Index:

- Gangetic Dolphin Survey 2024

- Cities Coalition for Circularity (C-3)

- Supreme Court on Regulation of Vulgarity Online

- India's Economic Growth in Q3FY25

- Ukraine Ceasefire Plans & Global Reactions

- Rise in Women Seeking Retail Credit

- Trump's Focus on Virtual Digital Assets & Crypto Reserve

- Other News Headlines

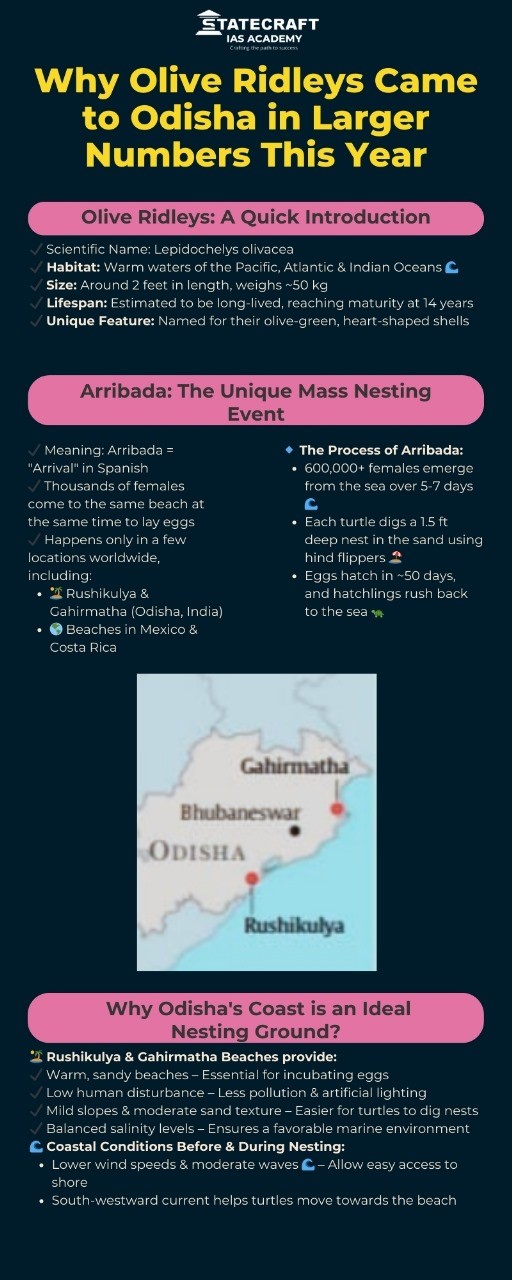

- Why Did More Olive Ridleys Nest in 2024? -Infographics

- Why Olive Ridleys Came to Odisha in Larger Numbers This Year -Infographics

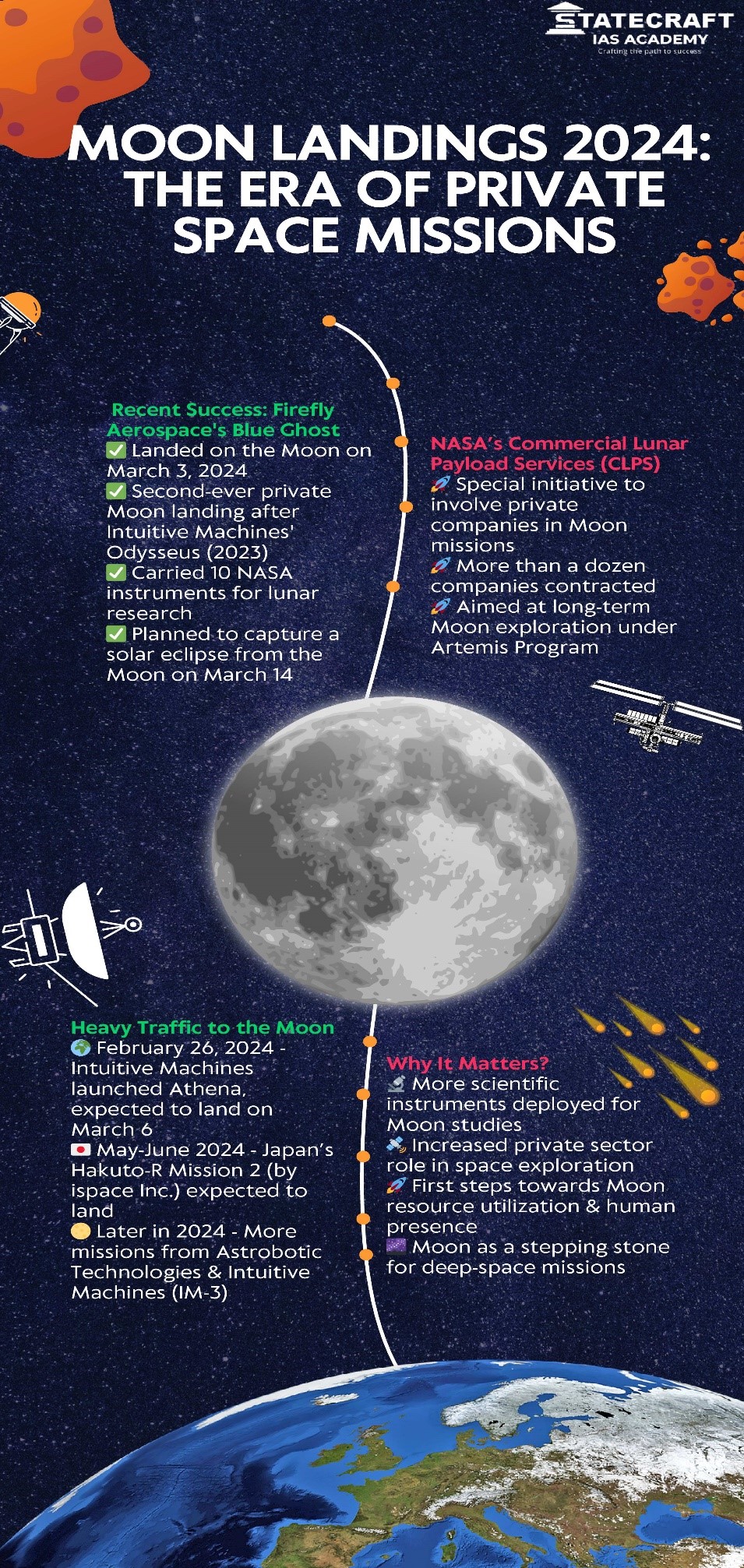

- MOON LANDINGS 2024: THE ERA OF PRIVATE SPACE MISSION -Infographics

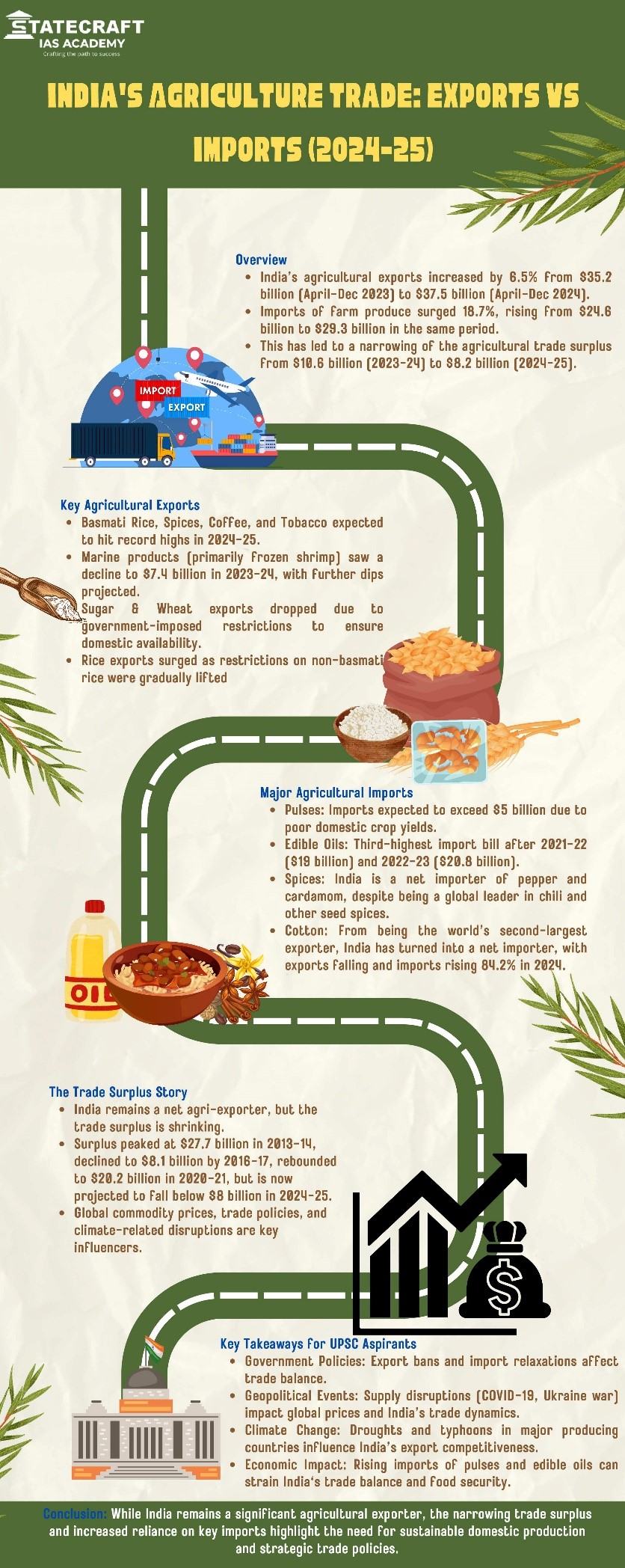

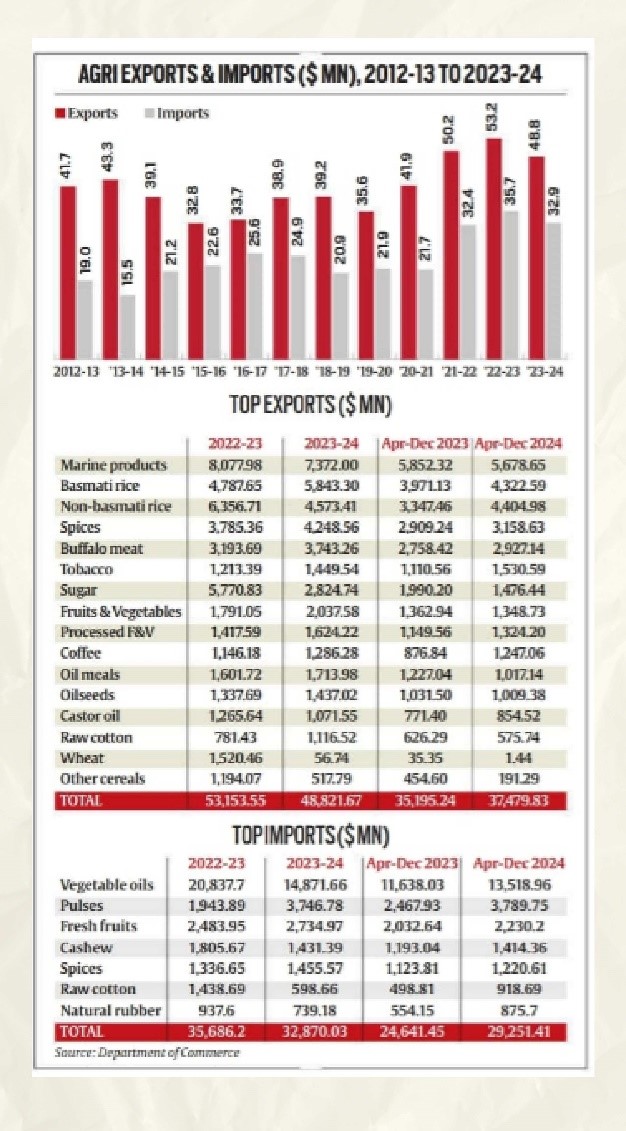

