1. Climate change mitigation needs funding

- Municipal Corporations & Governance

- Urban development: Constitutionally, a state subject, implying states must follow specific statutory frameworks for governance, waste management, transport, education, water, and health services.

- Challenges in funding: Municipal projects face challenges like high operating costs and limited sources of revenue, requiring innovative financial solutions (e.g., green bonds).

- Discretionary services: Some cities provide public transport services based on discretion.

- Climate Change and Urban Areas

- India’s vulnerability: India ranks high in the Climate Risk Index (2021), indicating significant exposure to climate risks like floods, wildfires, and pollution.

- Urban local bodies (ULBs): Crucial in climate resilience; however, limited capacity to raise funds for necessary infrastructure developments.

- Financial Tools for Mitigation

- Green bonds: Suggested as a financial tool for cities to raise capital for climate-related projects.

- Property tax: Low in India compared to other countries; has potential to be leveraged for urban development.

- Public-private partnerships: Encouraged to bridge funding gaps in urban projects.

- Sustainable Urban Development

- Compact cities: Promoted through the concept of “15-minute neighbourhoods,” reducing travel and promoting walking for daily tasks.

- Water management: ULBs urged to treat and recycle wastewater for industrial and non-drinking uses.

- Challenges in Municipal Operations

- Lack of resources: Municipal bodies face limitations in land and road management, inadequate personnel, and difficulty in maintaining basic services.

- Need for better market access: Cities are encouraged to explore capital markets for funding climate mitigation and adaptation measures.

- Civic Amenities and Governance

- Critical civic services: ULBs responsible for births, deaths, marriage certificates, water supply, etc., have been highlighted as needing reform in their service delivery mechanisms.

Demand for enhanced services: As cities grow, demand for basic infrastructure like roads, sanitation, and health facilities increases, pressuring municipalities.

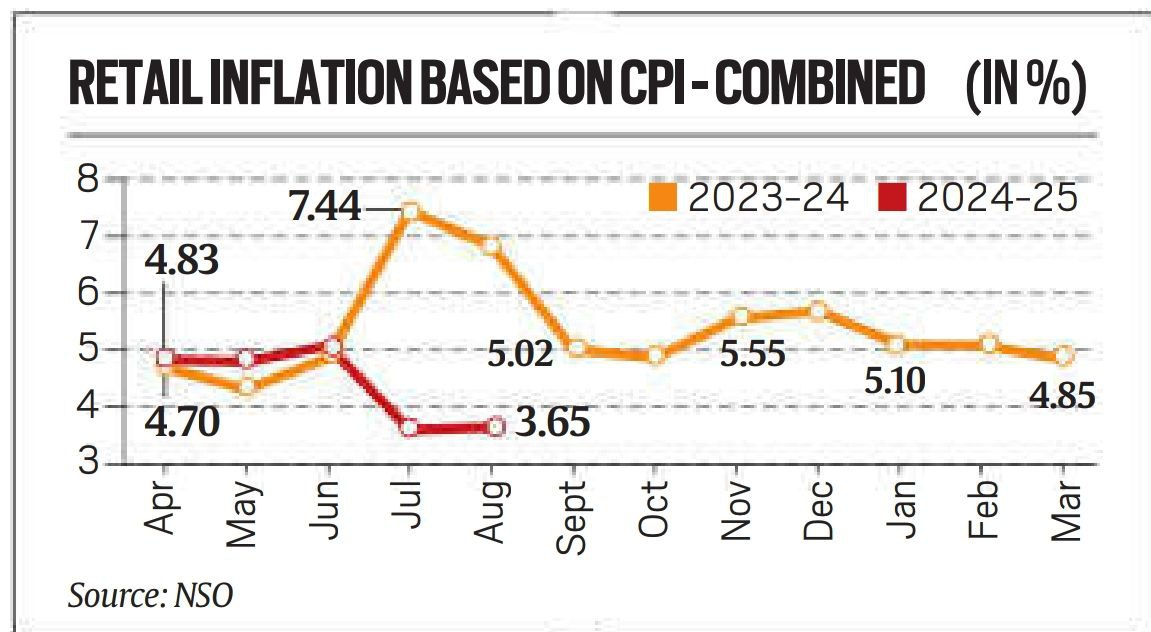

2. Retail inflation edges up to 3.65% in August fuelled by rising food prices

- Retail Inflation Trends

- August 2024 Inflation: Retail inflation rose to 65% in August, up from 3.60% in July, driven mainly by rising food prices.

- Food Prices: Contributed significantly to inflation, especially perishables like vegetables and fruits.

- Comparison with July: August saw a rebound in food inflation after a low of 42% in July, where inflation was 5.66% for August based on the Combined Food Price Index (CFPI).

- Core Inflation

- Non-food, Non-fuel Inflation: Core inflation remained steady at 34%, while personal care and services rose to 7.79%.

- Fuel & Miscellaneous Categories: Inflation in these areas remained lower, keeping overall inflation in check.

- Industrial Output (IIP)

- July 2024: Factory output, as measured by the Index of Industrial Production (IIP), grew by 8%, up from a five-month low of 4.7% in June.

- Sectoral Contributions: The manufacturing sector contributed 6% of IIP, and there was growth in electricity generation and industrial activities.

- Inflation Outlook

- Food Inflation Projection: High inflation in pulses and vegetables, with pulses reaching 6% and vegetables at 10.71% in August, are likely to influence future inflation.

- Monsoon Impact: Favorable monsoon conditions could improve the inflation situation in post-harvest months starting from October 2024.

- RBI’s Inflation Target

- 4% (+/-2%) Target: Inflation remains within the Reserve Bank of India’s (RBI) medium-term target range of 4% ±2%, offering the central bank flexibility in monetary policy.

- Monetary Policy Expectations: The U.S. Fed’s decisions on interest rates might impact RBI’s stance on rate cuts.

- Future Projections

- Short-term Inflation: Analysts expect headline inflation to remain within the range of 8-5% in September and October 2024.

Factory Output Forecast: Expected to see a rise from September due to better kharif harvest and a reduced base effect from 2023 figures.