Index:

1. The Centre’s Share in States’ Revenue: Trends and Challenges

Key Highlights:

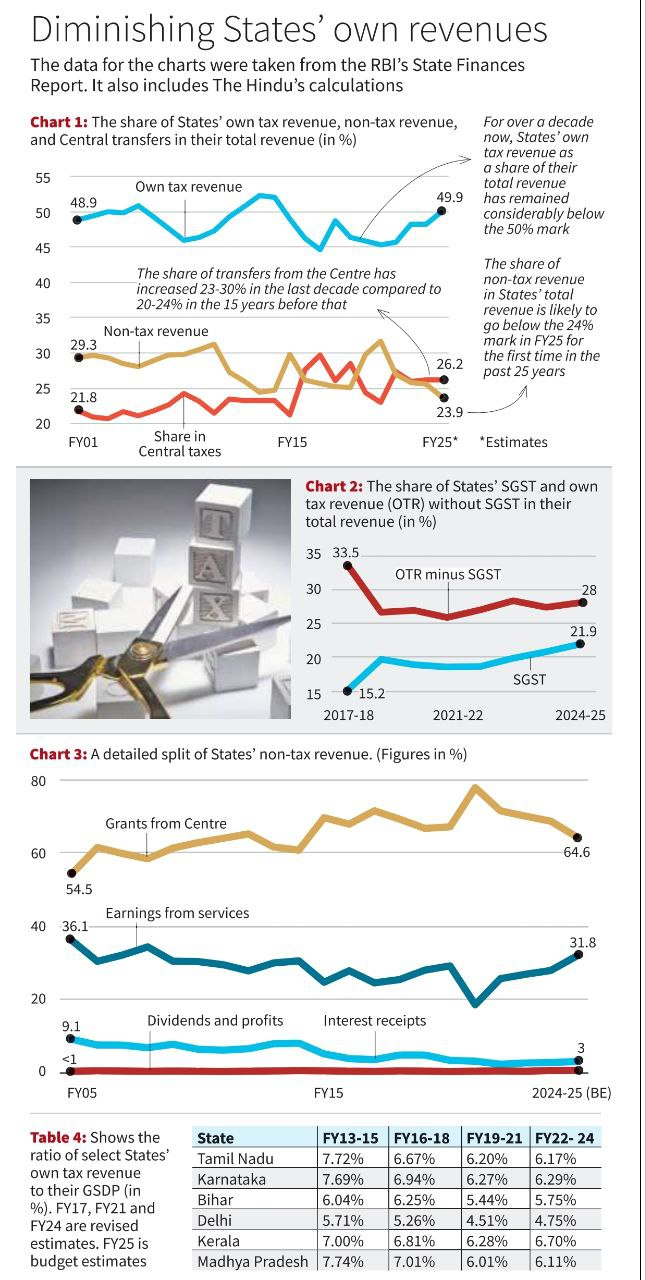

- Rising Dependency on Centre:

- States’ dependency on the Centre has grown over the last decade.

- Centre’s share in States’ total revenue increased from 20-24% in 2010 to 33% in FY16 to FY25.

- Decline in States’ Own Tax Revenue:

- States’ own tax revenue declined to 57% in FY16 to FY25 from 65-70% in the 15 years prior.

- Efficient collection of taxes by States has weakened, exacerbating dependency.

- Non-Tax Revenue Trends:

- Decline in non-tax revenue due to reduced dividends, earnings, and interest from State public enterprises.

- Non-tax revenue contribution to GDP decreased from FY15 to FY25.

- GST Impact:

- Introduction of GST reduced States’ flexibility in imposing taxes.

- Share of SGST (State GST) decreased, increasing the Centre’s role in indirect tax distribution.

- Sectoral Insights:

- Earnings from services like social/public health and power (economic services) have not reached 30% of total revenue.

- State contributions from economic activities have seen a marked decline.

- Declining Tax-GSDP Ratios:

- States like Tamil Nadu witnessed a significant decline in the tax-GSDP ratio from 7.72% in FY13-15 to 6.17% in FY22-24.

- Other states like Karnataka, Kerala, Bihar, and Delhi showed similar trends.

- Grants and Transfers:

- Grants from the Centre now account for a larger proportion of States’ revenue.

- Dependency increases States’ vulnerability to fiscal policies dictated by the Centre.

- Challenges:

- Reduced efficiency in collecting direct and indirect taxes.

- High reliance on GST and transfers.

- Inadequate service sector contributions.

Implications for Governance:

- Fiscal federalism faces challenges due to growing vertical imbalances.

- States’ reduced fiscal autonomy may hinder their ability to design region-specific policies.

- Calls for policy reforms to enhance States’ revenue collection capacity and reduce dependency on the Centre.

Way Forward:

- Strengthen States’ capacity to collect own tax revenue.

- Revamp policies on State public enterprises to enhance non-tax revenue.

- Ensure equitable GST compensation mechanisms.

- Promote regional industrial and service sector growth for robust revenue streams.

Rationalize Centre-State financial relations under cooperative federalism.

