Index:

- Innovative Notes on Poverty Estimation in India

- New Payment System in MGNREGA and Associated Issues

- Ad Hoc Judges in High Courts: Appointment and Recent Developments

- Tea Industry and Import Spurt from Kenya

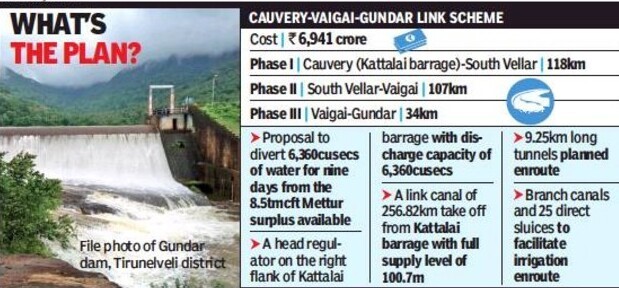

- Cauvery – Vellar Project

- Important headlines of the Day

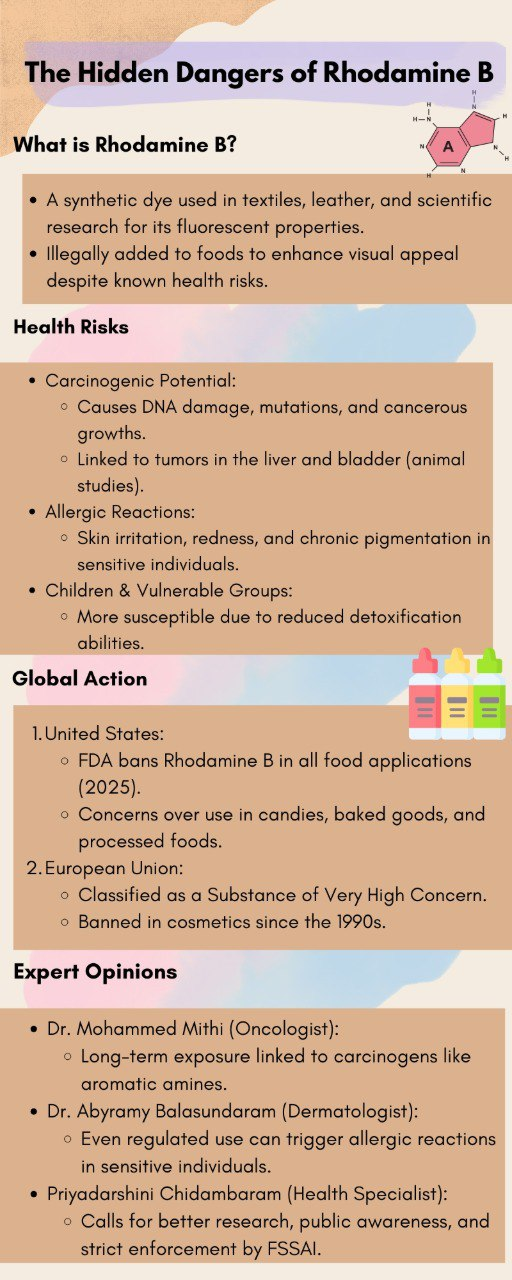

- The hidden Danger of Rhodamine – B - Infographic

1. Innovative Notes on Poverty Estimation in India

- Evolution of Poverty Measurement in India

- 1970s to 2005: Poverty was defined based on the expenditure required to sustain a minimum calorie intake, with updates every five years using National Sample Survey Office (NSSO) data.

- Post-2005: Divergence between NSSO’s private expenditure estimates and National Accounts led to questions about data accuracy. The government appointed the Tendulkar Committee to address these concerns.

- Methodological Shifts in Data Collection

- Recall Periods: NSSO experimented with varying recall periods to improve consumption data accuracy:

- Uniform Reference Period (URP): 30-day recall for all items.

- Mixed Reference Period (MRP): 30-day recall for food and 365-day recall for other goods.

- Modified Mixed Reference Period (MMRP): 7-day recall for food items, with 30-day and 365-day periods for other items.

- Recent Changes: The latest methodology involves visiting households in three sittings instead of one, allowing for better data reporting through improved recall.

- Recent Findings from the Household Consumption Expenditure Survey (HCES) 2023-24

- Average Monthly Per Capita Expenditure (MPCE):

- Rural Areas: ₹4,122

- Urban Areas: ₹6,996

- Consumption Patterns:

- Non-Food Expenditure: Accounts for 53% in rural areas and 60% in urban areas, indicating a shift towards non-food items.

- Food Expenditure: Significant spending on beverages, refreshments, and processed foods.

