1. Powering India's Future: Key Considerations

- Introduction:

- India’s energy landscape is evolving amidst challenges from climate change, rising energy demand, and the need for a clean energy transition.

- The government has emphasized energy security and a clean energy shift in recent budgets, reflecting a commitment to addressing these challenges.

- Achievements and Current Status:

- Electrification: The Saubhagya scheme has led to near-universal electrification, with approximately 97% of households electrified by 2020.

- Renewable Energy (RE) Capacity: India has seen a five-fold increase in installed RE capacity, positioning it as the fourth-largest globally.

- Power Distribution Efficiency: Aggregate losses of power distribution companies (discoms) have decreased by 40% to about 15% in 2022-23.

- Challenges Facing the Power Sector:

- Rising Demand: Annual electricity demand has been growing by 7-9% since the COVID-19 pandemic, with peak demand rising faster.

- Climate Change Impacts: Extreme weather conditions exacerbate demand surges and strain existing power infrastructure.

- Power Supply Issues: Discoms struggle with unplanned surges in demand, which can lead to power outages.

- Recommendations for Addressing Challenges:

- Expand Renewable Energy Targets and Storage Solutions:

- Raise Targets: Set renewable energy and storage targets beyond 500 GW by 2030.

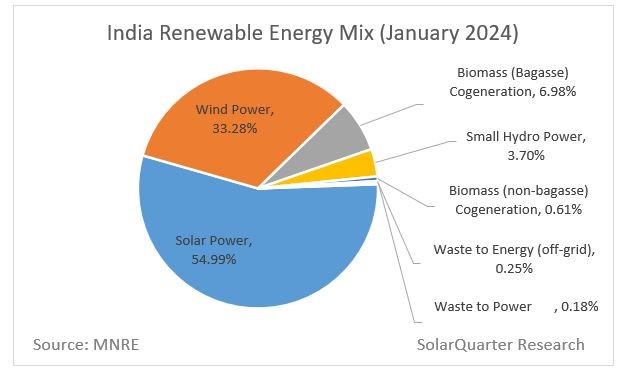

- Increase Share of Renewables: Despite current efforts, renewables contribute only 13% to the power generation mix.

- Develop Storage Solutions: Invest in storage to support peak demand and integrate renewables effectively.

- Accelerate Deployment of Clean Energy Resources:

- Speed and Scale: Deploy renewables at a faster pace, similar to the progress made by China and the European Union.

- Diversify Technologies: Beyond solar, integrate other clean technologies to meet evolving energy demands.

- Enhance Grid Connectivity: Improve grid infrastructure and access to land for timely project completion.

- Improve Energy Availability and Market Efficiency:

- Power Exchanges: Increase the volume of power traded through exchanges to reduce price volatility and enhance integration of renewables.

- Innovative Bidding: Design bidding processes that encourage renewable energy developers to participate in power exchanges and long-term contracts.

- Maintain and Utilize Coal Fleet Effectively:

- Fleet Maintenance: Ensure timely maintenance and upgrade coal plants to enhance flexibility and availability.

- Compensate Investments: Revise norms to support investment in coal plants that can complement renewable energy sources.

- Fast-Track Digitalization:

- Smart Meters: Expand smart metering to improve demand forecasting, network planning, and integration of renewables.

- Overcome Hesitations: Use successful examples from states like Bihar and Assam to drive wider adoption of smart meters.

- Ensure Security: Prioritize consumer privacy and system security against cyber threats in digitalization efforts.

Key Data Points for Answer Writing: |

· Electrification Rate: 97% households electrified (2020) · Renewable Energy Capacity: 144 GW installed; 128 GW in the pipeline · Power Distribution Losses: Reduced to 15% (2022-23) · Growth in Electricity Demand: 7-9% annually · Coal Capacity Utilization: 210 GW generating 80% of power during non-solar hours

|

- Conclusion:

- The Indian government faces a critical task in balancing rapid economic growth with a sustainable and resilient power sector.

- Investments in clean energy infrastructure, improved maintenance of existing assets, and digitalization are essential to support the country’s energy needs and economic aspirations.

2. Institutional Violence and Gender-Based Violence in India

- Introduction:

Institutional violence is a significant barrier to justice for survivors of gender-based violence (GBV) in India. Despite a large democratic framework and electoral participation, systemic issues persist that prevent effective support and justice for victims.

- Statistical Context:

- Electoral Process: India has 642 million voters, with over 50% female participation.

- Gender-Based Violence Statistics:

- Rape Reports: Approximately 90 rapes are reported daily.

- Domestic Violence: Nearly 50% of women face domestic violence.

- Sexual Violence among Dalit Women: Two out of three Dalit women experience sexual violence in their lifetimes.

- Divorce Rate: India has one of the lowest divorce rates globally at 1%, despite high levels of intimate partner violence.

- Institutional Violence:

- Pre-Reporting Challenges: Institutional violence begins before reporting, influenced by prejudiced attitudes. A 2019 J-PAL report found 39% of police officers view GBV complaints as baseless.

- Judicial System Issues: The judicial process is traumatic and prolonged, maintaining a cycle of violence and discouraging victims from seeking justice.

- Case Study: Ranjita from Samarthya describes difficulties faced by survivors in navigating the justice system, including police attempts to dissuade complaints and jurisdictional issues.

- Rural and Systemic Barriers:

- Rural India: In rural areas, male and upper-caste dominated panchayats create additional barriers for women seeking justice.