- MAKING SENSE OF INDIA’S GDP DATA -Infographics

1. Gangetic Dolphin Survey 2024

Key Findings

- Total Population: 6,327 Gangetic dolphins recorded in India.

- Gangetic River Dolphins: 6,324

- Indus River Dolphins: 3

Geographical Distribution

- Ganga Main Stem: 3,275

- Ganga Tributaries: 2,414

- Brahmaputra Main Stem: 584

- Brahmaputra Tributaries: 412

- Beas River: 101

States with Highest Population

- Uttar Pradesh (highest)

- Followed by Bihar, West Bengal, and Assam

Survey Details

- Conducted by the Environment Ministry

- Started in 2021, covering 8,507 km of river stretch

- Used acoustic hydrophones to detect dolphin sounds

Challenges in Counting Dolphins

- Dolphins surface only sporadically, making visual detection difficult

- No unique physical markers like stripes (tigers) or ears (elephants)

- Possibility of double counting, tackled using hydrophones and multiple observers

Conservation Measures

- Gangetic dolphins are crucial for river health monitoring

- Threats: Pollution, habitat destruction, fishing nets

- Initiatives: Local populations in the Gangetic States identified for conservation efforts

Awareness: School children encouraged to visit dolphin habitats

2. Cities Coalition for Circularity (C-3)

Context

- India launched Cities Coalition for Circularity (C-3), a multi-nation alliance for sustainable urban development.

