The Green Revolution in Maize: A Private Sector Story

CONTEXT: Rise in Maize Production. Over the last two decades, maize production in India has more than tripled, from 11.5 million tonnes (mt) to over 35 mt (2023-24). The average per-hectare yield has risen from 1.8 to 3.3 tonnes.

Maize Utilization

- Unlike rice and wheat, only a fifth of India’s maize production is used for direct human consumption.

- Around 60% goes to poultry and livestock feed, indirectly consumed as chicken, eggs, or milk.

- Maize grains are used for industrial purposes like starch production (textile, paper, pharmaceutical, food, and beverage industries).

- Recently, maize has emerged as a feedstock for ethanol blending with petrol.

A New Kind of Maize for Ethanol Production

- IARI has developed India’s first “waxy” maize hybrid with high amylopectin starch content, better suited for ethanol production.

- Regular maize starch has 30% amylose and 70% amylopectin, while waxy maize has 93.9% amylopectin (better for fermentation).

- This new hybrid offers higher recoverable starch content (68-70% compared to 58-62% in normal maize) leading to more ethanol production (415-420 litres per tonne compared to 390 litres).

New Breeding Strategies

- CIMMYT’s maize doubled haploid (DH) facility in Kunigal produces genetically pure inbred lines for further breeding of hybrids.

- DH technology reduces inbred line development time from 6-8 generations to just two cropping cycles.

- CIMMYT shares these improved inbred lines with public institutions and private seed companies for developing high-yielding hybrids.

Private Sector Driven Green Revolution

- Unlike wheat and rice (self-pollinating), maize (cross-pollinating) benefits from hybridisation leading to higher yields.

- Private sector-bred maize hybrids account for over 80% of the maize cultivation area in India.

- Farmers cannot save and reuse seeds from these hybrids, requiring them to purchase new seeds every season, benefiting private seed companies.

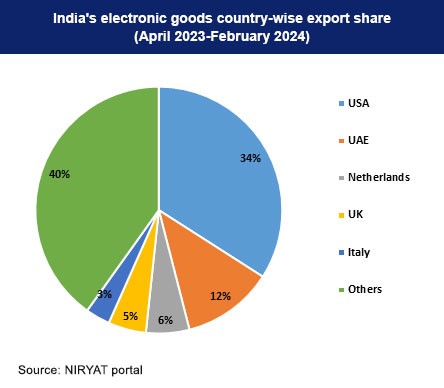

NITI Aayog report "Electronics: Powering India's Participation in Global Value Chains"

CONTEXT: NITI proposes simpler tariffs, fresh incentives for electronic sector

Challenge: Grow India’s electronics sector from $100 billion to $500 billion by 2030.

Current Status:

- Import dependence: India relies heavily on imports for critical components (microprocessors, GPUs, etc.) used in electronics manufacturing.

- High tariffs: Average tariffs on electronics components in India (7.5%) are higher than competitors like China (4%), Malaysia (3.5%), and Mexico (2.7%).

- Limited impact of existing schemes: Ongoing incentive schemes haven’t effectively driven domestic component manufacturing.

Recommendations:

- Tariff rationalization: Simplify and streamline import tariffs on components to make Indian exports more competitive globally.

- Reducing GST rates on electronics could further boost domestic demand

- Streamlining approval processes for foreign companies critical for ecosystem development

- Fiscal incentives: Offer fiscal support for design-focused companies.

- Provide operational expense (opex) support for manufacturing less complex components.

- Provide capital expenditure (capex) and hybrid (opex+capex) support for manufacturing complex components.

- Technology transfer: Ease the process for technology transfer to boost domestic capabilities.

Potential Outcomes:

- Business-as-usual scenario: Electronics sector grows to $275 billion by FY30 (from $101 billion in FY23).

Export-focused scenario: Electronics sector reaches $500 billion by FY30, with exports at $240 billion (from $24 billion in FY23).

Benefits:

- Increased domestic manufacturing and reduced import dependence.

- Enhanced competitiveness of Indian electronics exports in the global market.

- Potential for significant job creation (50-60 lakh).

U-Win - A Game Changer for India's Immunization Programme

CONTEXT: Analysis on proposed U-Win a digital vaccination registry

Background: India’s Universal Immunization Programme (UIP) is a public health success story targeting 12 diseases.

Current challenges include:

- Manual data collection by ASHA workers leading to delays.

- Unrecorded private healthcare facility vaccinations.

- Disruptions due to the COVID-19 pandemic.

- Gaps in coverage for migrant populations and dropouts.

U-Win: A Digital Solution:

- U-Win is a digital vaccination registry for pregnant women and children under 6.

- U-Win is currently in pilot mode and a pan-India launch is expected by August end 2024.

- The focus is on timely vaccination and reducing infant mortality rates.

Benefits:

- Real-time vaccination data for improved planning and outbreak prevention.

- SMS alerts and appointment booking for increased coverage and convenience.

- Potential to reduce dropouts and improve access for disadvantaged groups.

Learning from Past Successes

- CoWIN platform’s role in efficient COVID-19 vaccination delivery.

- e-VIN’s success in managing cold chain logistics for vaccines.

The Road Ahead

- U-Win poised to become the world’s largest immunization registry.

- Expanding the UIP: Including the HPV vaccine and potentially others.

Bridging the digital divide to ensure accessibility for all.