- Court Backlog: India has a backlog of 40 million court cases, disproportionately affecting survivors from marginalized communities due to systemic inequities related to caste, literacy, and geography.

- Recommendations for Addressing Institutional Violence:

- Survivor-Centric Reforms:

- Create Survivor-Centric Institutions: Bureaucrats and elected leaders should work to develop institutions that prioritize the needs and safety of survivors.

- Training and Education: Organizations like Vanangna train officials on trauma-informed and survivor-centric approaches. These methods should be adopted nationwide.

Key Data Points for Answer Writing: |

· Electoral Participation: 642 million voters, over 50% female · Rape Reports: 90 cases reported daily · Domestic Violence: 50% of women · Divorce Rate: 1% in India · Court Backlog: 40 million cases · Police Attitudes: 39% see GBV complaints as baseless

|

- Strengthen Law Implementation:

- Improve Enforcement: Despite strong domestic violence laws, implementation remains weak due to inept officials and outdated processes. Laws need to be reimagined and adapted to ensure effective implementation.

- Leverage Social Impact: Utilize insights from organizations working directly with survivors to inform policy and procedural reforms.

- Enhance Data Collection and Transparency:

- Increase Data Availability: More data and public sharing of stories are necessary to understand the scope of institutional violence and the barriers faced by survivors.

- Monitor and Evaluate: Implement gender-sensitive training and establish monitoring measures to ensure a trauma-informed approach in the justice system.

- Engage Voters and Politicians:

- Advocacy for Change: Voters and politicians should highlight and address institutional violence. Historical success in educational campaigns shows the potential for similar shifts in other areas of social justice.

- Demand Rights: Citizens must actively demand their rights and work towards a justice system where survivors do not fear repercussions for seeking justice.

- Conclusion:

To effectively address institutional violence in India, comprehensive reforms are needed. This includes creating survivor-focused institutions, enhancing legal frameworks, improving data transparency, and engaging both voters and politicians in the advocacy for justice. The ultimate goal is to ensure safety and dignity for all women and survivors of violence.

3. The Social Benefits of Stock Market Speculation

- Introduction: The Indian Government’s recent budget increased taxes on short-term and long-term capital gains from stock market investments and raised the securities transaction tax on derivatives.

This reflects a belief that stock market gains are akin to gambling and waste limited savings. However, a deeper understanding reveals several social benefits of stock market speculation and the role it plays in economic efficiency.

- Understanding Capital Gains:

- Capital Gains Definition: Profits earned from the sale of assets such as stocks or real estate at a higher price than the purchase price.

- Perfect Market Hypothesis: In an ideal world with perfect information, no capital gains would occur as assets would always be priced at their fair value.

- Real-World Scenario: In reality, due to uncertainty and imperfect information, investors sometimes over-invest in or under-invest in businesses, leading to overvaluation and undervaluation of assets. Capital gains arise when investors correctly identify undervalued assets.

- Social Benefits of Speculation: a. Efficient Capital Allocation:

- Resource Allocation: Speculation helps in directing capital towards businesses with promising prospects. Investors who correctly allocate their capital contribute to more efficient use of resources, enhancing overall economic productivity.

- Example: During a crisis, if investors prioritize sectors like healthcare over luxury goods, it leads to better resource utilization in critical areas.

- Market Liquidity:

- Role of Short-Term Traders: Short-term traders provide liquidity to the market, making it easier for long-term investors to buy and sell shares. Without such traders, long-term investors might face difficulties in entering or exiting positions.

- Efficient Pricing: High liquidity helps in the accurate pricing of stocks, ensuring that businesses can raise funds more easily based on their true value.

- Derivatives and Risk Management:

- Function of Derivatives: Derivatives allow investors to manage risk by transferring it between parties. For example, farmers use futures contracts to lock in prices for their produce, mitigating the risk of price fluctuations.

- Speculative vs. Fundamental Trading: While some derivatives trading is purely speculative, it also facilitates risk management for fundamental investors, ensuring broader market participation and stability.

- Criticisms and Misconceptions:

- Capital Gains vs. Gambling:

- Common Misconception: Capital gains are often compared to gambling, but the key difference is that speculation, when done effectively, can contribute to economic efficiency by ensuring that capital flows to its most productive uses.

- Economic Impact: Speculative activities that increase market efficiency and liquidity are distinct from gambling, which does not add value to the economy.

- Real Estate Gains:

- Indexation Benefits: Removal of indexation benefits for real estate investors reflects a similar disdain for capital gains from property sales, despite the role such investments play in capital formation and economic growth.

- Policy Implications:

- Tax Policy Considerations:

- Balance Taxation: While higher taxes on capital gains may address income inequality concerns, they should be balanced to avoid discouraging efficient capital allocation and investment.

- Encourage Long-Term Investment: Policies should encourage long-term investment and efficient capital allocation while ensuring adequate liquidity in the market.

- Understanding Speculation:

- Educate Policymakers: A better understanding of the benefits of speculation can lead to more informed public policies that enhance market efficiency and economic growth.

- Conclusion: Stock market speculation and derivatives trading, despite their controversial nature, play crucial roles in ensuring efficient capital allocation, providing market liquidity, and facilitating risk management. Recognizing these benefits can help in crafting better public policies that support economic efficiency while addressing concerns related to income inequality and market stability.