- Focus on city-to-city collaboration, knowledge sharing, and private sector partnerships.

- Aim: Waste management and resource efficiency in the Asia-Pacific region.

Key Themes

- Reduce, Reuse, Recycle (3R):

- Emphasized by PM Narendra Modi under the Pro-Planet People (P3) approach.

- Highlights circular economy principles for sustainable urban development.

- International Collaboration:

- India proposes a working group of member nations to finalize the framework of the coalition.

- CITIIS 2.0 MoU signed at Jaipur launch event.

- Financial Commitments:

- Union Minister Manohar Lal announced agreements worth ₹1,800 crore.

- 18 cities across 14 states to benefit under this initiative.

Environmental Impact

- Regional 3R and Circular Economy Forum (Asia-Pacific) launched in 2009 for:

- Sustainable waste management

- Resource efficiency

- Circular economy principles

- Hanoi 3R Declaration (2013-2023):

Outlined 33 voluntary goals for a resource-efficient and circular economy.

3. Supreme Court on Regulation of Vulgarity Online

Context

- The Supreme Court (SC) has sought regulatory measures to control the use of filthy language and vulgarity in online content.

- The focus is to maintain morality and decency in streamed programs without censorship.

Observations by the Court

- Justice Surya Kant:

- Humour should be family-friendly and not rely on filthy language.

- True talent lies in using ordinary words for humour.

- Regulation vs. Free Speech:

- SC emphasized ensuring content adheres to moral standards while respecting freedom of speech.

- Any restriction should be a reasonable limitation to uphold decency and morality.

- The court seeks stakeholder inputs for a healthy debate on the matter.

Case Context: Ranveer Allahbadia’s Podcast Ban

- Issue: His comments on the show “India Got Latent” led to restrictions on his content.

- SC Decision:

- Modified the restriction, permitting the resumption of “The Ranveer Show”, provided it follows morality and decency

- Ensures content remains suitable for all age groups.

Arguments Presented

- Petitioner’s Argument (Ranveer Allahbadia’s Lawyer):

- Ban on podcasts and shows would affect his livelihood.

- No sense of humour was involved in the alleged offensive comments.

- Solicitor-General Tushar Mehta:

Humour should not rely on obscenity; true comedy should be genuinely funny without offensive language.

4. India's Economic Growth in Q3FY25

Context

- Real GDP Growth: 2% in Q3FY25 (compared to 5.6% in Q2FY25).

- Slowest growth since Q4FY23 (except for Q2FY25).

- Government’s 6.5% full-year growth target seems unlikely due to global headwinds and domestic slowdown.

Sector-wise Growth Trends

- Primary Sector:

- Value-add increased to 5.2% (from 1.8% last year).

- Helped sustain overall GDP growth.

- Manufacturing & Services (Secondary & Tertiary Sectors):

- Manufacturing growth fell to 4.8% (from 12.4% last year).

- Services growth slowed to 7.4% (from 8.3% last year).

- Weakness due to global trade uncertainties.

Challenges & Risks

- Trade Uncertainty:

- S. tariffs: 25% import tariff on steel and proposed 25% tariff on pharmaceuticals.

- India’s dependency on the U.S.: 31% of India’s pharma exports ($8.7 billion) go to the U.S.

- Firms may pivot production to the U.S., impacting India’s trade revenue.

- Inflation & Domestic Demand:

- Inflation projected at 4.8% in FY25, expected to ease to 4.2% in FY26.

- Moderation in inflation helped increase government spending (+8.3%) and private consumption (+6.9%).

Data & Methodology Concerns

- NSO’s Revision in GDP Estimates:

- Methodological changes based on “industry-wise/institution-wise” information.

- Lacks clarity on its impact on data quality and accuracy.

Need for more transparent revisions to ensure data reliability.

5. Ukraine Ceasefire Plans & Global Reactions

Context

- European nations, led by Britain and France, are discussing possible ceasefire proposals for the Ukraine war.

- France proposed a one-month ceasefire as an initial step toward peace talks.

- Discussions follow a meeting between Donald Trump and Ukrainian President Volodymyr Zelenskyy in the U.S.

Key Stakeholders & Their Positions

- United Kingdom (UK):

- Acknowledges multiple proposals but avoids detailed commentary.

- France & Britain:

- Considering sending troops to Ukraine, but not for direct war involvement.

- France suggests a temporary ceasefire to test Russia’s intentions for peace.

- United States (US) & Trump’s View:

- Trump claims Zelenskyy “doesn’t want peace” and questions continued American support.