- Urban-Rural Gap: The consumption gap has narrowed to 70% in 2023-24 from 84% in 2011-12, reflecting improved rural consumption.

- Consumption Inequality: The Gini coefficient declined from 0.266 in 2022-23 to 0.237 in 2023-24 for rural areas, and from 0.314 to 0.284 for urban areas, indicating reduced inequality.

- Debates on Poverty Estimation

- Divergent Estimates: Some studies claim a drastic reduction in poverty, while others, using different methodologies, estimate higher poverty rates. For instance, a study by the Foundation for Agrarian Studies estimated around 25% poverty using the Rangarajan methodology on 2022-23 data.

- Need for Consensus: There’s a call for an agreed-upon methodology for poverty estimation, with government endorsement to ensure consistency and reliability.

- Multidimensional Poverty Index (MPI)

- Broader Definition: The MPI includes indicators beyond income, such as education, health, and living standards.

- India’s Customization: India’s MPI includes additional indicators like bank accounts and maternal health, expanding upon the United Nations Development Programme’s framework.

- Criticisms: Some argue that certain indicators may not be applicable to all households, and once a household attains certain assets or services, they are no longer considered deprived in those areas, potentially leading to perpetually low poverty estimates.

- Policy Implications

- Data-Driven Policies: Accurate poverty measurement is crucial for effective policy formulation and resource allocation.

Targeted Interventions: Understanding the nuances of poverty through comprehensive data allows for more targeted and effective poverty alleviation programs.

2. New Payment System in MGNREGA and Associated Issues

About MGNREGA

The Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) is a pivotal social security measure in India, ensuring the “right to work” by providing at least 100 days of wage employment annually to rural households.

To enhance transparency and efficiency in wage disbursements, the government has introduced the Aadhaar-Based Payment System (ABPS). However, this shift has surfaced several challenges impacting the program’s efficacy.

Aadhaar-Based Payment System (ABPS) in MGNREGA

- Implementation: ABPS mandates linking workers’ Aadhaar numbers with their bank accounts to facilitate direct benefit transfers. This system aims to reduce fraud and ensure timely payments.

- Mandatory Adoption: Since January 1, 2024, ABPS has been made compulsory for MGNREGA payments.

Challenges and Issues

- Exclusion of Workers: Technical discrepancies, such as mismatches in Aadhaar details and bank records, have led to the exclusion of numerous workers. Between April and September 2024, over 3.9 million workers were removed from MGNREGA rolls due to ABPS-related issues.

- Payment Delays: Persistent connectivity issues and technical glitches with the National Mobile Monitoring System (NMMS) app result in workers losing their attendance and consequently wages for the day.

- Low Wage Rates: The Parliamentary Standing Committee on Rural Development and Panchayati Raj highlighted that the current wage rates under MGNREGA are inadequate and not aligned with the rising cost of living. They recommended revising the base year for wage calculation and linking wages to an index that reflects national inflation trends.

Recommendations

- Reassess Mandatory ABPS Implementation: The Parliamentary Panel suggests that while ABPS has potential benefits, making it mandatory is premature due to unresolved Aadhaar seeding issues. They recommend maintaining alternative payment mechanisms alongside ABPS to ensure no worker is excluded.

- Enhance Technical Infrastructure: Address connectivity and technical challenges, especially in remote areas, to prevent payment delays and ensure workers receive their due wages promptly.

Revise Wage Rates: Update the base year for wage calculations and link MGNREGA wages to a more current and relevant inflation index to ensure fair compensation for workers.

3. Ad Hoc Judges in High Courts: Appointment and Recent Developments

Constitutional Provision: Article 224A

- Purpose: Article 224A of the Indian Constitution empowers the Chief Justice of a High Court to request retired judges to serve temporarily as ad hoc judges, with the prior consent of the President.

- Text of Article 224A: “The Chief Justice of a High Court for any State may at any time, with the previous consent of the President, request any person who has held the office of a Judge of that Court or of any other High Court to sit and act as a Judge of the High Court for that State.”

Procedure for Appointment

- Initiation: The Chief Justice of the High Court identifies the need for ad hoc judges due to factors like case backlog or vacancies.

- Consent: The retired judge’s consent is obtained for reappointment.

- Presidential Approval: The proposal is forwarded to the President of India for approval, following consultation with the Chief Justice of India.

Supreme Court’s 2021 Guidelines (Lok Prahari Case)

In the 2021 Lok Prahari case, the Supreme Court provided guidelines for appointing ad hoc judges under Article 224A:

- Trigger Points: Ad hoc appointments can be considered if:

- Vacancies exceed 20% of the sanctioned strength.

- Over 10% of pending cases are more than five years old.