3. Unlawful Activities (Prevention) Act (UAPA): A Draconian Law

Key Highlights:

- Overview of UAPA:

- Enacted in 1967, UAPA allows stringent measures to combat terrorism and unlawful activities.

- Accusations under UAPA often lead to prolonged incarceration without bail due to strict bail provisions.

- Case Study:

- Umar Khalid, an accused in the 2020 Delhi riots case, has been in custody for over 500 days under UAPA.

- Bail hearings turn into mini-trials, causing delays and further curtailing the accused’s rights.

- Stringent Bail Provisions:

- Courts can deny bail if the accusation appears prima facie true based on police reports.

- This creates a presumption of guilt and shifts the burden of proof onto the accused.

- Judicial Process Issues:

- Bail applications under UAPA involve long hearings, adjournments, and delays.

- Courts fail to adequately scrutinize police evidence due to legislative constraints.

- Impact on Justice:

- Trials often extend over years, leading to prolonged pre-trial detention.

- Accused individuals face severe personal and social consequences without being proven guilty.

- Rank Injustice:

- Case of Zahoor Ahmad Shah Watali (2019): Supreme Court limited lower courts’ ability to scrutinize evidence in UAPA cases.

- Defense cannot challenge police evidence effectively, undermining fair trial principles.

- Critique of the Law:

- UAPA criminalizes individuals even before guilt is established, violating the principle of presumption of innocence.

- Prolonged detention creates a de facto punishment for the accused.

- Comparison with Normal Criminal Law:

- Under non-UAPA provisions, courts weigh evidence more thoroughly during bail hearings.

UAPA’s stringent framework shifts focus away from fair judicial process.

4. Supreme Court to Hear Pleas Challenging CEC and EC Appointment Law

Key Highlights:

- Context: The retirement of Chief Election Commissioner (CEC) Rajiv Kumar in February 2024 has brought attention to the legality of the Chief Election Commissioners (Appointment, Conditions of Service, and Term of Office) Act, 2023.

- The law gives the Union Government significant control over the appointment process.

- Section 7(1) of the Act:

- Allows the President to appoint the CEC and Election Commissioners based on the advice of a Selection Committee comprising:

- Prime Minister.

- Leader of Opposition (or leader of the largest opposition party).

- A Union Cabinet Minister nominated by the Prime Minister.

- This structure allegedly undermines the independence of the Election Commission (EC).

- Allows the President to appoint the CEC and Election Commissioners based on the advice of a Selection Committee comprising:

- Petitions Filed:

- Petitioners, including the NGO Association for Democratic Reforms, argue that the law dilutes the Constitution Bench’s March 2023 judgment in the Anoop Baranwal case.

- The judgment had mandated a diverse and independent Selection Committee to ensure the EC’s impartiality.

- Constitutional Concerns:

- The law is being challenged on the grounds of:

- Circumvention of Article 141, which binds all authorities by Supreme Court judgments.

- Violation of the principle of “fierce independence” and “neutrality” necessary for the EC’s functioning.

- Debate over whether Parliament can nullify a Supreme Court judgment through legislation or ordinances.

- The law is being challenged on the grounds of:

- Supreme Court’s Response:

- A three-judge bench, led by Justice Surya Kant, has emphasized the need to fast-track hearings due to upcoming appointments in the EC.

- The case is likely to be heard on February 4, 2024.

- Key Arguments by Petitioners:

- Advocate Prashant Bhushan highlighted the urgency of resolving the case before new appointments are made.

Concerns were raised over the Union Government’s potential monopoly and exclusive control over the EC.

5. India's Economic Growth Challenges

Current Scenario

- GDP Growth:

- NSO projects GDP growth at 4% for 2024-25 (down from 8.2% in 2023-24).

- Q2 GDP growth dropped to 4% (lowest in 7 quarters).

- Sectoral Trends:

- Agriculture: Expected to grow faster than last year.

- Manufacturing & Mining: Facing stagnation.

- Services: Relatively stable but losing momentum.

- Private Consumption: Estimated rebound to 3%, up from 4% last year.

Key Issues

- Weak Demand:

- Low urban demand recovery.

- Declining Purchasing Managers’ Indices for manufacturing & services.

- Public Capex & Private Investment:

- Public capital expenditure remains subdued.

- Gross Fixed Capital Formation Growth: Slipping to 4% from 9% (2023-24).

- Household Challenges:

- Slow wage growth leading to reduced consumption demand.

Policy Responses & Gaps

- Government’s View: Attributing slowdown to monetary policy and central bank measures.

- Economists’ Concerns:

- India is in a cyclical slowdown with risks of only 6% growth.

- Global uncertainties further aggravate domestic challenges.

Recommendations for Union Budget 2025-26

- Fiscal Reforms:

- Shift focus from incremental tinkering to tailored reforms.

- Ensure fiscal actions boost growth back to 7%+.

- Policy Measures:

- Slash taxes on income, fuel, and consumption.

- Avoid reliance solely on interest rate cuts.Bottom of Form