- White House security officials say European involvement is welcome but needs investment in defense capabilities.

- Ukraine’s Position:

- Zelenskyy rejects a ceasefire without explicit security guarantees ensuring Russia will not attack again.

- Asserts that European military support alone is not enough without US backing.

- Russia’s Reaction:

- Kremlin spokesman Dmitry Peskov dismisses the US and Europe’s efforts as insufficient for ending the war.

- Suggests that Russia may push for a tougher deal than it did in 2022 peace talks, which Ukraine rejected.

Geopolitical Implications

- European Troop Deployment:

- France and Britain’s willingness to send troops (not for combat) may escalate tensions.

- US-EU Relations:

- Europe is seeking greater US involvement, but Trump and sections of the US question continued military aid.

- Russia’s Negotiation Tactics:

- Russia may demand more concessions, such as Ukraine adopting neutrality, reducing military size, and avoiding NATO.

- Potential for Peace Talks:

- The one-month ceasefire proposal could test Russia’s commitment to peace.

Lack of US endorsement may weaken the proposal’s effectiveness.

6. Rise in Women Seeking Retail Credit

Context

- The number of women availing retail credit in India has nearly tripled between 2019 and 2024.

- This reflects a changing financial behavior with more women leveraging credit for personal and professional goals.

- Growth rate: 22% CAGR (Compound Annual Growth Rate) over five years.

Key Trends

- Increase in Credit Demand

- Women’s share in business loans and gold loans increased by 14% and 6%, respectively, since 2019.

- In 2024, 36% of all loans availed by women were gold loans (up from 19% in 2019).

- Women from semi-urban and rural areas account for 60% of borrowers.

- Types of Loans Preferred by Women

- Gold loans dominate: 38% of all loans taken by women are against gold.

- Personal finance loans (personal, consumer durable, homeownership loans) are the major share of women’s borrowing.

- Business credit for women remains low, with most loans being collateral-backed.

- Challenges for Women Borrowers

- Credit aversion and poor banking experience.

- Lack of collateral and guarantees for business loans.

- Barriers to credit readiness (financial literacy, documentation issues).

- Growth in Self-Monitoring of Credit Health

- Women checking their credit scores increased by 42% (from 18.9 million in Dec 2023 to 26.92 million in Dec 2024).

- Self-monitoring helps in informed financial decision-making and entrepreneurship.

- Demographic Insights

- Gen Z (born mid-1990s to early 2010s) accounts for 19.43% of the total self-monitoring base (up from 17.89% in 2023).

- Indicates growing financial awareness among young women.

Implications for Economy & Society

- Financial Inclusion: More women entering the formal credit system.

- Women Entrepreneurship: Business loans remain underutilized, requiring better support systems.

- Economic Growth: More women leveraging credit can boost consumption and investments.

Policy Considerations: Need for targeted schemes to improve women’s access to unsecured credit.

7. Trump's Focus on Virtual Digital Assets & Crypto Reserve

Context

- Former US President Donald Trump has announced plans to create a “Crypto Strategic Reserve” if re-elected.

- He named five cryptocurrencies to be included in this reserve:

- Bitcoin (BTC)

- Ethereum (ETH)

- XRP

- Solana (SOL)

- Cardano (ADA)

- This move has given a boost to the crypto market, leading to a sharp rise in prices.

Key Announcements & Market Impact

- Rationale Behind the Crypto Reserve

- Trump cited concerns over attacks on the crypto industry by the Biden administration.

- Advocated for US dominance in the digital asset space, calling the US “the Crypto Capital of the World.”

- Market Reactions

- Bitcoin surged over 8%, crossing $90,000.

- Ethereum rose 10%, trading at over $2,000.

- XRP increased nearly 25%, Solana jumped 18%, while Cardano surged 60%.

- Prices rose due to speculation that Trump might ease regulations on cryptocurrencies.

- Concerns & Risks

- Volatility: Cryptocurrencies remain highly volatile.

- Fraud & Scams: Example of Argentina’s failed “Libra” coin, promoted by President Javier Milei.

- Regulatory Issues: The US SEC (Securities and Exchange Commission) has been investigating crypto firms.

- Potential Policy Influence

- Trump may appoint crypto-friendly regulators like Paul Atkins to the SEC.

- Speculation that Elon Musk (a crypto advocate) may join as an adviser.

- Geopolitical & Economic Implications

- Trump’s trade policies, including tariff wars, add uncertainty to markets.

- US government’s stance on crypto regulations could impact global markets.

Institutional interest in crypto may increase due to official recognition.