- The rate of case disposal is lower than the rate of filing over a specified period.

- Tenure: Ad hoc judges are typically appointed for a period of 2-3 years.

- Limitations: The appointment of ad hoc judges is not a substitute for regular appointments and should be used sparingly.

Recent Developments

On January 21, 2025, the Supreme Court proposed modifying its 2021 guidelines to address the significant backlog of criminal appeals in various High Courts. The Court suggested appointing ad hoc judges even if the vacancy threshold of 20% is not met, emphasizing the urgency of the situation.

The Court highlighted substantial pendency in several High Courts:

- Allahabad High Court: Approximately 63,000 criminal appeals pending.

- Patna High Court: Around 20,000 pending cases.

- Karnataka High Court: About 20,000 pending cases.

- Punjab and Haryana High Court: Approximately 21,000 pending cases.

The Supreme Court emphasized that ad hoc judges would primarily focus on adjudicating criminal appeals and would work alongside permanent judges to expedite case resolution.

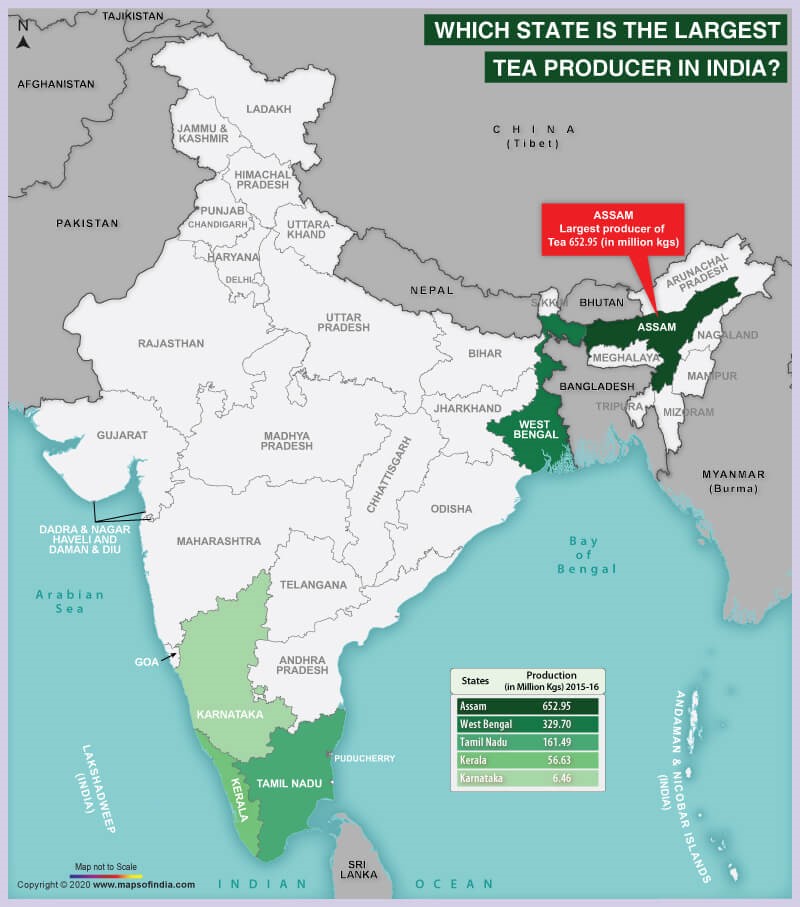

4. Tea Industry and Import Spurt from Kenya

Key Points:

- India’s Position in Tea Production: India is the world’s largest tea producer after China.

- Tea Imports from Kenya:

- Tea imports from Kenya increased by 288% from 53 million kg (Jan-Oct 2023) to 13.71 million kg (Jan-Oct 2024) (Tea Board of Kenya).

- India has become the largest importer of Kenyan tea.

- Tea Exports by India: India’s tea exports grew by 4%, from 184.46 million kg (Jan-Oct 2023) to 209.14 million kg (Jan-Oct 2024) (Tea Board of India).

- Domestic Challenges in India:

- Oversupply: Indian tea producers face challenges due to oversupply in the domestic market.

- Production Decline:

- Total tea production in India fell by 50 million kg in 2024.

- Assam, a major tea-producing state, recorded a crop loss of 20 million kg.

- Price Pressure: Oversupply has kept local tea prices in check.

- Blending with Imported Tea: Some Indian brands use cheap, lower-quality African teas and substandard teas from Iran and Vietnam for blending and re-exporting as Indian teas.

Concerns for India’s Tea Industry:

- Massive imports from Kenya affect domestic producers and traders.

Use of lower-quality imported teas undermines the quality perception of Indian tea globally.