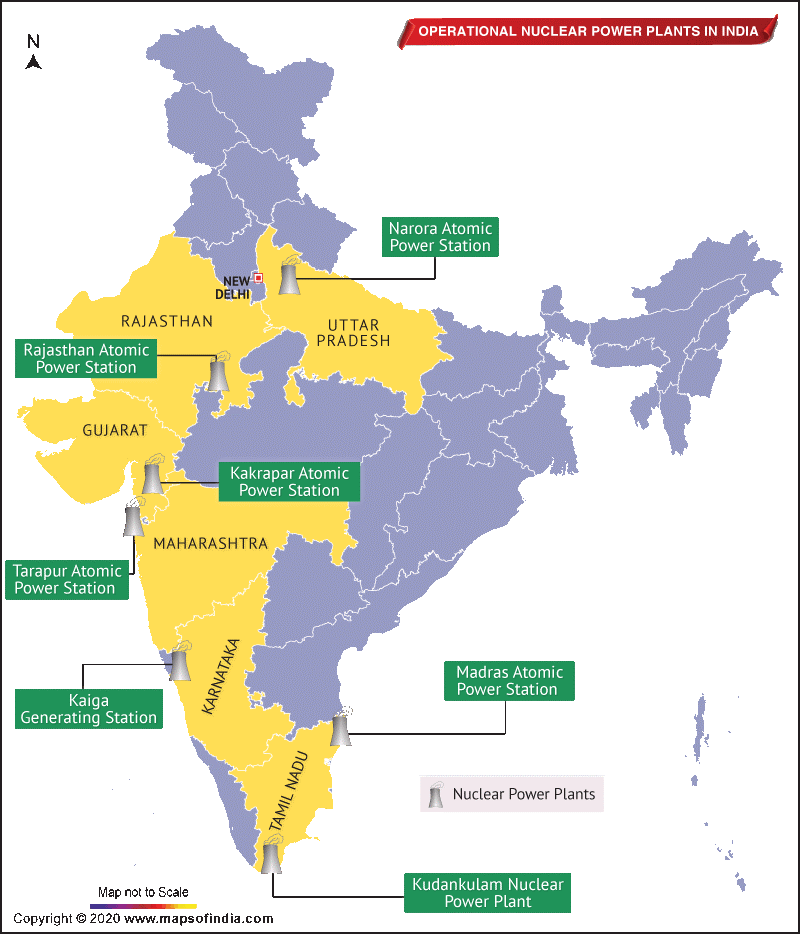

Nuclear Power in India

- Importance: Crucial for energy security and reducing carbon emissions.

- Current Scenario: India has a mix of conventional nuclear reactors with varying capacities.

- Department of Atomic Energy (DAE): Responsible for nuclear power generation and research.

- Challenges: High capital costs, long construction timelines, and public perception issues.

Government Initiatives:

- Collaboration with private sector for SMR development.

- Focus on indigenous technology development.

- Plans to increase nuclear power capacity.

Comparison of SMRs and Conventional Reactors

Feature | Small Modular Reactors (SMRs) | Conventional Reactors |

Size | Smaller | Larger |

Cost | Lower capital cost | Higher capital cost |

Construction time | Faster | Slower |

Flexibility | Can be deployed in various locations | Typically large, centralized plants |

Proliferation risk | Higher due to frequent refuelling | Lower |

Safety | Designed for inherent safety | Multiple safety systems |